Answered step by step

Verified Expert Solution

Question

1 Approved Answer

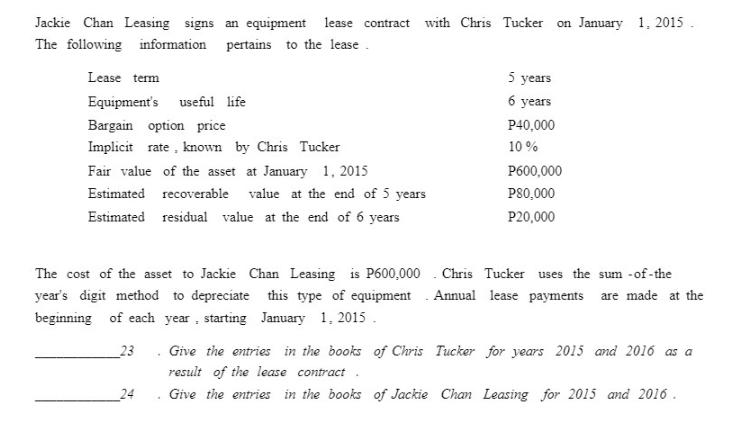

Jackie Chan Leasing signs an equipment lease contract with Chris Tucker on January 1, 2015. The following information pertains to the lease Lease term

Jackie Chan Leasing signs an equipment lease contract with Chris Tucker on January 1, 2015. The following information pertains to the lease Lease term Equipment's useful life Bargain option price Implicit rate, known by Chris Tucker Fair value of the asset at January 1, 2015 Estimated recoverable value at the end of 5 years Estimated residual value at the end of 6 years The cost of the asset to Jackie Chan Leasing is P600,000 year's digit method to depreciate this type of equipment beginning of each year, starting January 1, 2015. 23 5 years 6 years P40,000 10% P600,000 P80,000 P20,000 Chris Tucker uses the sum-of-the Annual lease payments are made at the Give the entries in the books of Chris Tucker for years 2015 and 2016 as a result of the lease contract. Give the entries in the books of Jackie Chan Leasing for 2015 and 2016.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Entries in the books of Chris Tucker for 2015 Leased Equipment Asset P 600000 Lease liability Present Value 517845 Cash 82155 To record lease ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started