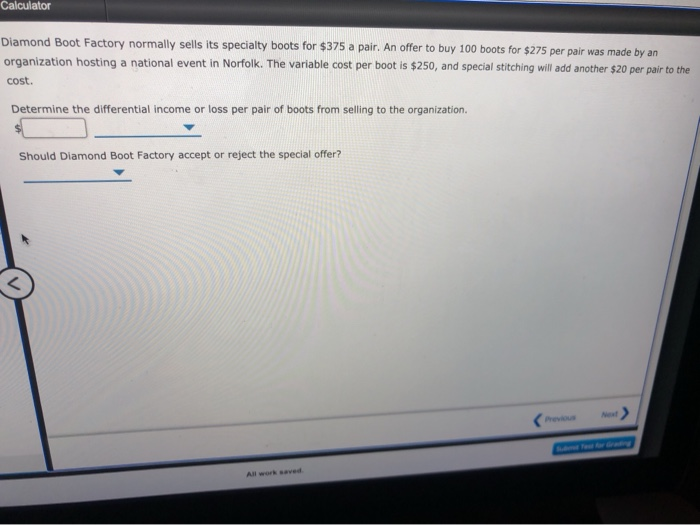

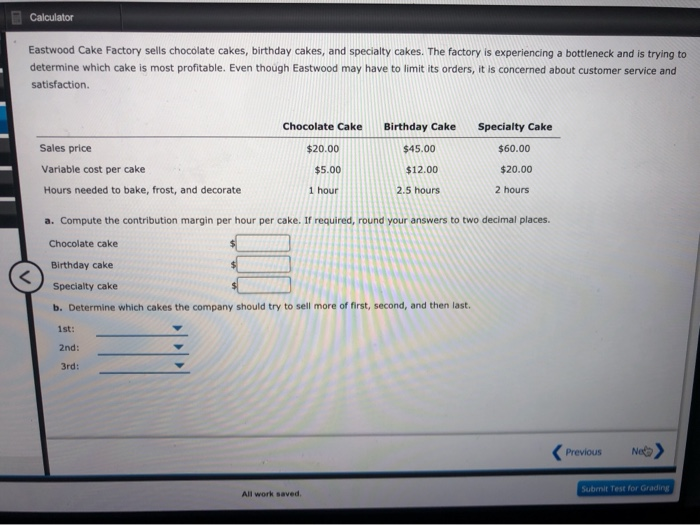

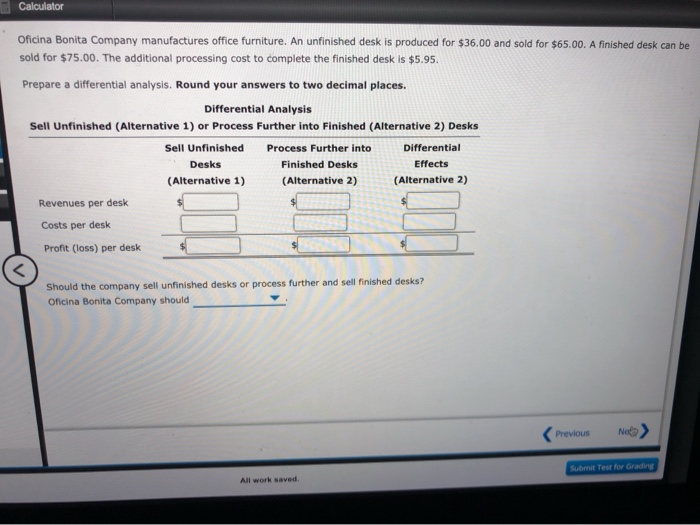

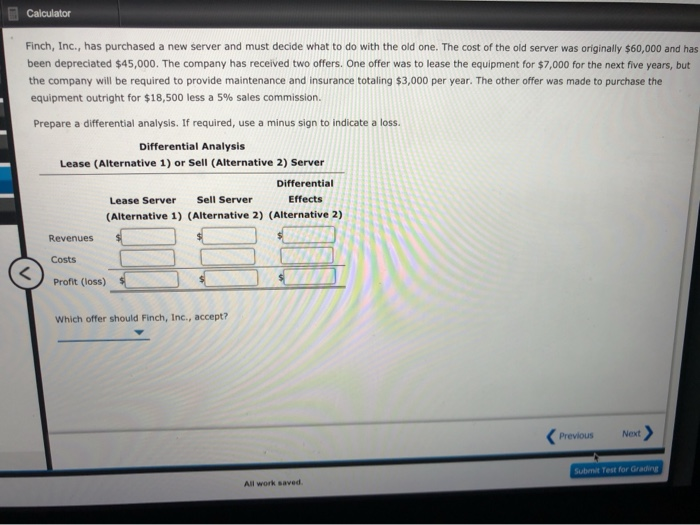

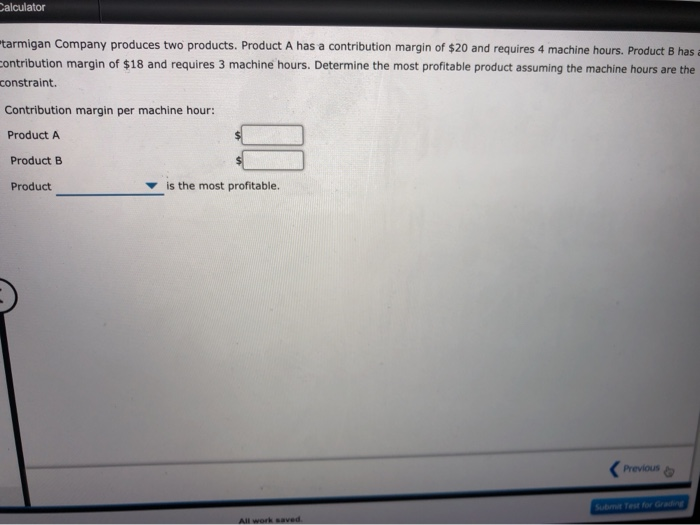

Calculator Diamond Boot Factory normally sells its specialty boots for $375 a pair. An offer to buy 100 boots for $275 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $250, and special stitching will add another $20 per pair to the cost. Determine the differential income or loss per pair of boots from selling to the organization. Should Diamond Boot Factory accept or reject the special offer? Calculator Eastwood Cake Factory sells chocolate cakes, birthday cakes, and specialty cakes. The factory is experiencing a bottleneck and is trying to determine which cake is most profitable. Even though Eastwood may have to limit its orders, it is concerned about customer service and satisfaction Chocolate Cake Birthday Cake Specialty Cake $60.00 $20.00 $45.00 Sales price Variable cost per cake Hours needed to bake, frost, and decorate $5.00 $12.00 $20.00 1 hour 2.5 hours 2 hours a. Compute the contribution margin per hour per cake. If required, round your answers to two decimal places. Chocolate cake Birthday cake Specialty cake b. Determine which cakes the company should try to sell more of first, second, and then last. 1st: 2nd: 3rd: Previous Ne Submit Test for Grading All work saved Calculator Oficina Bonita Company manufactures office furniture. An unfinished desk is produced for $36.00 and sold for $65.00. A finished desk can be sold for $75.00. The additional processing cost to complete the finished desk is $5.95. Prepare a differential analysis. Round