Answered step by step

Verified Expert Solution

Question

1 Approved Answer

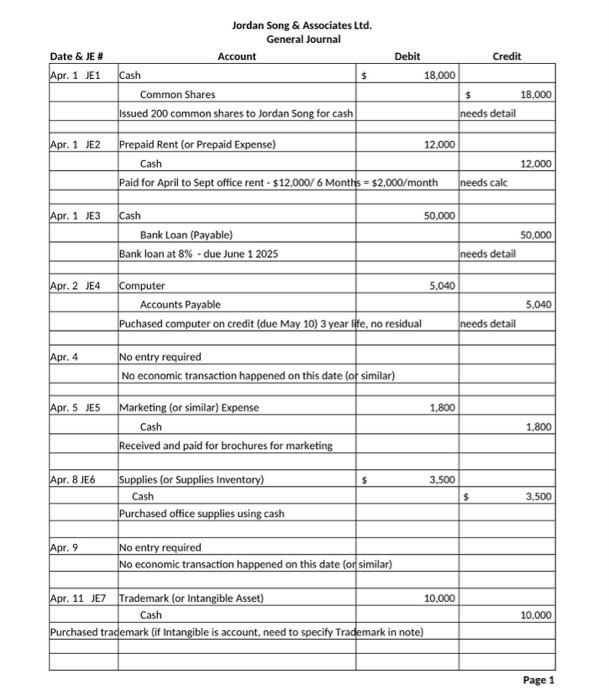

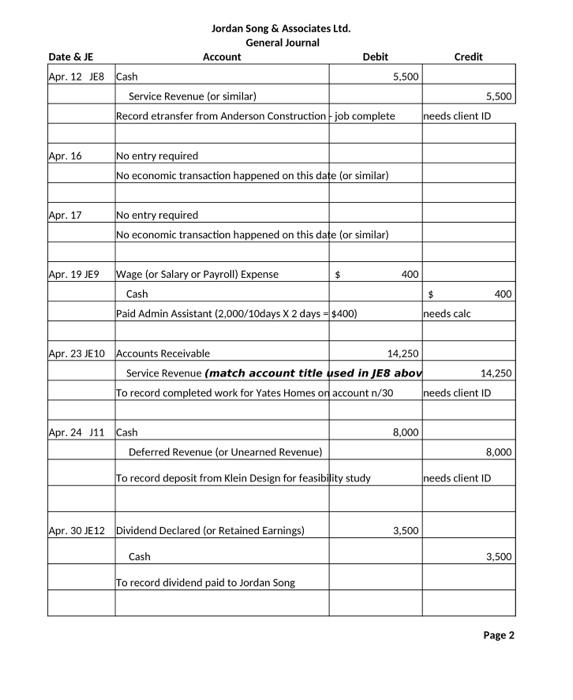

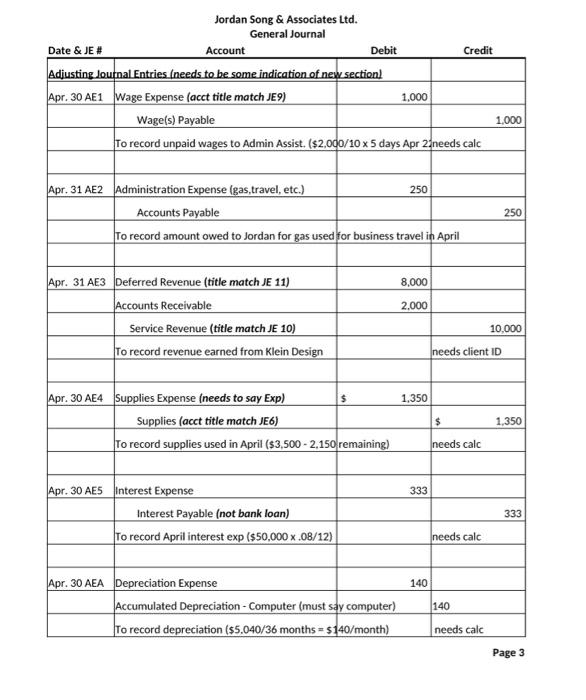

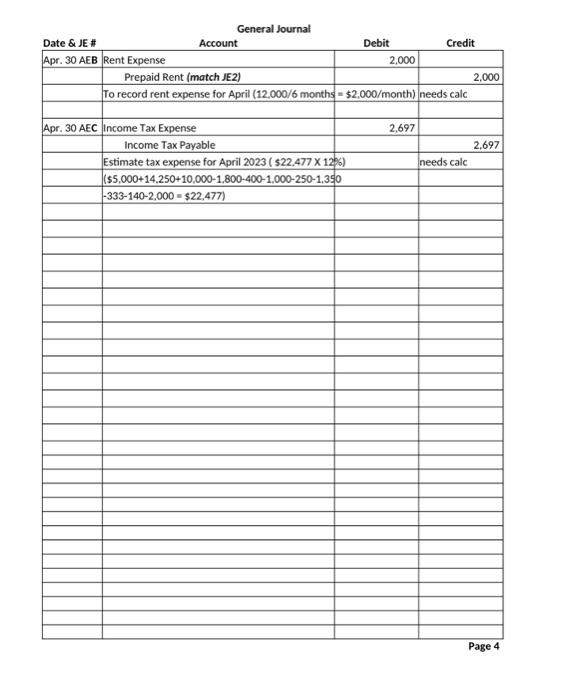

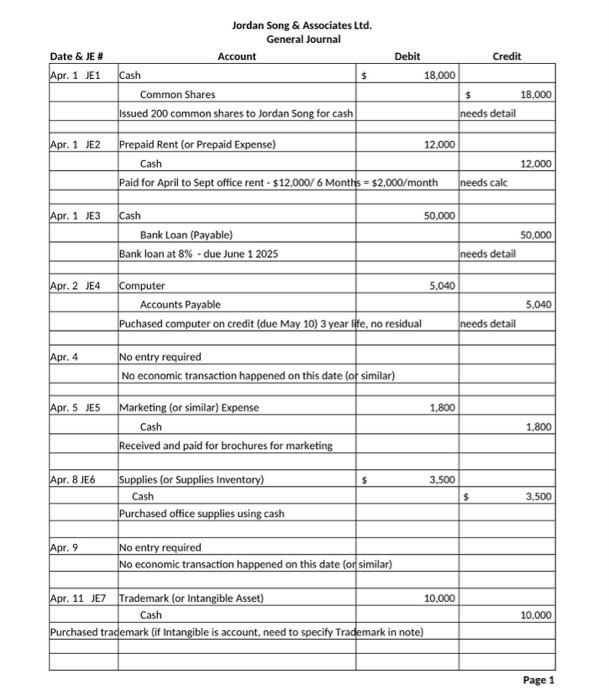

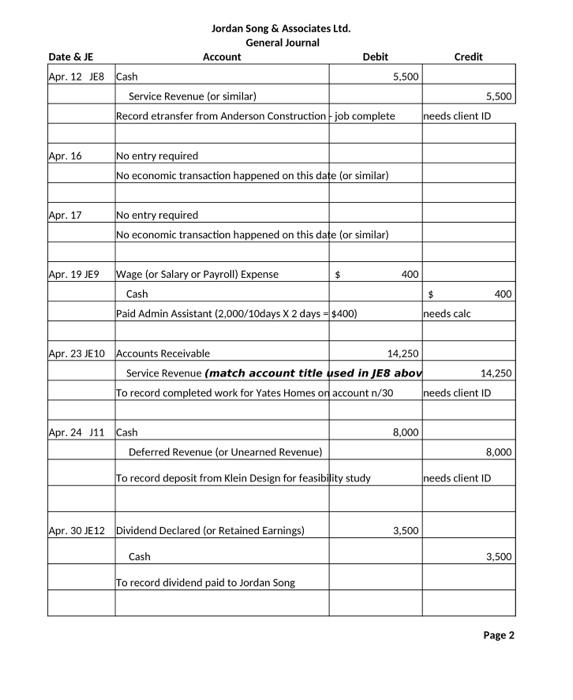

