Answered step by step

Verified Expert Solution

Question

1 Approved Answer

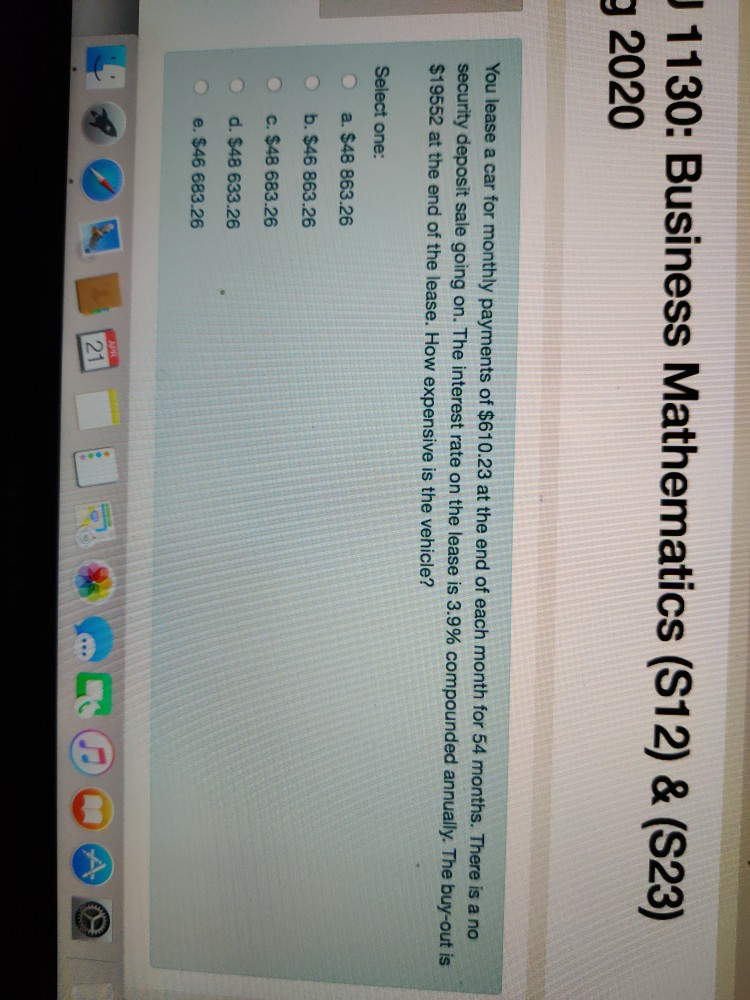

J1130: Business Mathematics (S12) & (S23) 9 2020 You lease a car for monthly payments of $610.23 at the end of each month for 54

