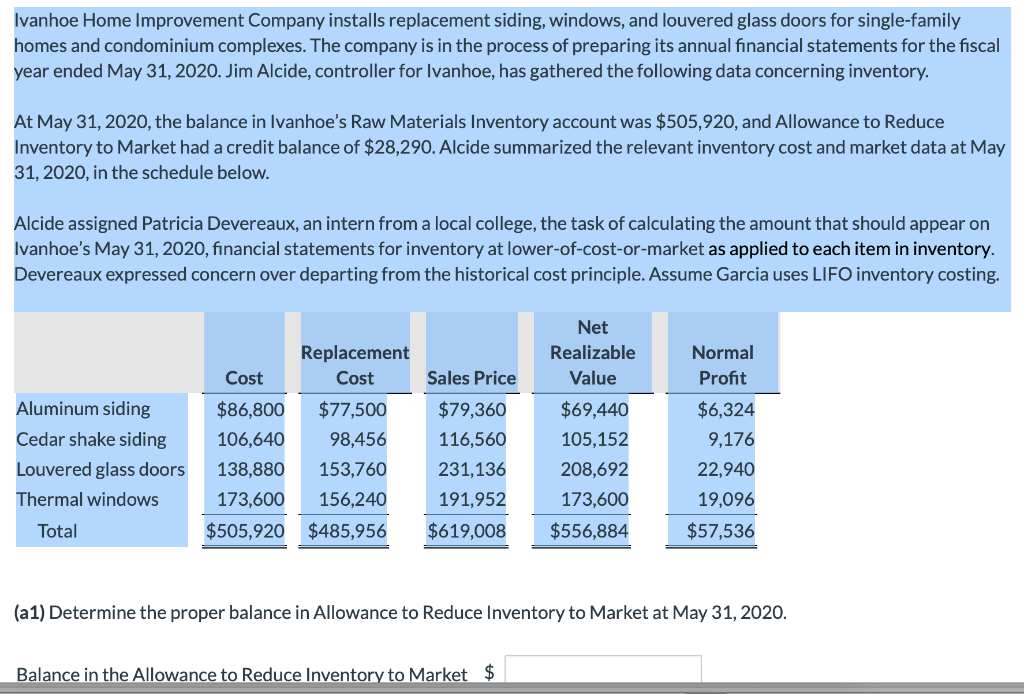

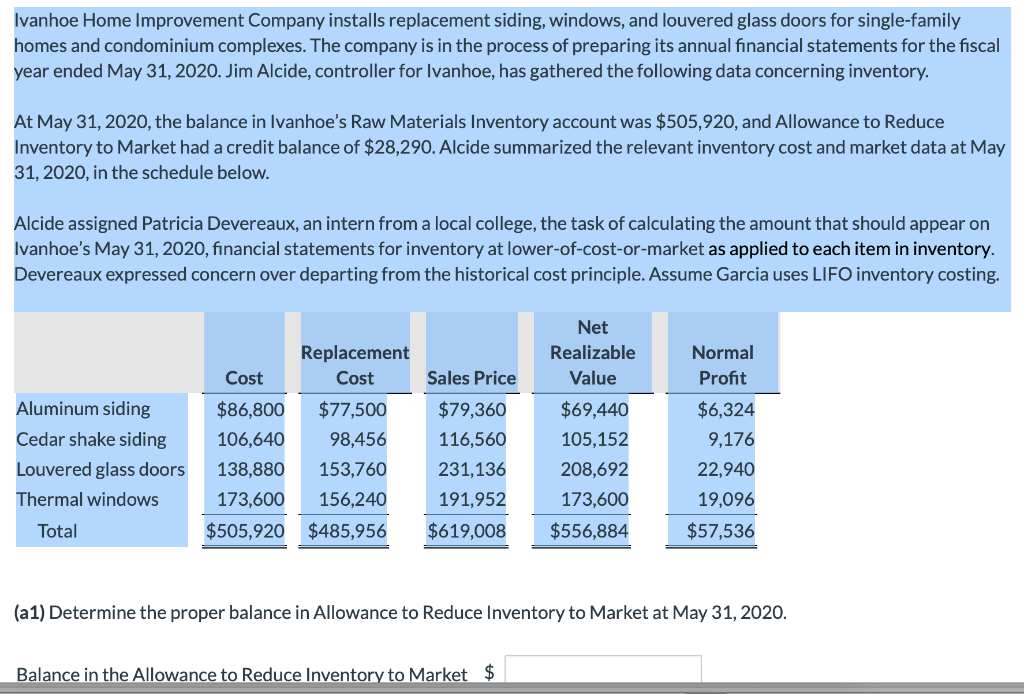

Ivanhoe Home Improvement Company installs replacement siding, windows, and louvered glass doors for single-family homes and condominium complexes. The company is in the process of preparing its annual financial statements for the fiscal year ended May 31, 2020. Jim Alcide, controller for Ivanhoe, has gathered the following data concerning inventory. At May 31, 2020, the balance in Ivanhoe's Raw Materials Inventory account was $505,920, and Allowance to Reduce Inventory to Market had a credit balance of $28,290. Alcide summarized the relevant inventory cost and market data at May 31, 2020, in the schedule below. Alcide assigned Patricia Devereaux, an intern from a local college, the task of calculating the amount that should appear on Ivanhoe's May 31, 2020, financial statements for inventory at lower-of-cost-or-market as applied to each item in inventory. Devereaux expressed concern over departing from the historical cost principle. Assume Garcia uses LIFO inventory costing. Aluminum siding Cedar shake siding Louvered glass doors Thermal windows Total Cost $86,800 106,640 138,880 173,600 $505,920 Replacement Cost $77,500 98,456 153,760 156,240 $485,956 Sales Price $79,360 116,560 231,136 191,952 $619,008 Net Realizable Value $69,440 105,152 208,692 173,600 $556,884 Normal Profit $6,324 9,176 22,940 19,096 $57,536 (21) Determine the proper balance in Allowance to Reduce Inventory to Market at May 31, 2020. Balance in the Allowance to Reduce Inventory to Market $ (a2) For the fiscal year ended May 31, 2020, determine the amount of the gain or loss that would be recorded due to the change in Allowance to Reduce Inventory to Market. The amount of the gain (loss) $ Ivanhoe Home Improvement Company installs replacement siding, windows, and louvered glass doors for single-family homes and condominium complexes. The company is in the process of preparing its annual financial statements for the fiscal year ended May 31, 2020. Jim Alcide, controller for Ivanhoe, has gathered the following data concerning inventory. At May 31, 2020, the balance in Ivanhoe's Raw Materials Inventory account was $505,920, and Allowance to Reduce Inventory to Market had a credit balance of $28,290. Alcide summarized the relevant inventory cost and market data at May 31, 2020, in the schedule below. Alcide assigned Patricia Devereaux, an intern from a local college, the task of calculating the amount that should appear on Ivanhoe's May 31, 2020, financial statements for inventory at lower-of-cost-or-market as applied to each item in inventory. Devereaux expressed concern over departing from the historical cost principle. Assume Garcia uses LIFO inventory costing. Aluminum siding Cedar shake siding Louvered glass doors Thermal windows Total Cost $86,800 106,640 138,880 173,600 $505,920 Replacement Cost $77,500 98,456 153,760 156,240 $485,956 Sales Price $79,360 116,560 231,136 191,952 $619,008 Net Realizable Value $69,440 105,152 208,692 173,600 $556,884 Normal Profit $6,324 9,176 22,940 19,096 $57,536 (21) Determine the proper balance in Allowance to Reduce Inventory to Market at May 31, 2020. Balance in the Allowance to Reduce Inventory to Market $ (a2) For the fiscal year ended May 31, 2020, determine the amount of the gain or loss that would be recorded due to the change in Allowance to Reduce Inventory to Market. The amount of the gain (loss) $