Ive to find Formulas you Compute for year 1 and 2.

thank you for helping

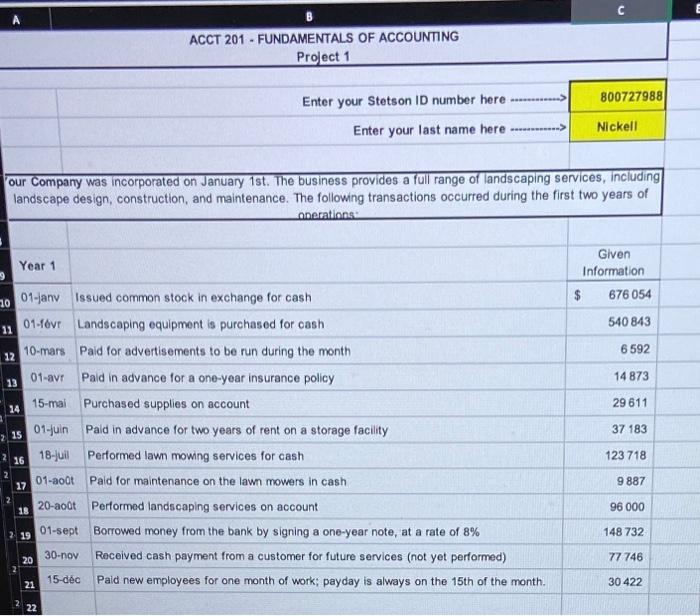

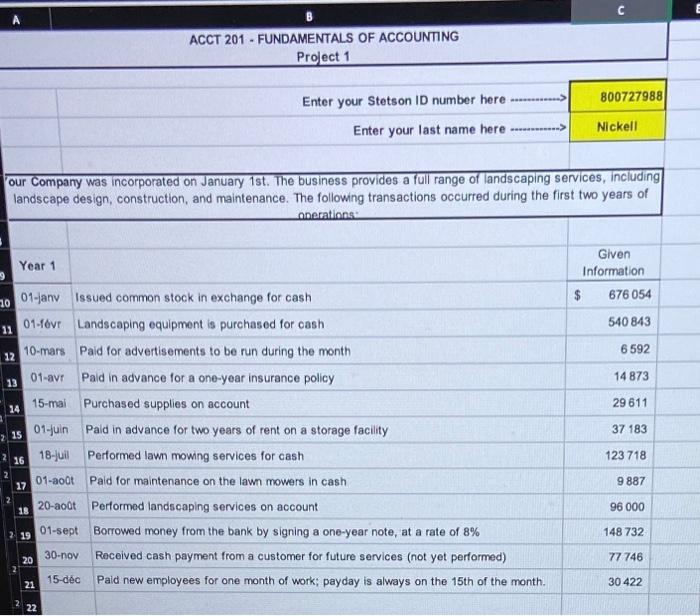

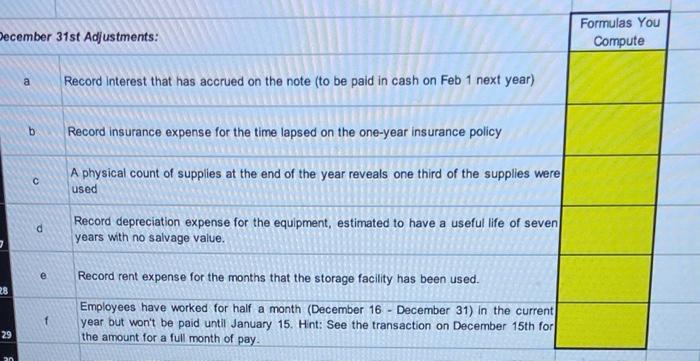

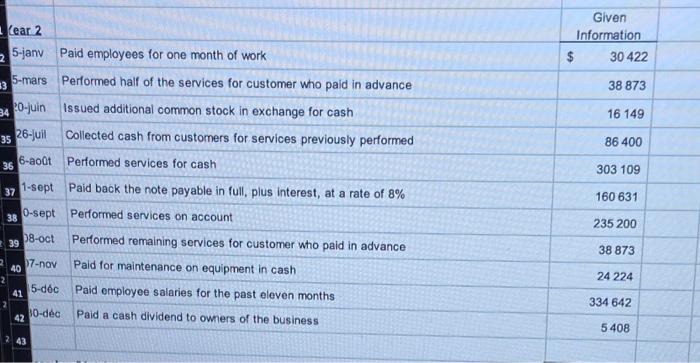

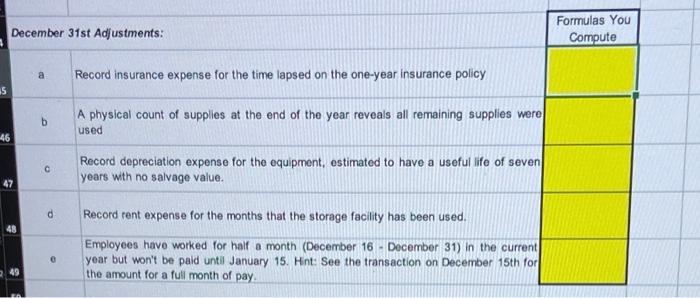

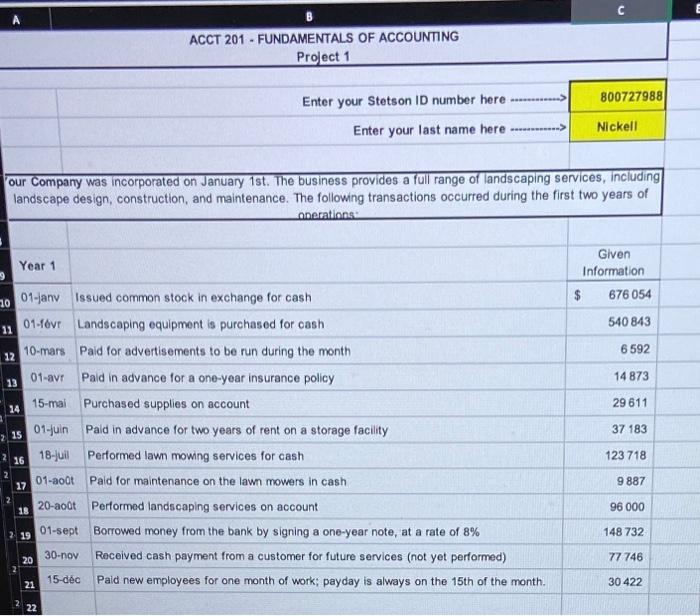

ACCT 201 - FUNDAMENTALS OF ACCOUNTING Project 1 800727988 Enter your Stetson ID number here Enter your last name here ... Nickell our Company was incorporated on January 1st. The business provides a full range of landscaping services, including landscape design, construction, and maintenance. The following transactions occurred during the first two years of operations Year 1 9 Given Information $ 676 054 540 843 11 6592 12 14 873 29 611 14 37 183 10 01-Jany issued common stock in exchange for cash 01-1vr Landscaping equipment is purchased for cash 10-mars Paid for advertisements to be run during the month 13 01-avr Paid in advance for a one-year insurance policy 15-mal Purchased supplies on account 01-Juin Pald in advance for two years of rent on a storage facility 18-ju Performed lawn mowing services for cash 01-aout Pald for maintenance on the lawn mowers in cash 20-aoot Performed landscaping services on account 01-sept Borrowed money from the bank by signing a one-year note, at a rate of 8% 30-nov Received cash payment from a customer for future services (not yet performed) 15-dc Paid new employees for one month of work; payday is always on the 15th of the month. 15 16 123 718 2 17 9 887 18 96 000 19 148 732 20 77 746 21 30 422 22 December 31st Adjustments: Formulas You Compute Record Interest that has accrued on the note (to be paid in cash on Feb 1 next year) b Record insurance expense for the time lapsed on the one-year insurance policy A physical count of supplies at the end of the year