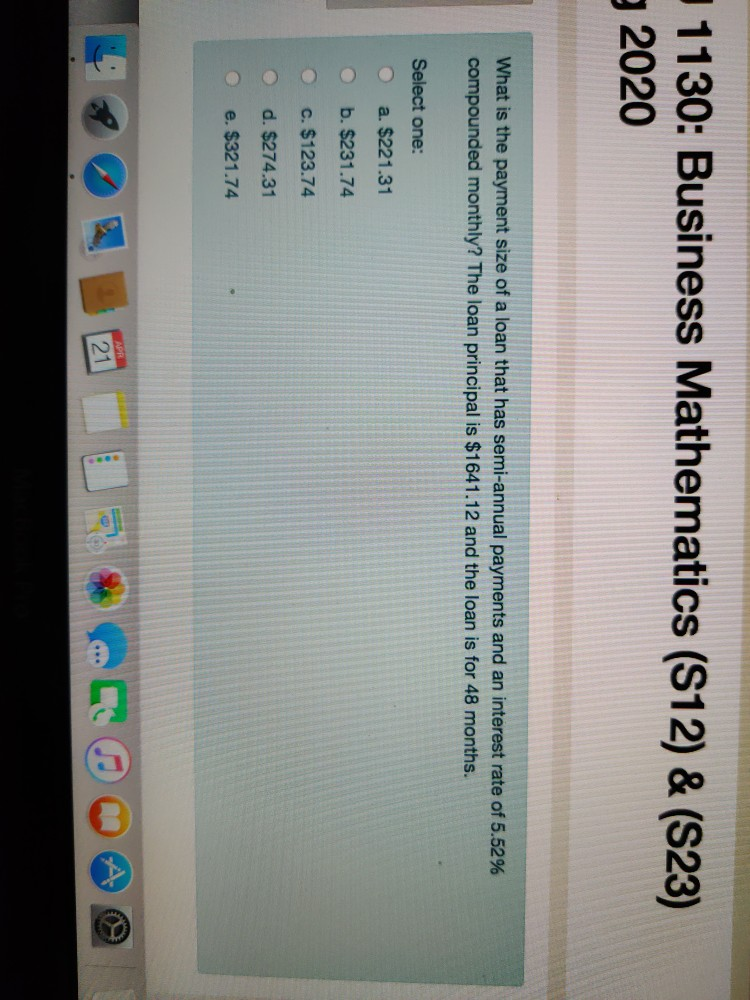

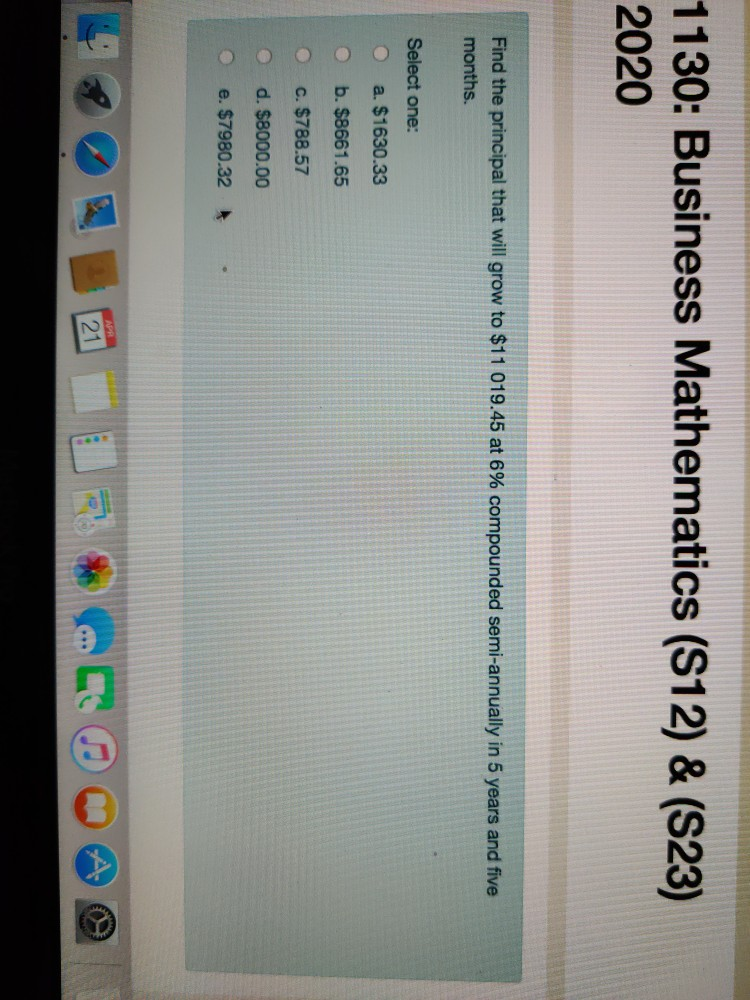

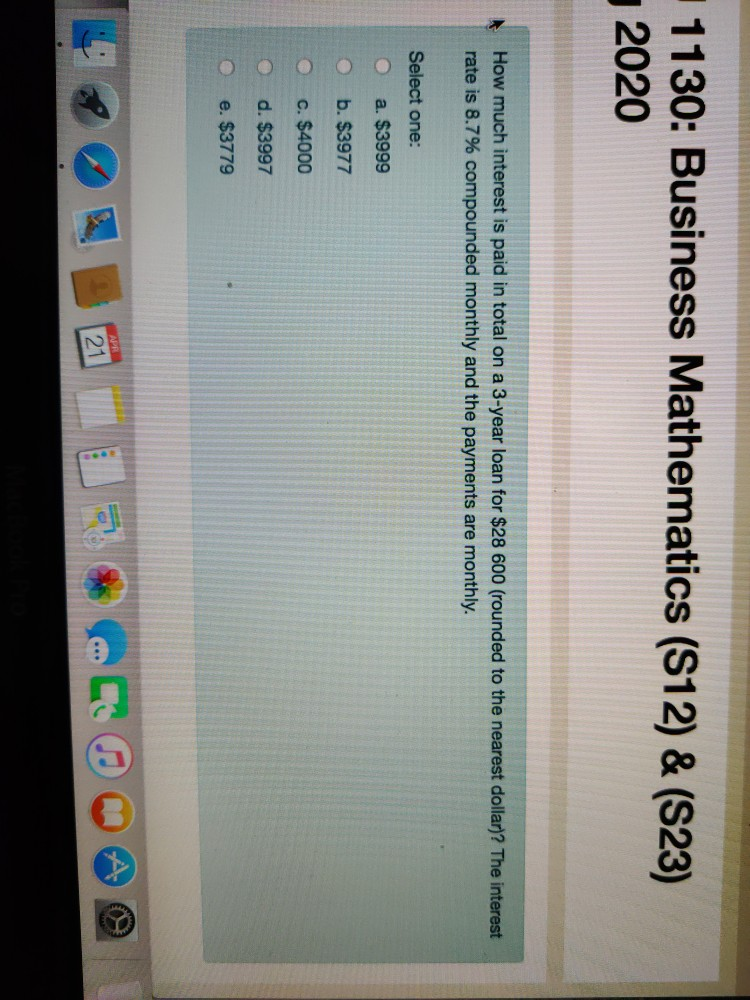

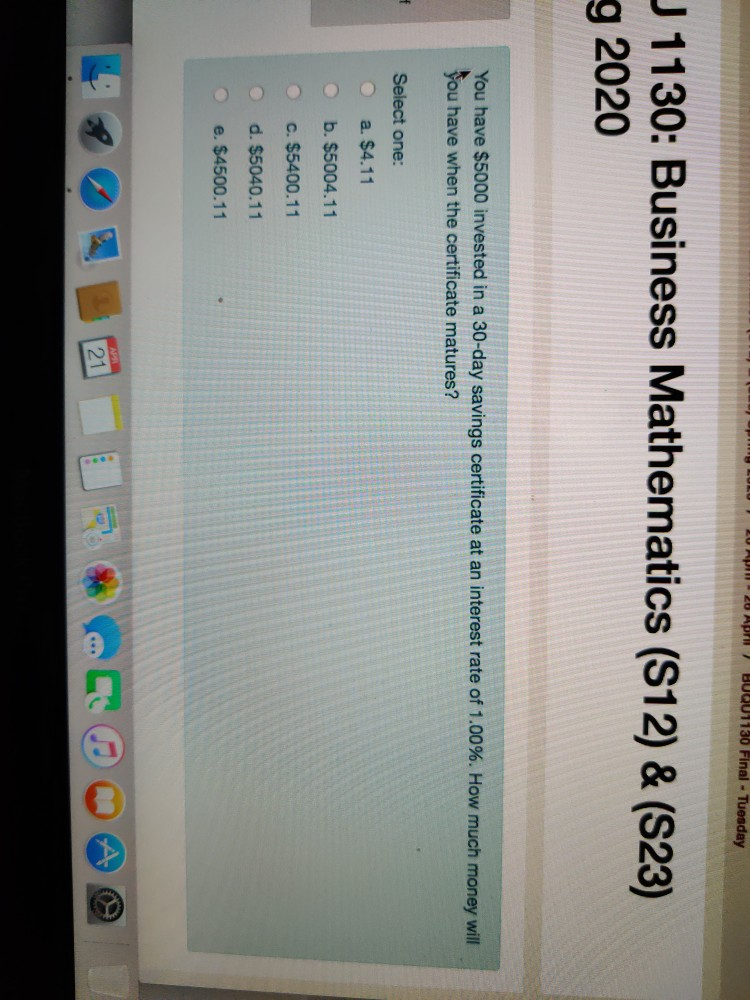

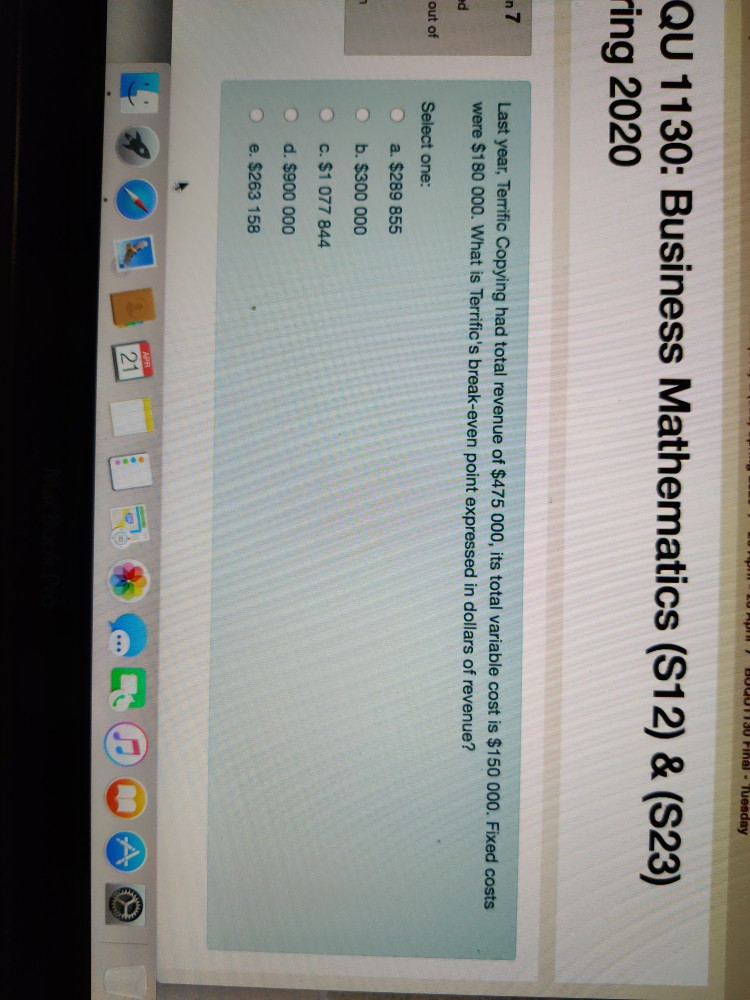

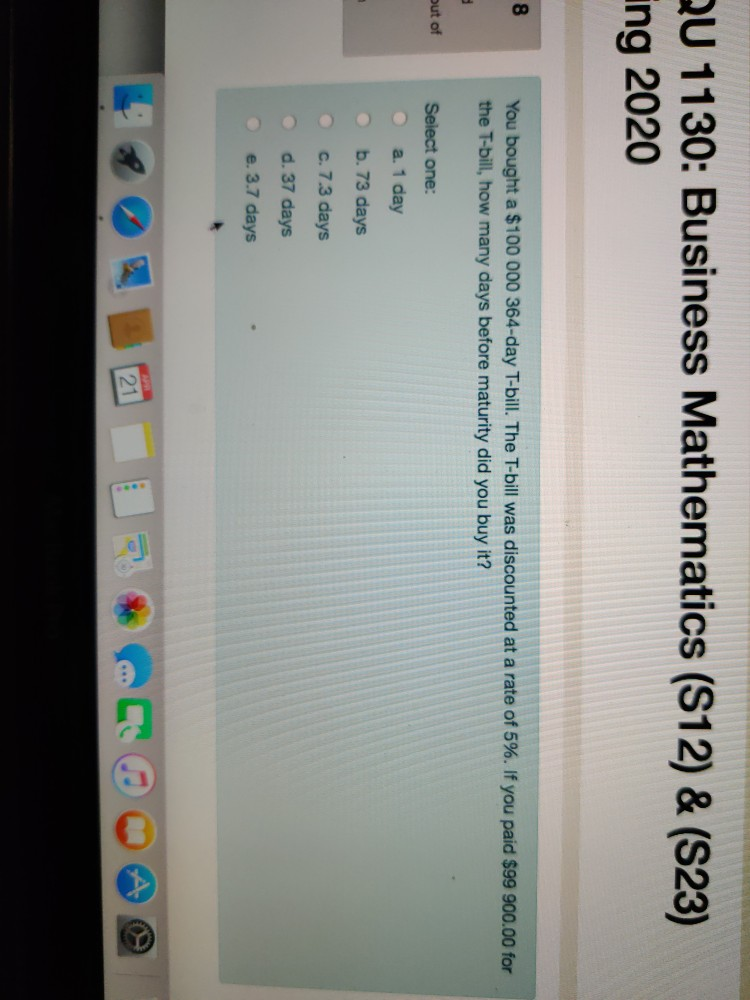

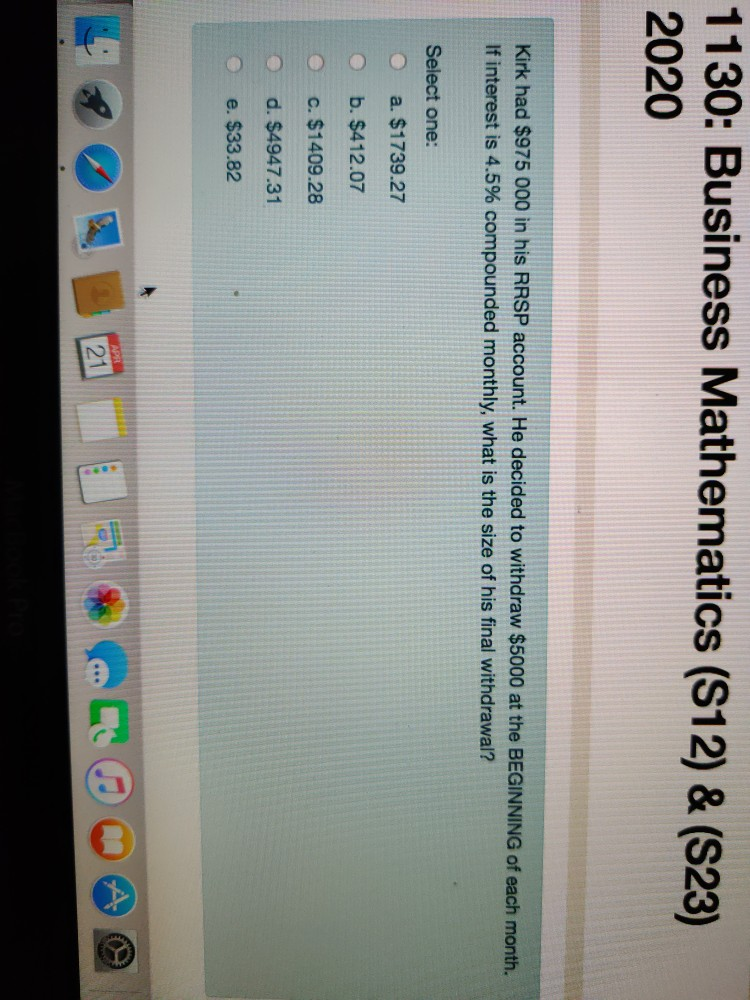

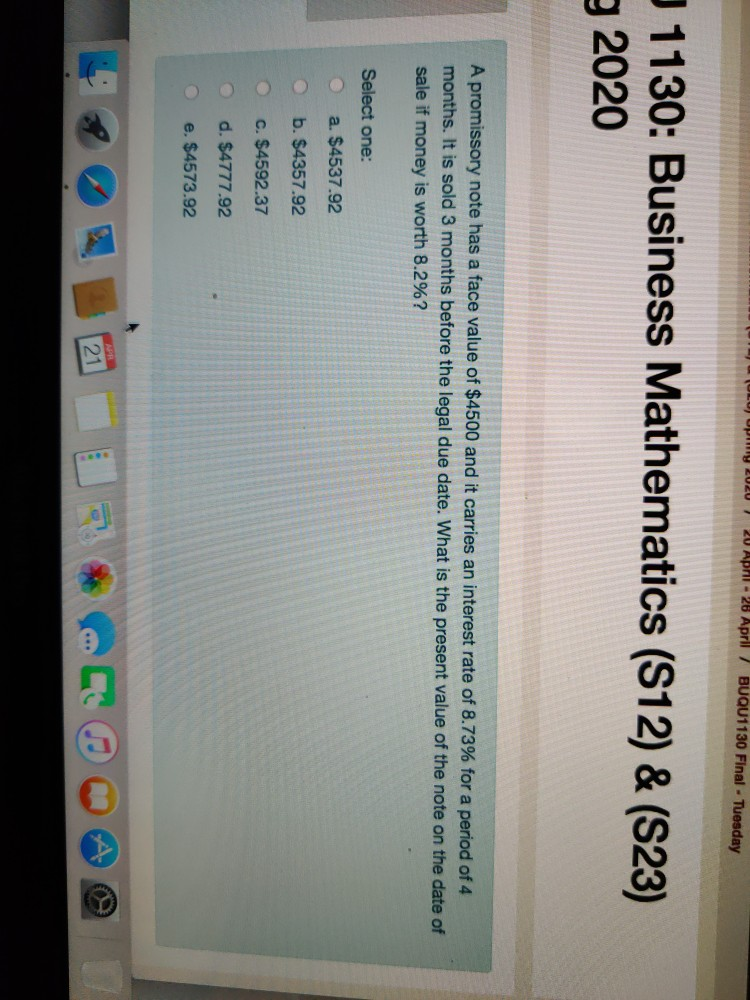

J1130: Business Mathematics (S12) & (S23) 9 2020 You lease a car for monthly payments of $610.23 at the end of each month for 54 months. There is a no security deposit sale going on. The interest rate on the lease is 3.9% compounded annually. The buy-out is! $19552 at the end of the lease. How expensive is the