Answered step by step

Verified Expert Solution

Question

1 Approved Answer

J. D https://mdc.blackboard.com/webapps/assessment/take/launch.jsp?course_assessment id--464953 1&course id-115481 1&content id-559 Microsoft AutoUpdate Update Later QUESTION 9 Updates are ready to be instaled. Restart App Hastings Corporation has

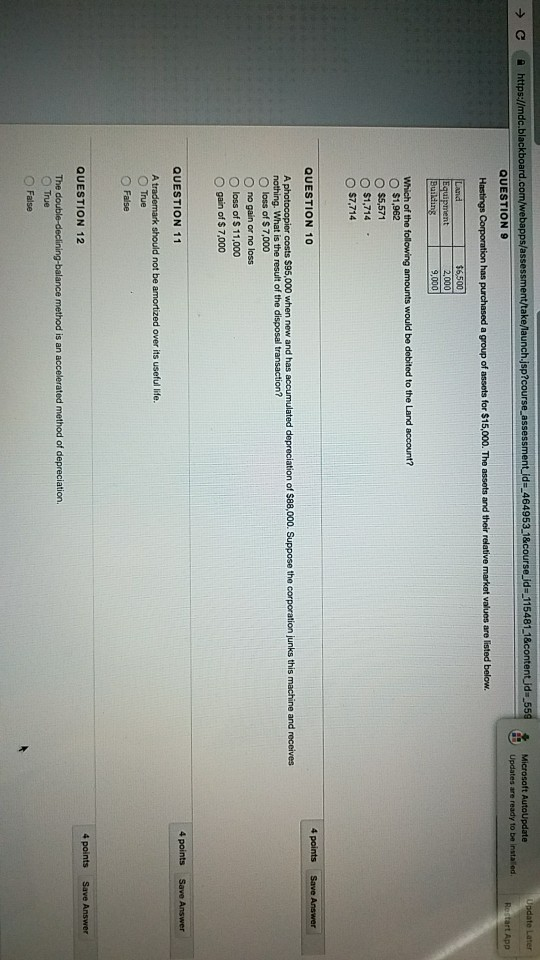

J. D https://mdc.blackboard.com/webapps/assessment/take/launch.jsp?course_assessment id--464953 1&course id-115481 1&content id-559 Microsoft AutoUpdate Update Later QUESTION 9 Updates are ready to be instaled. Restart App Hastings Corporation has purchased a group of assets for $15,000. The assets and their relative market values are listed below. Land $6,500 Equipment Building 2,000 9,000 Which of the following amounts would be debited to the Land account? O $1,962 O $5,571 O $1,714 O $7,714 QUESTION 10 4 points Save Answer A photocopier costs $95,000 when new and has accumulated depreciation of $88,000. Suppose the corporation junks this machine and receives. nothing. What is the result of the disposal transaction? O loss of $ 7,000 O no gain or no loss O loss of $ 11,000 O gain of $ 7,000 QUESTION 11 4 points Save Answer A trademark should not be amortized over its useful life. True O False QUESTION 12 4 points Save Answer The double-declining-balance method is an accelerated method of depreciation. O True O False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started