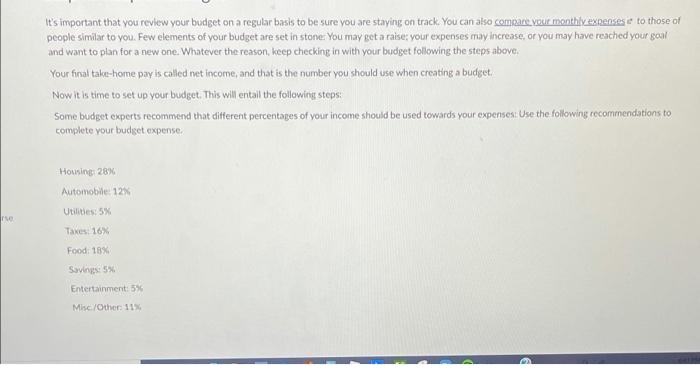

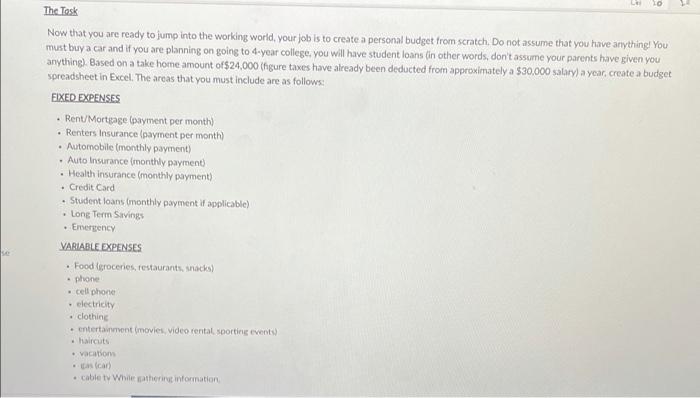

It's important that you review your budget on a regular basis to be sure you are staying on track. You can also compare your monthly expenses e to those of people similar to you. Few elements of your budget are set in stone. You may get a raise your expenses may increase, or you may have reached your soul and want to plan for a new one. Whatever the reason, keep checking in with your budget following the steps above. Your final tak-home pay is called net income, and that is the number you should use when creating a budget Now it is time to set up your budget. This will entail the following steps: Some budget experts recommend that different percentages of your income should be used towards your expenses: Use the following recommendations to complete your budget expense Housing 28% Automobile: 12% Utilities: 5% Taxes: 16% Food: 18% Savingse 5% Entertainment: 5% Misc/Other 11% LO The Tosk Now that you are ready to jump into the working world, your job is to create a personal budget from scratch. Do not assume that you have anything You must buy a car and if you are planning on going to 4-year college, you will have student loans in other words, don't assume your parents have given you anything). Based on a take home amount of$24,000 (hgure taxes have already been deducted from approximately a $30,000 salary) a year, create a budget spreadsheet in Excel. The areas that you must include are as follows: FIXED EXPENSES . Rent/Mortgage (payment per month) Renters Insurance (payment per month Automobile (monthly payment) Auto Insurance (monthly payment Health insurance (monthly payment) Credit Card . Student loans onthly payment of applicable) Long Term Savings Emergency VARIABLE EXPENSES Food Laroceries, restaurants, snacks) . phone cellphone electricity clothing entertainment movies, video rental sporting events haircuts vacation cal cable tv While there information It's important that you review your budget on a regular basis to be sure you are staying on track. You can also compare your monthly expenses e to those of people similar to you. Few elements of your budget are set in stone. You may get a raise your expenses may increase, or you may have reached your soul and want to plan for a new one. Whatever the reason, keep checking in with your budget following the steps above. Your final tak-home pay is called net income, and that is the number you should use when creating a budget Now it is time to set up your budget. This will entail the following steps: Some budget experts recommend that different percentages of your income should be used towards your expenses: Use the following recommendations to complete your budget expense Housing 28% Automobile: 12% Utilities: 5% Taxes: 16% Food: 18% Savingse 5% Entertainment: 5% Misc/Other 11% LO The Tosk Now that you are ready to jump into the working world, your job is to create a personal budget from scratch. Do not assume that you have anything You must buy a car and if you are planning on going to 4-year college, you will have student loans in other words, don't assume your parents have given you anything). Based on a take home amount of$24,000 (hgure taxes have already been deducted from approximately a $30,000 salary) a year, create a budget spreadsheet in Excel. The areas that you must include are as follows: FIXED EXPENSES . Rent/Mortgage (payment per month) Renters Insurance (payment per month Automobile (monthly payment) Auto Insurance (monthly payment Health insurance (monthly payment) Credit Card . Student loans onthly payment of applicable) Long Term Savings Emergency VARIABLE EXPENSES Food Laroceries, restaurants, snacks) . phone cellphone electricity clothing entertainment movies, video rental sporting events haircuts vacation cal cable tv While there information