vehicle? Select one: a. $48 863.26 b. $46 863.26 c. $48 683.26 d. $48 633.26 e. $46 683.26 21 11130: Business Mathematics (S12) & (S23) g 2020 What is the payment size of a loan that has semi-annual payments and an interest rate of 5.52% compounded monthly? The loan principal is $1641.12 and the loan is for 48 months. Select one: O a. $221.31 O b. $231.74 O c. $123.74 d. $274.31 e. $321.74 1130: Business Mathematics (S12) & (S23) 2020 Find the principal that will grow to $11 019.45 at 6% compounded semi-annually in 5 years and five months. Select one: O a. $1630.33 b. $8661.65 c. $788.57 d. $8000.00 e. $7980.32 1130: Business Mathematics (S12) & (S23) 2020 How much interest is paid in total on a 3-year loan for $28 600 (rounded to the nearest dollar)? The interest rate is 8.7% compounded monthly and the payments are monthly. Select one: O a. $3999 O b. $3977 O c. $4000 od. $3997 O e. $3779 I BUQU1130 Final - Tuesday J1130: Business Mathematics (S12) & (S23) g 2020 You have $5000 invested in a 30-day savings certificate at an interest rate of 1.00%. How much money will You have when the certificate matures? Select one: a. $4.11 b. $5004.11 c. $5400.11 d. $5040.11 e. $4500.11 21 BOUNT Final - Tuesday QU 1130: Business Mathematics (S12) & (S23) ring 2020 n7 Last year, Terrific Copying had