Its a single question asking for the profit or loss statment at the end.

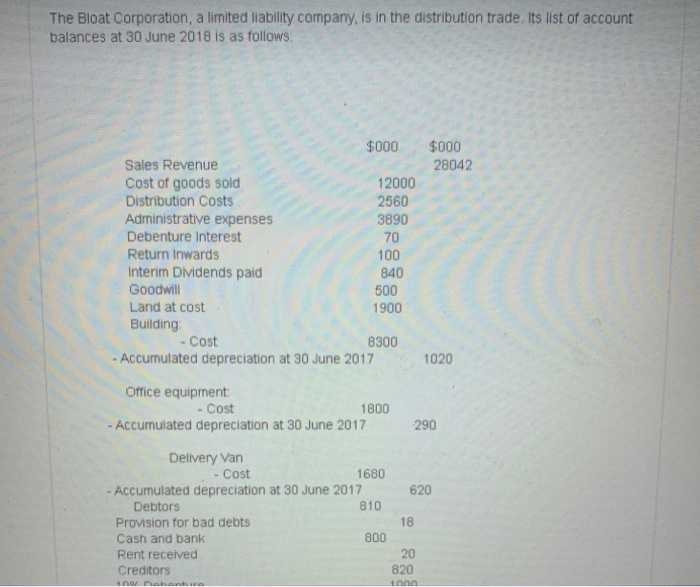

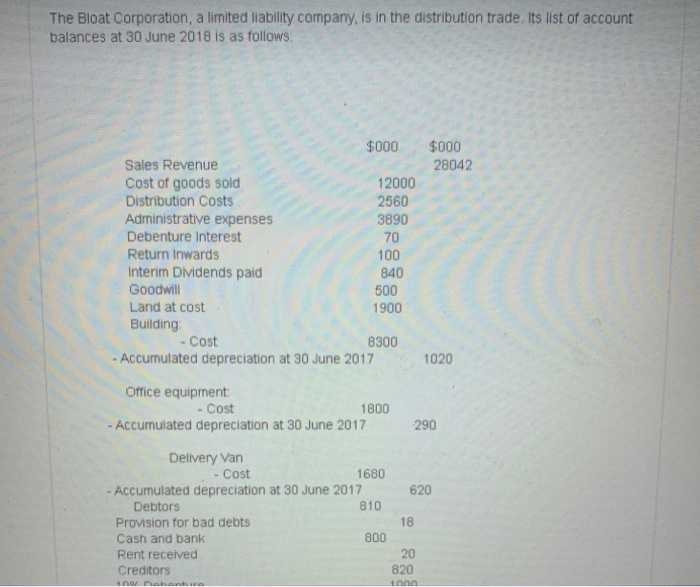

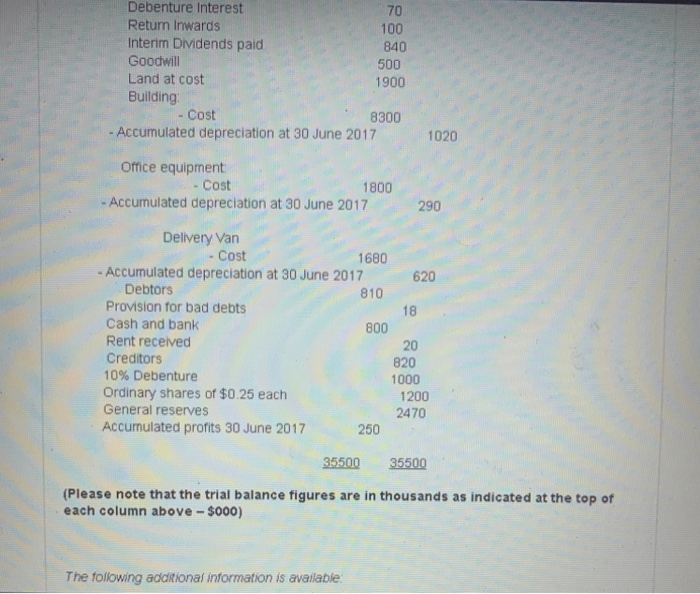

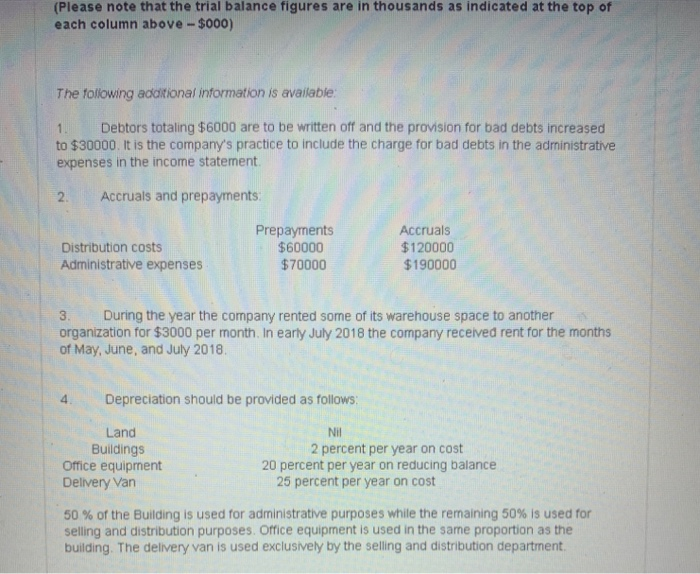

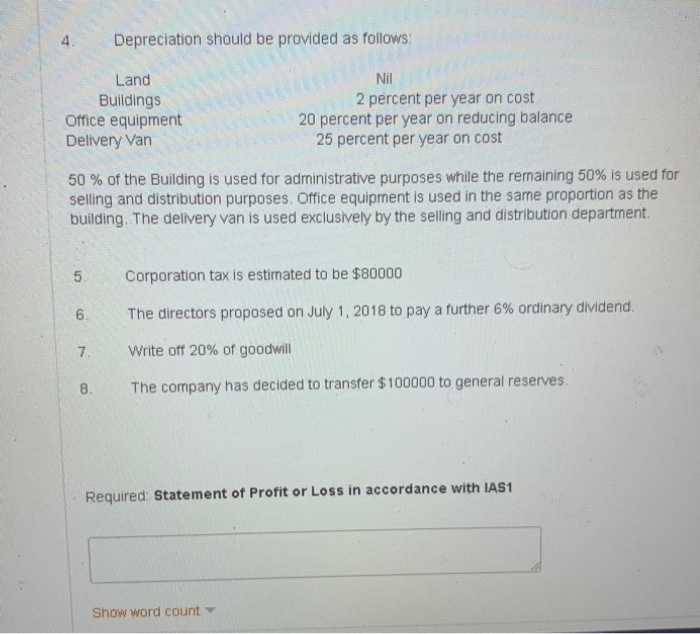

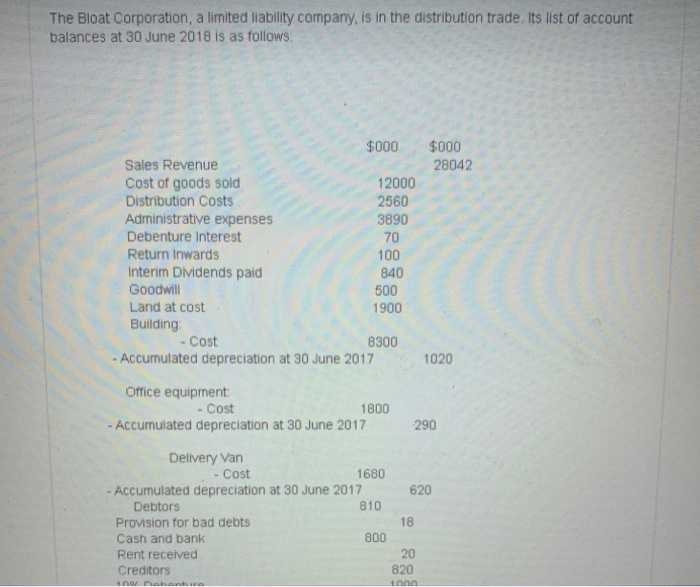

The Bloat Corporation, a limited liability company, is in the distribution trade. Its list of account balances at 30 June 2018 is as follows: $000 28042 $000 Sales Revenue Cost of goods sold 12000 Distribution Costs 2560 Administrative expenses 3890 Debenture Interest 70 Return Inwards 100 Interim Dividends paid 840 Goodwill 500 Land at cost 1900 Building - Cost 8300 Accumulated depreciation at 30 June 2017 1020 Office equipment: - Cost 1800 Accumulated depreciation at 30 June 2017 290 Delivery Van - Cost 1680 - Accumulated depreciation at 30 June 2017 620 Debtors 810 Provision for bad debts 18 Cash and bank 800 Rent received 20 Creditors 820 inn 4 no no Debenture Interest 70 Return Inwards 100 Interim Dividends paid 840 Goodwill 500 Land at cost 1900 Building Cost 8300 - Accumulated depreciation at 30 June 2017 1020 Office equipment - Cost 1800 - Accumulated depreciation at 30 June 2017 290 Delivery Van - Cost 1680 - Accumulated depreciation at 30 June 2017 620 Debtors 810 Provision for bad debts 18 Cash and bank 800 Rent received 20 Creditors 820 10% Debenture 1000 Ordinary shares of $0.25 each 1200 General reserves 2470 Accumulated profits 30 June 2017 250 35500 35500 (Please note that the trial balance figures are in thousands as indicated at the top of each column above - $000) The following additional information is available: (Please note that the trial balance figures are in thousands as indicated at the top of each column above - $000) The following additional information is available: Debtors totaling $6000 are to be written off and the provision for bad debts increased to $30000. It is the company's practice to include the charge for bad debts in the administrative expenses in the income statement. 2 Accruals and prepayments: Distribution costs Administrative expenses Prepayments $60000 $70000 Accruals $120000 $190000 3. During the year the company rented some of its warehouse space to another organization for $3000 per month. In early July 2018 the company received rent for the months of May, June, and July 2018, 4 Depreciation should be provided as follows: Land Buildings Office equipment Delivery Van Nil 2 percent per year on cost 20 percent per year on reducing balance 25 percent per year on cost 50 % of the Building is used for administrative purposes while the remaining 50% is used for selling and distribution purposes. Office equipment is used in the same proportion as the building. The delivery van is used exclusively by the selling and distribution department Depreciation should be provided as follows: Land Buildings Office equipment Delivery Van Nil 2 percent per year on cost 20 percent per year on reducing balance 25 percent per year on cost 50 % of the Building is used for administrative purposes while the remaining 50% is used for selling and distribution purposes. Office equipment is used in the same proportion as the building. The delivery van is used exclusively by the selling and distribution department. 5 Corporation tax is estimated to be $80000 6 The directors proposed on July 1, 2018 to pay a further 6% ordinary dividend. 7 Write off 20% of goodwill 8 The company has decided to transfer $100000 to general reserves Required: Statement of Profit or Loss in accordance with IAS1 Show word count