Answered step by step

Verified Expert Solution

Question

1 Approved Answer

its the same answer choices for the 5 statements A freshman at Brightest College needs your help on revenue and expense recognition and measurement criteria.

its the same answer choices for the 5 statements

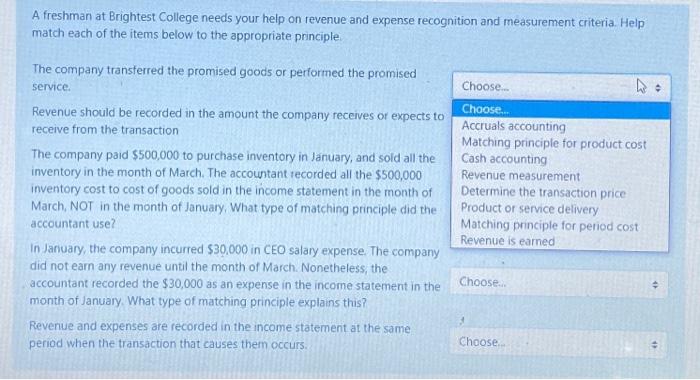

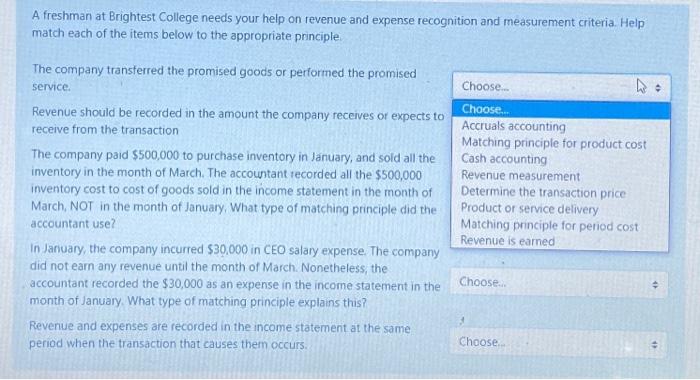

A freshman at Brightest College needs your help on revenue and expense recognition and measurement criteria. Help match each of the items below to the appropriate principle. The company transferred the promised goods or performed the promised service Revenue should be recorded in the amount the company receives or expects to receive from the transaction The company paid $500,000 to purchase inventory in January, and sold all the inventory in the month of March. The accountant recorded all the $500,000 inventory cost to cost of goods sold in the income statement in the month of March, NOT in the month of January, What type of matching principle did the accountant use? in January, the company incurred $30,000 in CEO salary expense. The company did not earn any revenue until the month of March. Nonetheless, the accountant recorded the $30,000 as an expense in the income statement in the month of January. What type of matching principle explains this? Revenue and expenses are recorded in the income statement at the same period when the transaction that causes them occurs. Choose... w Choose... Accruals accounting Matching principle for product cost Cash accounting Revenue measurement Determine the transaction price Product or service delivery Matching principle for period cost Revenue is earned Choose 45 Choose

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started