total revenue of $475 000, its total variable cost is $150 000. Fixed costs were $180 000. What is Terrific's break-even point expressed in dollars of revenue? out of Select one: O a. $289 855 O b. $300 000 c. $1 077 844 d. $900 000 e. $263 158 QU 1130: Business Mathematics (S12) & (S23) ing 2020 You bought a $100 000 364-day T-bill. The T-bill was discounted at a rate of 5%. If you paid $99 900.00 for the T-bill, how many days before maturity did you buy it? out of Select one: a. 1 day b. 73 days c. 7.3 days d. 37 days e. 3.7 days 1130: Business Mathematics (S12) & (S23) 2020 Kirk had $975 000 in his RRSP account. He decided to withdraw $5000 at the BEGINNING of each month. If interest is 4.5% compounded monthly, what is the size of his final withdrawal? Select one: a. $1739.27 O b. $412.07 c. $1409.28 d. $4947.31 e. $33.82 20 Apr - 28 April 7 BUQU1130 Final - Tuesday J1130: Business Mathematics (S12) & (S23) 9 2020 A promissory note has a face value of $4500 and it carries an interest rate of 8.73% for a period of 4 months. It is sold 3 months before the legal due date. What is the present value of the note on the date of sale if money is worth 8.2%? Select one: o a. $4537.92 b. $4357.92 c. $4592.37 d. $4777.92 O e. $4573.92

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started