Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Riza, Inc. leased an equipment form Joey Company on December 31,2019. The equipment has a fair value of P1,011,840 at this date Annual lease

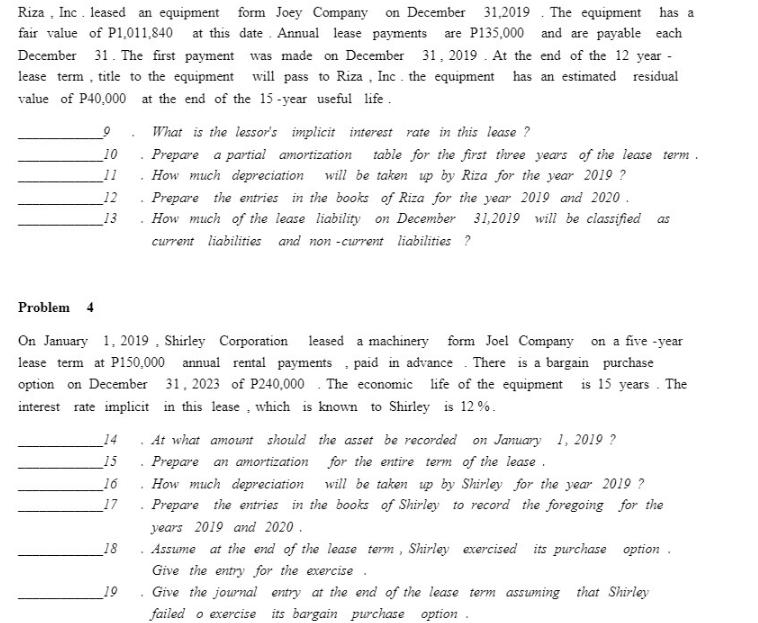

Riza, Inc. leased an equipment form Joey Company on December 31,2019. The equipment has a fair value of P1,011,840 at this date Annual lease payments are P135,000 and are payable each December 31. The first payment was made on December 31, 2019. At the end of the 12 year - lease term, title to the equipment will pass to Riza, Inc. the equipment has an estimated residual value of P40,000 at the end of the 15-year useful life. Problem 4 10 11 12 13 14 15 16 17 18 . 19 . On January 1, 2019 Shirley Corporation leased a machinery form Joel Company on a five -year lease term at P150,000 annual rental payments, paid in advance There is a bargain purchase option on December 31, 2023 of P240,000 The economic life of the equipment is 15 years. The interest rate implicit in this lease, which is known to Shirley is 12%. . . What is the lessor's implicit interest rate in this lease ? Prepare a partial amortization table for the first three years of the lease term. How much depreciation will be taken up by Riza for the year 2019 ? . Prepare the entries in the books of Riza for the year 2019 and 2020. How much of the lease liability on December 31,2019 will be classified as current liabilities and non-current liabilities ? At what amount should the asset be recorded on January 1, 2019 ? Prepare an amortization for the entire term of the lease. How much depreciation will be taken up by Shirley for the year 2019 ? Prepare the entries in the books of Shirley to record the foregoing for the years 2019 and 2020. Assume at the end of the lease term, Shirley exercised its purchase option. Give the entry for the exercise. Give the journal entry at the end of the lease term assuming that Shirley failed o exercise its bargain purchase option.

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

The image displays a text that outlines two problems related to lease accounting Each problem details specific information about equipment leases and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started