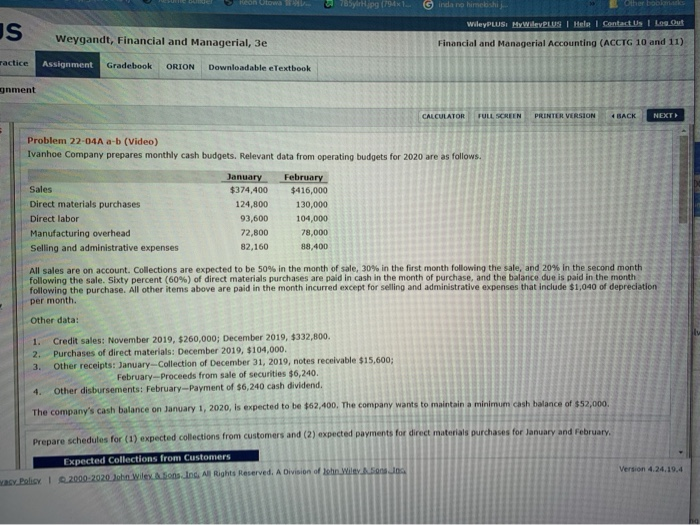

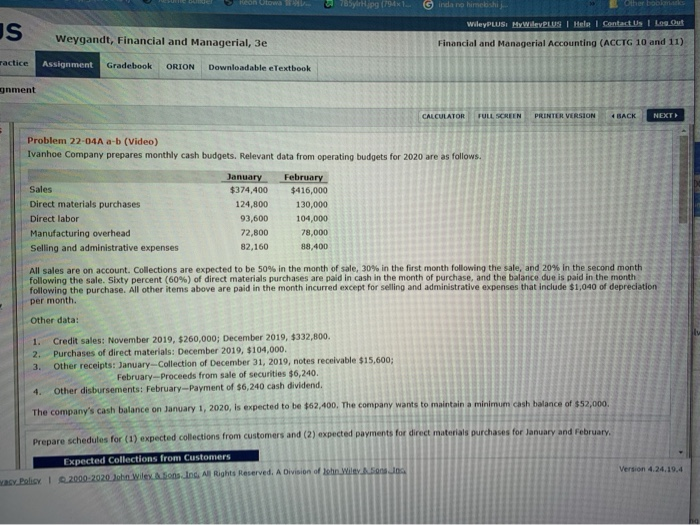

Ivanhoe Company prepares monthly cash budgets. Relevant data from operating budgets for 2020 are as follows. January February Sales $374,400 $416,000 Direct materials purchases 124,800

Ivanhoe Company prepares monthly cash budgets. Relevant data from operating budgets for 2020 are as follows.