your answers to two decimal places. Differential Analysis Sell Unfinished (Alternative 1) or Process Further into Finished (Alternative 2) Desks Sell Unfinished Process Further into Differential Desks Finished Desks Effects (Alternative 1) (Alternative 2) (Alternative 2) Revenues per desk Costs per desk Profit (loss) per desk Should the company sell unfinished desks or process further and sell finished desks? Oficina Bonita Company should Previous Neb Submit Test for Grading All work saved Calculator Finch, Inc., has purchased a new server and must decide what to do with the old one. The cost of the old server was originally $60,000 and has been depreciated $45,000. The company has received two offers. One offer was to lease the equipment for $7,000 for the next five years, but the company will be required to provide maintenance and insurance totaling $3,000 per year. The other offer was made to purchase the equipment outright for $18,500 less a 5% sales commission Prepare a differential analysis. If required, use a minus sign to indicate a loss. Differential Analysis Lease (Alternative 1) or Sell (Alternative 2) Server Differential Lease Server Sell Server (Alternative 1) (Alternative 2) (Alternative 2) Effects Revenues Costs Su Test for Gradine All work saved Calculator tarmigan Company produces two products. Product A has a contribution margin of $20 and requires 4 machine hours. Product B has a Contribution margin of $18 and requires 3 machine hours. Determine the most profitable product assuming the machine hours are the constraint. Contribution margin per machine hour: Product A Product B Product is the most profitable. Previous Su Test for All work saved