Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Its just a case study my lecturer gave me only 1 paper like this :( FINA604-Personal Finance Case Study- Establishing insurance needs Cameron and Val

Its just a case study my lecturer gave me only 1 paper like this :(

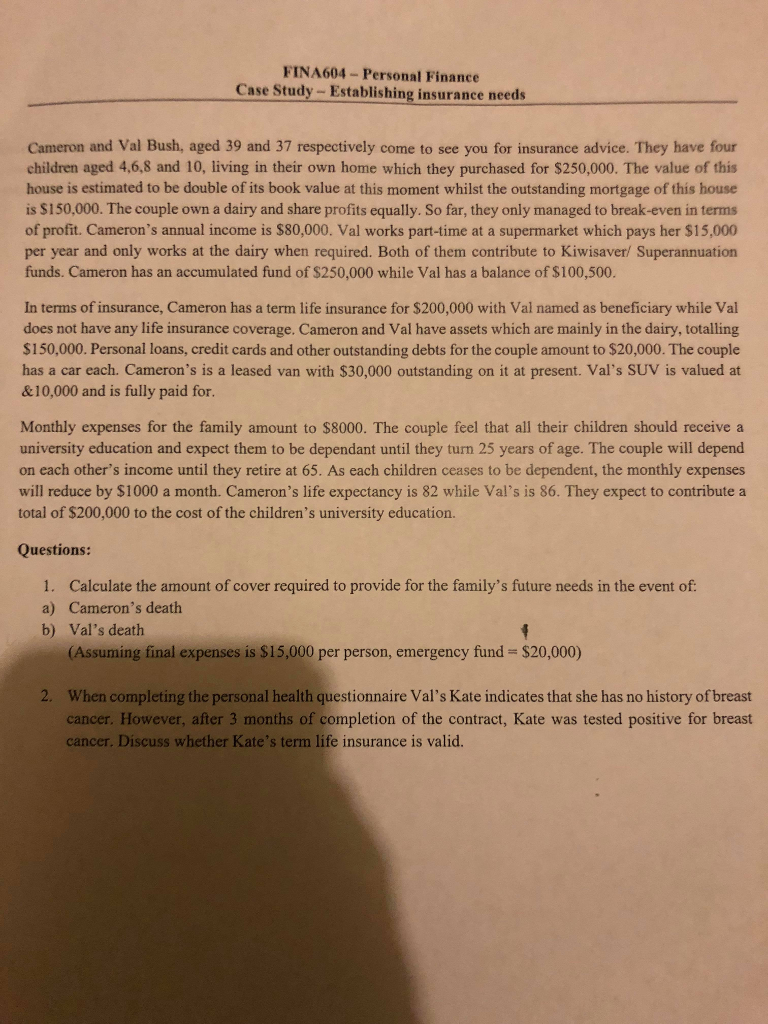

FINA604-Personal Finance Case Study- Establishing insurance needs Cameron and Val Bush, aged 39 and 37 respectively come to see you for insurance advice. They have four children aged 4,6,8 and 10, living in their own home which they purchased for $250,000. The value of this house is estimated to be double of its book value at this moment whilst the outstanding mortgage of this house is $150,000. The couple own a dairy and share profits equally. So far, they only managed to break-even in terms of profit. Cameron's annual income is $80,000. Val works part-time at a supermarket which pays her $15,000 per year and only works at the dairy when required. Both of them contribute to Kiwisaver/ Superannuation funds. Cameron has an accumulated fund of $250,000 while Val has a balance of $100,500. In terms of insurance, Cameron has a term life insurance for $200,000 with Val named as beneficiary while Val does not have any life insurance coverage. Cameron and Val have assets which are mainly in the dairy, totalling $150,000. Personal loans, credit cards and other outstanding debts for the couple amount to $20,000. The couple has a car each. Cameron's is a leased van with $30,000 outstanding on it at present. Val's SUV is valued at &10,000 and is fully paid for. Monthly expenses for the family amount to $8000. The couple feel that all their children should receive a university education and expect them to be dependant until they turn 25 years of age. The couple will depend on each other's income until they retire at 65. As each children ceases to be dependent, the monthly expenses will reduce by $1000 a month. Cameron's life expectancy is 82 while Val's is 86. They expect to contribute a total of $200,000 to the cost of the children's university education. Questions: Calculate the amount of cover required to provide for the family's future needs in the event of 1. a) b) Cameron's death Val's death Assuming final expenses is $15,000 per person, emergency fund $20,000) 2. When completing the personal health questionnaire Val's Kate indicates that she has no history of breast cancer. However, after 3 months of completion of the contract, Kate was tested positive for breast cancer. Discuss whether Kate's term life insurance is valid. FINA604-Personal Finance Case Study- Establishing insurance needs Cameron and Val Bush, aged 39 and 37 respectively come to see you for insurance advice. They have four children aged 4,6,8 and 10, living in their own home which they purchased for $250,000. The value of this house is estimated to be double of its book value at this moment whilst the outstanding mortgage of this house is $150,000. The couple own a dairy and share profits equally. So far, they only managed to break-even in terms of profit. Cameron's annual income is $80,000. Val works part-time at a supermarket which pays her $15,000 per year and only works at the dairy when required. Both of them contribute to Kiwisaver/ Superannuation funds. Cameron has an accumulated fund of $250,000 while Val has a balance of $100,500. In terms of insurance, Cameron has a term life insurance for $200,000 with Val named as beneficiary while Val does not have any life insurance coverage. Cameron and Val have assets which are mainly in the dairy, totalling $150,000. Personal loans, credit cards and other outstanding debts for the couple amount to $20,000. The couple has a car each. Cameron's is a leased van with $30,000 outstanding on it at present. Val's SUV is valued at &10,000 and is fully paid for. Monthly expenses for the family amount to $8000. The couple feel that all their children should receive a university education and expect them to be dependant until they turn 25 years of age. The couple will depend on each other's income until they retire at 65. As each children ceases to be dependent, the monthly expenses will reduce by $1000 a month. Cameron's life expectancy is 82 while Val's is 86. They expect to contribute a total of $200,000 to the cost of the children's university education. Questions: Calculate the amount of cover required to provide for the family's future needs in the event of 1. a) b) Cameron's death Val's death Assuming final expenses is $15,000 per person, emergency fund $20,000) 2. When completing the personal health questionnaire Val's Kate indicates that she has no history of breast cancer. However, after 3 months of completion of the contract, Kate was tested positive for breast cancer. Discuss whether Kate's term life insurance is validStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started