Answered step by step

Verified Expert Solution

Question

1 Approved Answer

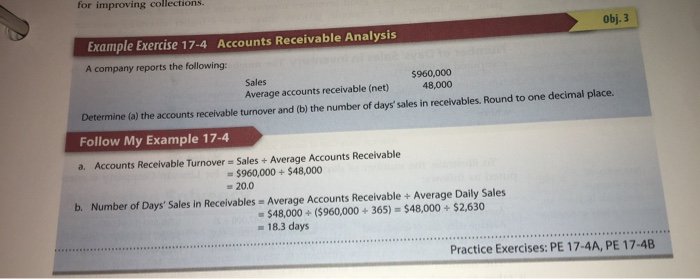

its problem 17 B for improving collections. Obj. 3 Example Exercise 17-4 Accounts Receivable Analysis A company reports the following: Sales $960,000 Average accounts receivable

its problem 17 B

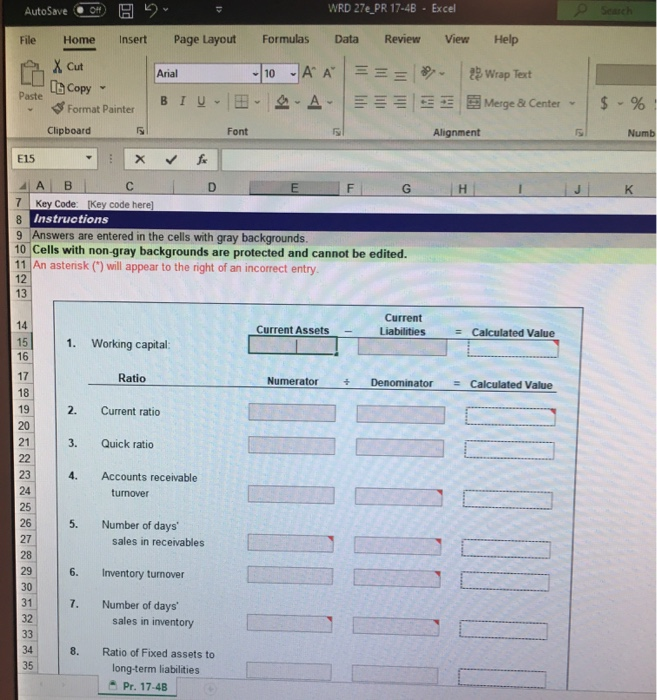

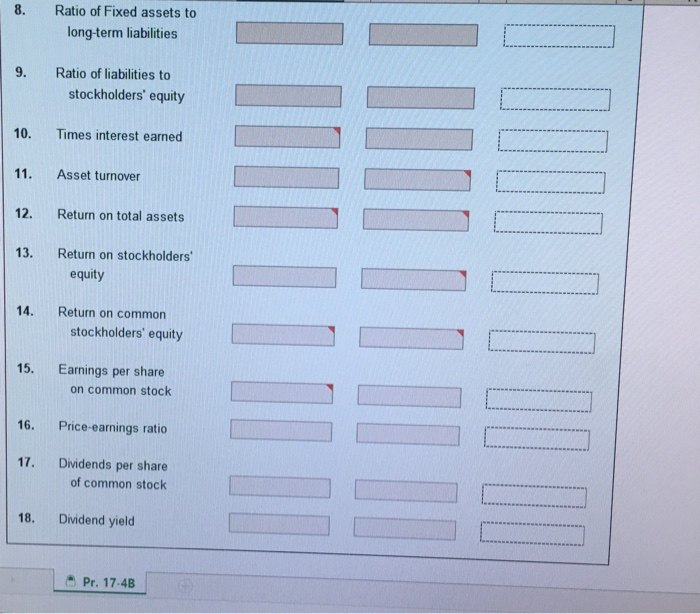

for improving collections. Obj. 3 Example Exercise 17-4 Accounts Receivable Analysis A company reports the following: Sales $960,000 Average accounts receivable (net) 48,000 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round to one decimal place. Follow My Example 17-4 a. Accounts Receivable Turnover = Sales + Average Accounts Receivable $960,000+ $48,000 20.0 b. Number of Days' Sales in Receivables = Average Accounts Receivable + Average Daily Sales -$48,000 + ($960,000 + 365) - $48,000 + $ 2,630 18.3 days Practice Exercises: PE 17-4A, PE 17-4B AutoSave OH H WRD 27e_PR 17-4B - Excel e Search File Home Insert Page Layout Formulas Data Review View Help X Cut Arial 10 Copy AA === S-A- 2 Wrap Text Merge & Center Paste BI U Format Painter $ - % Clipboard Font Alignment Numb E15 ** K AA B G 7 Key Code: Key code here) 8 Instructions 9 Answers are entered in the cells with gray backgrounds. 10 Cells with non-gray backgrounds are protected and cannot be edited. 11 An asterisk (1) will appear to the right of an incorrect entry. 12 13 Current Assets Current Liabilities = Calculated Value 14 15 16 1. Working capital Ratio Numerator Denominator = Calculated Value 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 5. Number of days' sales in receivables 6. Inventory turnover LUUT 7. Number of days' sales in inventory 8. Ratio of Fixed assets to long-term liabilities Pr. 17-4B 8. Ratio of Fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders' equity IIDIILIONI IIIIIIIIIII DO TI I DDINDI 14. Return on common stockholders' equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yield Pr. 17-4B for improving collections. Obj. 3 Example Exercise 17-4 Accounts Receivable Analysis A company reports the following: Sales $960,000 Average accounts receivable (net) 48,000 Determine (a) the accounts receivable turnover and (b) the number of days' sales in receivables. Round to one decimal place. Follow My Example 17-4 a. Accounts Receivable Turnover = Sales + Average Accounts Receivable $960,000+ $48,000 20.0 b. Number of Days' Sales in Receivables = Average Accounts Receivable + Average Daily Sales -$48,000 + ($960,000 + 365) - $48,000 + $ 2,630 18.3 days Practice Exercises: PE 17-4A, PE 17-4B AutoSave OH H WRD 27e_PR 17-4B - Excel e Search File Home Insert Page Layout Formulas Data Review View Help X Cut Arial 10 Copy AA === S-A- 2 Wrap Text Merge & Center Paste BI U Format Painter $ - % Clipboard Font Alignment Numb E15 ** K AA B G 7 Key Code: Key code here) 8 Instructions 9 Answers are entered in the cells with gray backgrounds. 10 Cells with non-gray backgrounds are protected and cannot be edited. 11 An asterisk (1) will appear to the right of an incorrect entry. 12 13 Current Assets Current Liabilities = Calculated Value 14 15 16 1. Working capital Ratio Numerator Denominator = Calculated Value 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 5. Number of days' sales in receivables 6. Inventory turnover LUUT 7. Number of days' sales in inventory 8. Ratio of Fixed assets to long-term liabilities Pr. 17-4B 8. Ratio of Fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders' equity IIDIILIONI IIIIIIIIIII DO TI I DDINDI 14. Return on common stockholders' equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yield Pr. 17-4B Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started