Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jack owns 100 shares of stock in Pink, which he purchased three years ago for $3,000. In the current year Pink Corporation declares a nontaxable

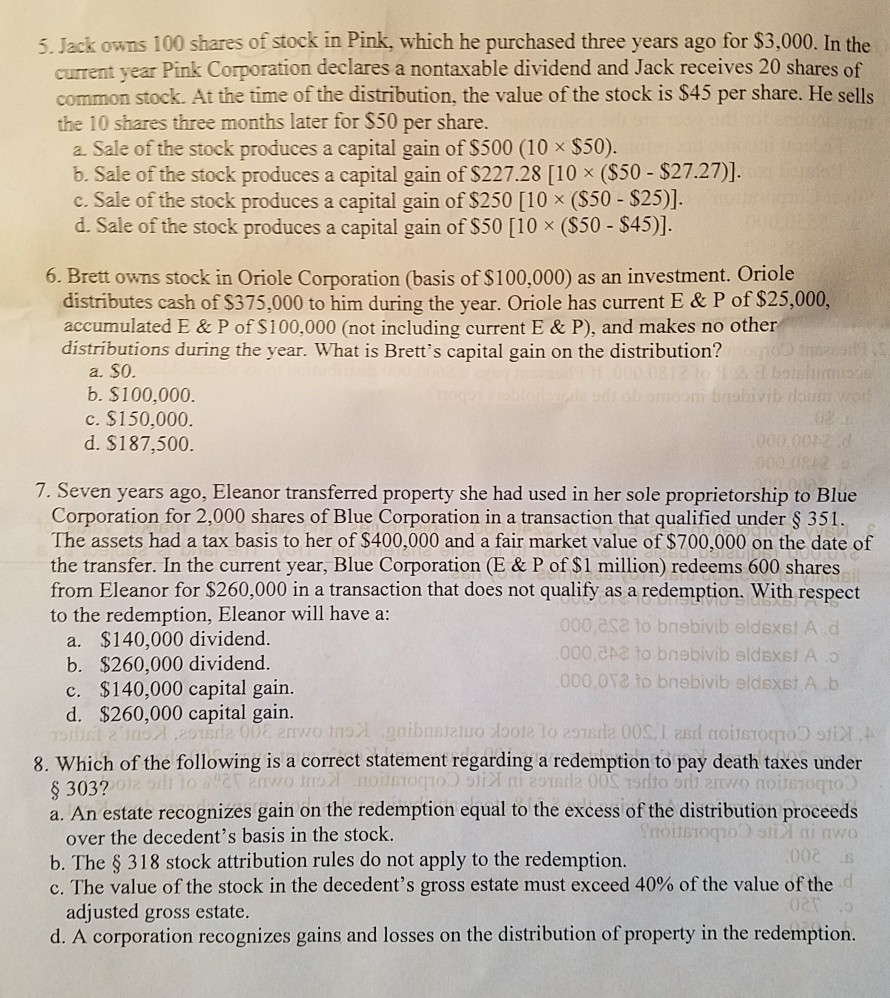

Jack owns 100 shares of stock in Pink, which he purchased three years ago for $3,000. In the current year Pink Corporation declares a nontaxable dividend and Jack receives 20 shares of common stock. At the time of the distribution, the value of the stock is S45 per share. He sells the 10 shares three months later for $50 per share a. Sale of the stock produces a capital gain of S500 (10 x S50) b. Sale of the stock produces a capital gain of $227.28 [10 x (S50- $27.27)] c. Sale of the stock produces a capital gain of $250 [10 x (S50- $25)] d. Sale of the stock produces a capital gain of S50 [10x (S50 - S45)] 6. Brett owns stock in Oriole Corporation (basis of $100,000) as an investment. Oriole distributes cash of $375,000 to him during the year. Oriole has current E & P of $25,000 accumulated E & P of S100,000 (not including current E & P), and makes no other distributions during the year. What is Brett's capital gain on the distribution? a. $O b. $100,000 c. $150,000 d. $187,500 7. Seven years ago, Eleanor transferred property she had used in her sole proprietorship to Blue Corporation for 2,000 shares of Blue Corporation in a transaction that qualified under 351 The assets had a tax basis to her of $400,000 and a fair market value of $700,000 on the date of the transfer. In the current year, Blue Corporation (E & P of $1 million) redeems 600 shares from Eleanor for $260,000 in a transaction that does not qualify as a redemption. With respect to the redemption, Eleanor will have a 000 ase to bnebivib eldsxsi A d a. $140,000 dividend. b. $260,000 dividend c. $140,000 capital gain. d. $260,000 capital gain 8. Which of the following is a correct statement regarding a redemption to pay death taxes under 303? a. An estate recognizes gain on the redemption equal to the excess of the distribution proceeds tO over the decedent's basis in the stock 000 B b, The 318 stock attribution rules do not apply to the redemption C. The value of the stock in the decedent's gross estate must exceed 40% of the value of the adjusted gross estate. d. A corporation recognizes gains and losses on the distribution of property in the redemption

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started