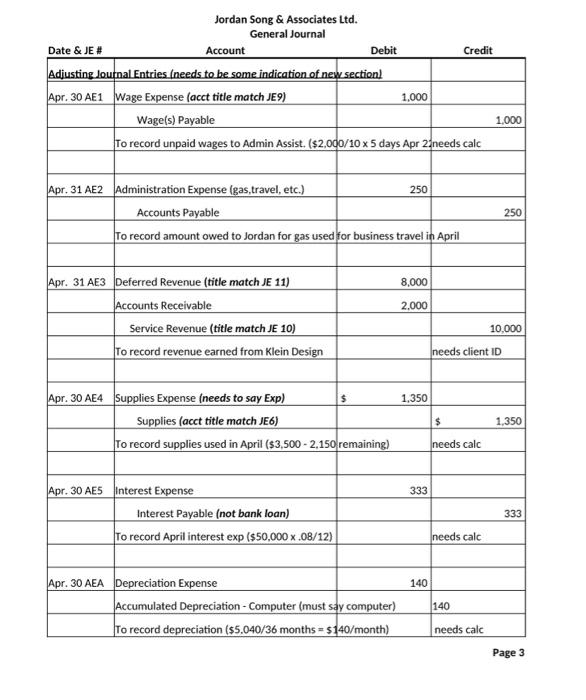

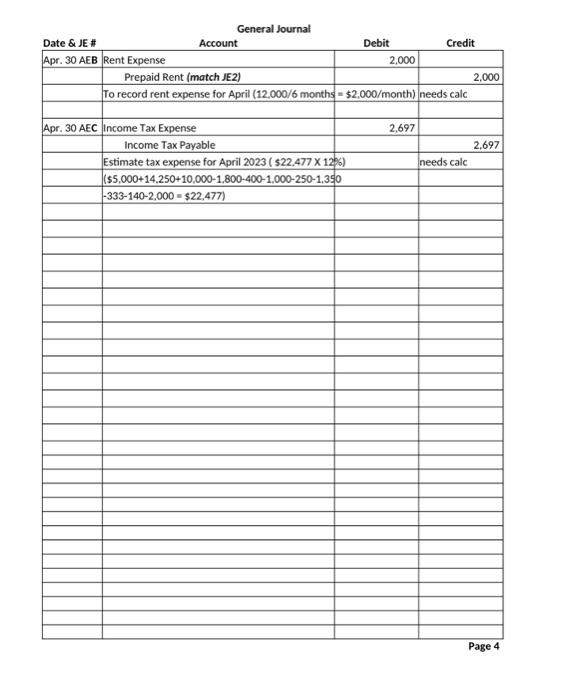

Using the following journal entries, create a Statement of Financial Position for the companys bank to review using Excel. Jordan Song & Associates Ltd. General

Using the following journal entries, create a Statement of Financial Position for the companys bank to review using Excel.