| | | January | | February |

| Sales | | $374,400 | | $416,000 |

| Direct materials purchases | | 124,800 | | 130,000 |

| Direct labor | | 93,600 | | 104,000 |

| Manufacturing overhead | | 72,800 | | 78,000 |

| Selling and administrative expenses | | 82,160 | | 88,400 |

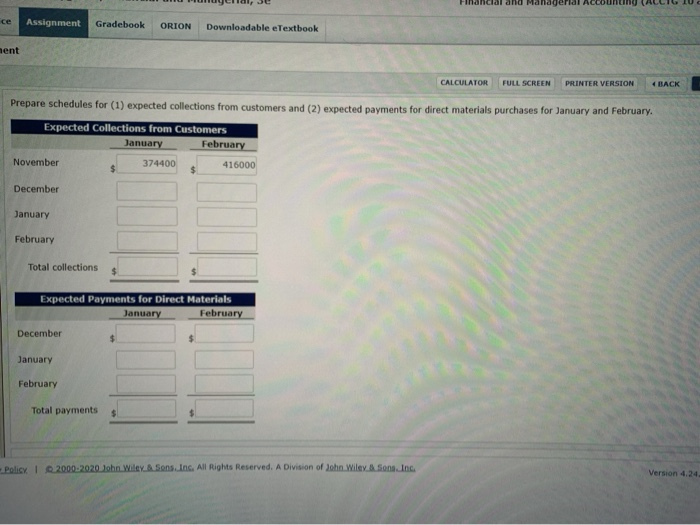

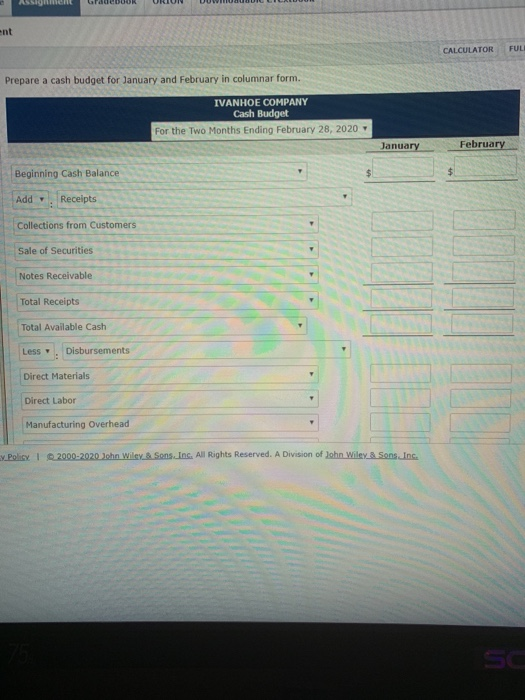

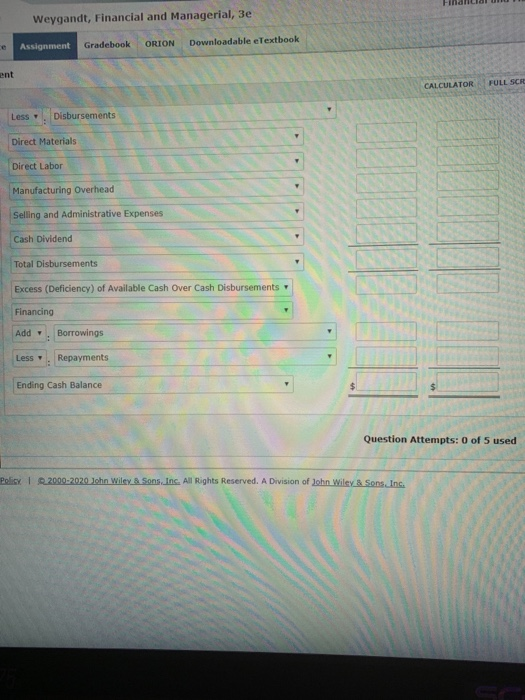

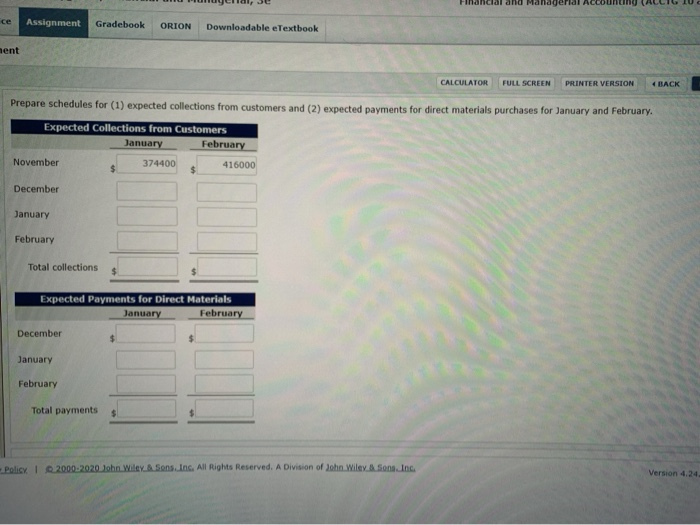

All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% in the second month following the sale. Sixty percent (60%) of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for selling and administrative expenses that include $1,040 of depreciation per month. Other data:

| 1. | | Credit sales: November 2019, $260,000; December 2019, $332,800. |

| 2. | | Purchases of direct materials: December 2019, $104,000. |

| 3. | | Other receipts: JanuaryCollection of December 31, 2019, notes receivable $15,600; |

| | | FebruaryProceeds from sale of securities $6,240. |

| 4. | | Other disbursements: FebruaryPayment of $6,240 cash dividend. |

The companys cash balance on January 1, 2020, is expected to be $62,400. The company wants to maintain a minimum cash balance of $52,000.

