it's urgent and show the calculation

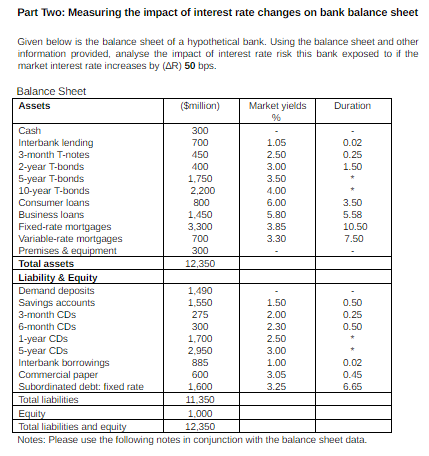

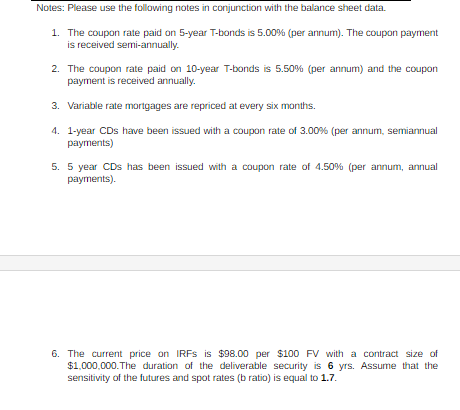

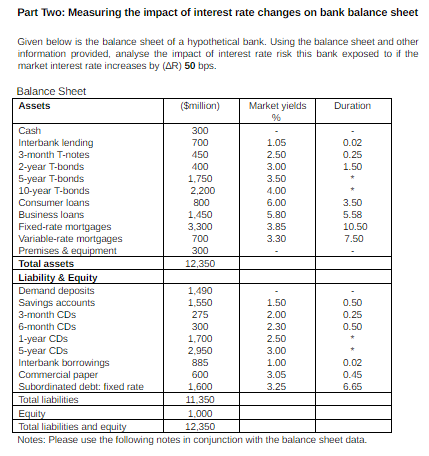

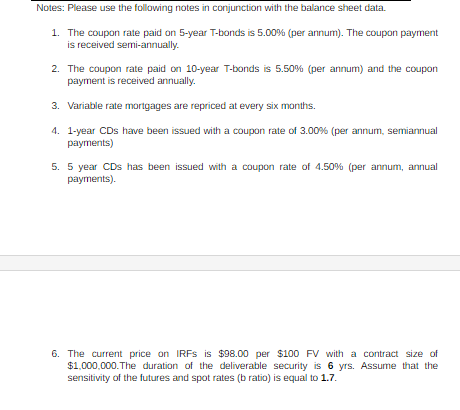

Part Two: Measuring the impact of interest rate changes on bank balance sheet Given below is the balance sheet of a hypothetical bank. Using the balance sheet and other information provided, analyse the impact of interest rate risk this bank exposed to if the market interest rate increases by ( R)50bps. Notes: Please use the following notes in conjunction with the balance sheet data. 1. The coupon rate paid on 5-year T-bonds is 5.00% (per annum). The coupon payment is received semi-annually. 2. The coupon rate paid on 10-year T-bonds is 5.50\% (per annum) and the coupon payment is received annually. 3. Variable rate mortgages are repriced at every six months. 4. 1-year CDs have been issued with a coupon rate of 3.00% (per annum, semiannual payments) 5. 5 year CD s has been issued with a coupon rate of 4.50% (per annum, annual payments). 6. The current price on IRFs is $98.00 per $100 FV with a contract size of $1,000,000. The duration of the deliverable security is 6 yrs. Assume that the sensitivity of the futures and spot rates ( b ratio) is equal to 1.7. Part Two: Measuring the impact of interest rate changes on bank balance sheet Given below is the balance sheet of a hypothetical bank. Using the balance sheet and other information provided, analyse the impact of interest rate risk this bank exposed to if the market interest rate increases by ( R)50bps. Notes: Please use the following notes in conjunction with the balance sheet data. 1. The coupon rate paid on 5-year T-bonds is 5.00% (per annum). The coupon payment is received semi-annually. 2. The coupon rate paid on 10-year T-bonds is 5.50\% (per annum) and the coupon payment is received annually. 3. Variable rate mortgages are repriced at every six months. 4. 1-year CDs have been issued with a coupon rate of 3.00% (per annum, semiannual payments) 5. 5 year CD s has been issued with a coupon rate of 4.50% (per annum, annual payments). 6. The current price on IRFs is $98.00 per $100 FV with a contract size of $1,000,000. The duration of the deliverable security is 6 yrs. Assume that the sensitivity of the futures and spot rates ( b ratio) is equal to 1.7