Jordan Song \& Associates Ltd. General Journal Date \& JE \# Account Debit Credit \begin{tabular}{|c|c|c|c|} \hline Adjusting Jou & Inal Entries (needs to be some indication of new & w sectionl & \\ \hline Apr. 30 AE1 & Wage Expense (acct title match JE9) & 1,000 & \\ \hline & Wage(s) Payable & & 1,000 \\ \hline & To record unpaid wages to Admin Assist. (\$2,00 & 0/105 days Apr 2 & Ineeds calc \\ \hline \multirow[t]{3}{*}{ Apr. 31 AE2 } & Administration Expense (gas,travel, etc.) & 250 & \\ \hline & Accounts Payable & & 250 \\ \hline & To record amount owed to Jordan for gas used & for business travel in & in April \\ \hline \multirow[t]{4}{*}{ Apr. 31 AE3 3} & Deferred Revenue (title match JE 11) & 8,000 & \\ \hline & Accounts Receivable & 2,000 & \\ \hline & Service Revenue (title match JE 10) & & 10,000 \\ \hline & To record revenue earned from Klein Design & & needs client ID \\ \hline \multirow[t]{3}{*}{ Apr. 30 AE4 } & Supplies Expense (needs to say Exp) & 1,350 & \\ \hline & Supplies (acct title match JE6) & & 1,350 \\ \hline & To record supplies used in April ($3,5002,150 & remaining) & needs calc \\ \hline \multirow[t]{3}{*}{ Apr. 30 AE5 } & Interest Expense & 333 & \\ \hline & Interest Payable (not bank loan) & & 333 \\ \hline & To record April interest exp($50,000.08/12) & & needs calc \\ \hline \multirow[t]{3}{*}{ Apr. 30 AEA } & Depreciation Expense & 140 & \\ \hline & Accumulated Depreciation - Computer (must sa & ay computer) & 140 \\ \hline & To record depreciation ($5.040/36 months =$1 & (40/month) & needs calc \\ \hline \end{tabular} Page 3 Jordan Song \& Associates Ltd. General Journal Date \& JE Account Debit Credit \begin{tabular}{|c|c|c|c|} \hline Apr. 12 JE8 & Cash & 5,500 & \\ \hline & Service Revenue (or similar) & & 5.500 \\ \hline & Record etransfer from Anderson Construction & - job complete & needs client ID \\ \hline \multirow[t]{2}{*}{ Apr. 16} & No entry required & & \\ \hline & No economic transaction happened on this da & te (or similar) & \\ \hline \multirow[t]{2}{*}{ Apr. 17} & No entry required & & \\ \hline & No economic transaction happened on this da & te (or similar) & \\ \hline \multirow[t]{3}{*}{ Apr. 19 JE9 } & Wage (or Salary or Payroll) Expense & 400 & \\ \hline & Cash & & 400 \\ \hline & Paid Admin Assistant (2,000/10 days 2 days = & =$400) & needs calc \\ \hline \multirow[t]{3}{*}{ Apr. 23 JE10 } & Accounts Receivable & 14,250 & \\ \hline & Service Revenue (match account title & used in JE8 abov & 14.250 \\ \hline & To record completed work for Yates Homes on & account n/30 & needs client ID \\ \hline \multirow[t]{3}{*}{ Apr. 24J11} & Cash & 8,000 & \\ \hline & Deferred Revenue (or Unearned Revenue) & & 8,000 \\ \hline & To