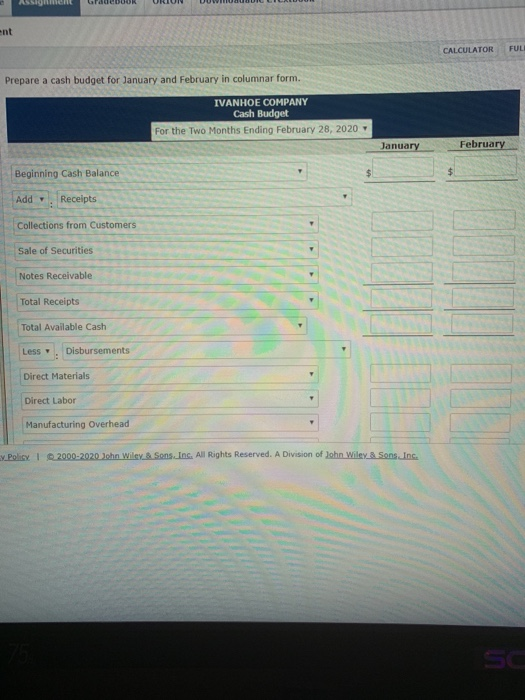

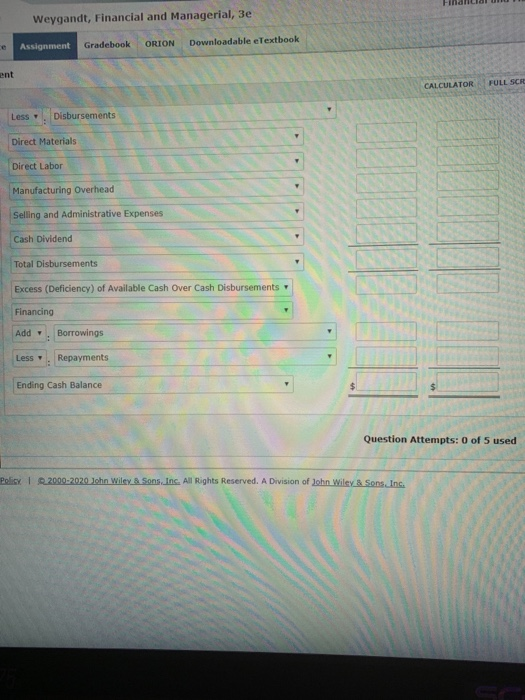

WileyPLUSI MyWEPLUS I Hele 1 Contact Us Logout IS Weygandt, Financial and Managerial, 3e Financial and Managerial Accounting (ACCTG 10 and 11) factice Assignment Gradebook ORION Downloadable eTextbook gnment EN PRINTER VERSION BACK Problem 22-04A a-b (Video) Ivanhoe Company prepares monthly cash budgets. Relevant data from operating budgets for 2020 are as follows Sales Direct materials purchases Direct labor Manufacturing overhead Selling and administrative expenses January $374,400 124,800 93,600 72,800 82,160 February $416,000 130,000 104,000 78,000 58.400 All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% in the second month following the sale. Sixty percent (60%) of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for selling and administrative expenses that include $1.040 of depreciation per month Other data: 1. Credit sales: November 2019, $260,000; December 2019, $332,800. 2. Purchases of direct materials: December 2019, $104,000. 3 Other receipts: January-Collection of December 31, 2019 notes receivable $15.600 February-Proceeds from sale of securities $6,240. 4. Other disbursements: February-Payment of $6,240 cash dividend. The company's cash balance on January 1, 2020, is expected to be $62,400. The company wants to maintain a minimum ch ance of $52.000 Prepare schedules for (1) expected collections from customers and (2) expected payments for de material purchases for January and February Expected Collections from Customers Policy 2000-2020 John Wiley. In All Rights Reserved. A Division of lohn Wiley Version 4.24.19.4 Assignment Gradebook ORION Downloadable eTextbook ent CALCULATOR FULL SCREEN PRINTER VERSION BACK Prepare schedules for (1) expected collections from customers and (2) expected payments for direct materials purchases for January and February Expected Collections from Customers January February November 374400 416000 December January February Total collections Expected Payments for Direct Materials February December January February Total payments Policy 2000-2020 John Wiley Son Inc. All Rights Reserved. A Division of John Wiley Son Inc Version 4.24 ASSIGNE GUBUK URIUN UUWIDAD ent CALCULATOR FUL Prepare a cash budget for January and February in columnar form. IVANHOE COMPANY Cash Budget For the Two Months Ending February 28, 2020 January February Beginning Cash Balance Add . Receipts Collections from Customers Sale of Securities Notes Receivable Total Receipts Total Available Cash Less . Disbursements Direct Materials Direct Labor Manufacturing Overhead y Policy. I 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. Weygandt, Financial and Managerial, 3e Assignment Gradebook ORION Downloadable eTextbook ent CALCULATOR FULL SCRE Less Disbursements Direct Materials Direct Labor Manufacturing Overhead Selling and Administrative Expenses Cash Dividend Total Disbursements Excess (Deficiency) of Available Cash Over Cash Disbursements Financing Add . Borrowings Less Repayments Ending Cash Balance Question Attempts: 0 of 5 used Policy D 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc