Answered step by step

Verified Expert Solution

Question

1 Approved Answer

its related - ans it allll On September 1, 2019, Mystery Inc. borrowed $6,000 from Creepy Co. signing a ten-month note payable with 4 %

its related - ans it allll

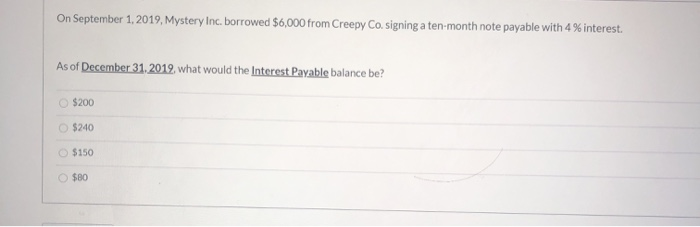

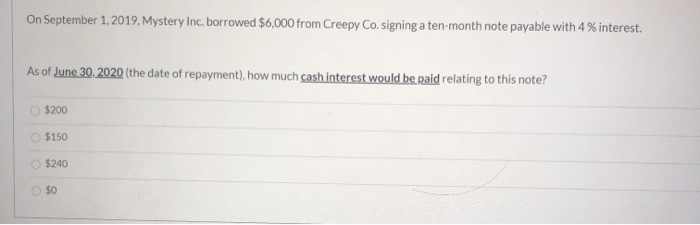

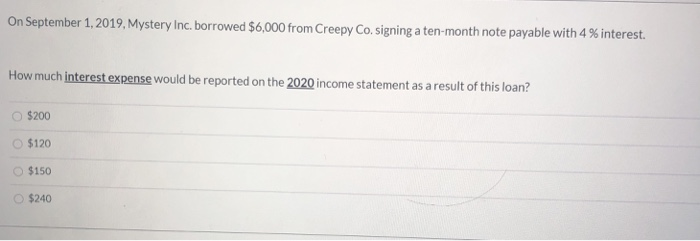

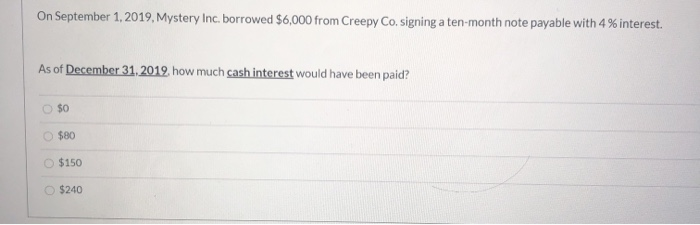

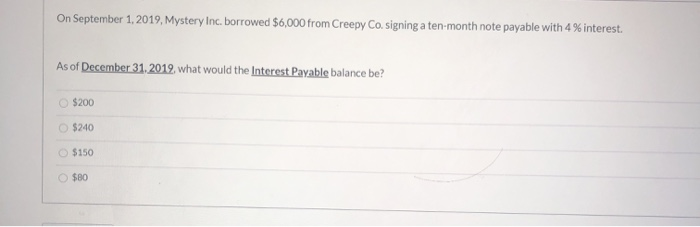

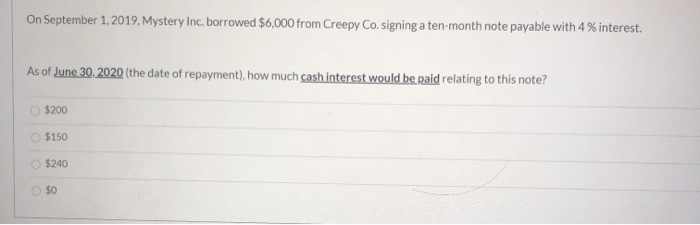

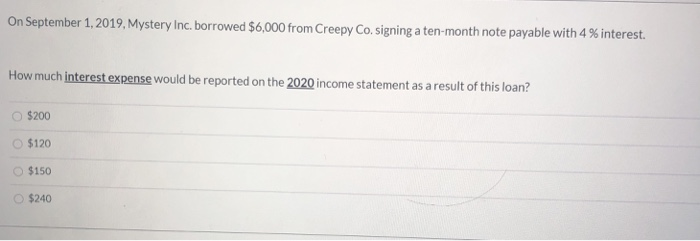

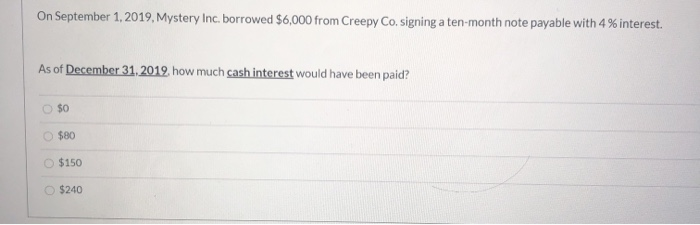

On September 1, 2019, Mystery Inc. borrowed $6,000 from Creepy Co. signing a ten-month note payable with 4 % interest. As of December 31, 2012, what would the Interest Payable balance be? $200 $240 $150 $80 On September 1, 2019, Mystery Inc. borrowed $6,000 from Creepy Co. signing a ten-month note payable with 4 % interest. As of June 30, 2020 (the date of repayment), how much cash interest would be paid relating to this note? $200 $150 $240 $0 On September 1, 2019, Mystery Inc. borrowed $6,000 from Creepy Co. signing a ten-month note payable with 4 % interest. How much interest expense would be reported on the 2020 income statement as a result of this loan? $200 $120 $150 $240 On September 1, 2019, Mystery Inc. borrowed $6,000 from Creepy Co, signing a ten-month note payable with 4 % interest. As of December 31, 2019. how much cash interest would have been paid? $0 $80 $150 $240

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started