record deposit from Klein Design for feasib & dity study & needs client ID \\ \hline \multirow[t]{3}{*}{ Apr. 30 JE12 } & Dividend Declared (or Retained Earnings) & 3,500 & \\ \hline & Cash & & 3,500 \\ \hline & To record dividend paid to Jordan Song & & \\ \hline \end{tabular} Page 2 Jordan Song \& Associates Ltd. General Journal Date & JE \# Account Debit Credit \begin{tabular}{|c|c|c|c|} \hline & \multirow[b]{2}{*}{ Cash } & & \\ \hline Apr. 1 JE1 & & 18,000 & \\ \hline & Common Shares & & 18,000 \\ \hline & Issued 200 common shares to Jordan Song for cash & & needs detail \\ \hline \multirow[t]{3}{*}{ Apr. 1 JE2 } & Prepaid Rent (or Prepaid Expense) & 12,000 & \\ \hline & Cash & & 12,000 \\ \hline & Paid for April to Sept office rent - $12,000/6Month & s=$2,000/ month & needs calc \\ \hline \multirow[t]{3}{*}{ Apr. 1 JE3 } & Cash & 50,000 & \\ \hline & Bank Loan (Payable) & & 50,000 \\ \hline & Bank loan at 8% - due June 12025 & & needs detail \\ \hline \multirow[t]{3}{*}{ Apr. 2 JE4 } & Computer & 5.040 & \\ \hline & Accounts Payable & & 5,040 \\ \hline & Puchased computer on credit (due May 10) 3 year lif & ife, no residual & needs detail \\ \hline \multirow[t]{2}{*}{ Apr. 4} & No entry required & & \\ \hline & No economic transaction happened on this date (or & similar) & \\ \hline \multirow[t]{3}{*}{ Apr. 5 JE5 } & Marketing (or similar) Expense & 1,800 & \\ \hline & Cash & & 1.800 \\ \hline & Received and paid for brochures for marketing & & \\ \hline \multirow[t]{3}{*}{ Apr. 8 JE6 } & Supplies (or Supplies Inventory) & 3,500 & \\ \hline & Cash & & 3.500 \\ \hline & Purchased office supplies using cash & & \\ \hline \multirow[t]{2}{*}{ Apr. 9} & No entry required & & \\ \hline & No economic transaction happened on this date (or & similar) & \\ \hline \multirow[t]{2}{*}{ Apr. 11 JE7 } & Trademark (or Intangible Asset) & 10,000 & \\ \hline & Cash & & 10,000 \\ \hline \multicolumn{4}{|c|}{ Purchased trademark (if Intangible is account, need to specify Trademark in note) } \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Page 1 General Journal Date \& JE \# Account Debit Credit \begin{tabular}{|c|c|c|c|} \hline Apr. 30 AEB & Rent Expense & 2,000 & \\ \hline & Prepaid Rent (match JE2) & & 2,000 \\ \hline & To record rent expense for April (12,000/6 months & =$2,000/ month) & needs calc \\ \hline Apr. 30 AEC & Income Tax Expense & 2,697 & \\ \hline & Income Tax Payable & & 2,697 \\ \hline & Estimate tax expense for April 2023 ( $22,47712 & & needs calc \\ \hline & ($5,000+14,250+10,0001,8004001,0002501,35 & 50 & \\ \hline & 3331402,000=$22,477) & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Page 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started