reveals one third of the supplies were used d Record depreciation expense for the equipment, estimated to have a useful life of seven years with no salvage value. e Record rent expense for the months that the storage facility has been used. 28 1 Employees have worked for half a month (December 16 - December 31) in the current year but won't be paid until January 15. Hint: See the transaction on December 15th for the amount for a full month of pay 29 30 Given Information $ 30 422 Cear 2 25-jany Paid employees for one month of work 5-mars Performed half of the services for customer who paid in advance 340-juin issued additional common stock in exchange for cash 26-juil Collected cash from customers for services previously performed 38 873 16 149 35 86 400 36 6-aout Performed services for cash 303 109 37 1-sept Paid back the note payable in full, plus interest, at a rate of 8% 160 631 38 0-sept Performed services on account 235 200 08-oct 39 38 873 97-nov 40 Performed remaining services for customer who paid in advance Pald for maintenance on equipment in cash Paid employee salaries for the past eleven months 24 224 5-doc 41 334 642 30-dc 42 Paid a cash dividend to owners of the business 5 408 2 43 December 31st Adjustments: Formulas You Compute a Record insurance expense for the time lapsed on the one-year insurance policy 5 b A physical count of supplles at the end of the year reveals all remaining supplies were used 46 Record depreciation expense for the equipment, estimated to have a useful life of seven years with no salvage value. 47 d Record rent expense for the months that the storage facility has been used. 48 0 Employees have worked for half a month December 16 - December 31) In the current year but won't be paid until January 15. Hint: See the transaction on December 15th for the amount for a full month of pay