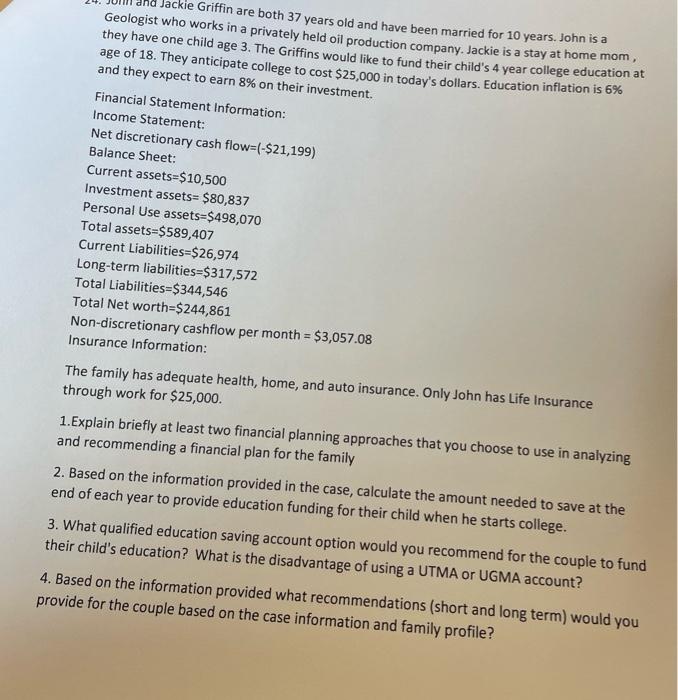

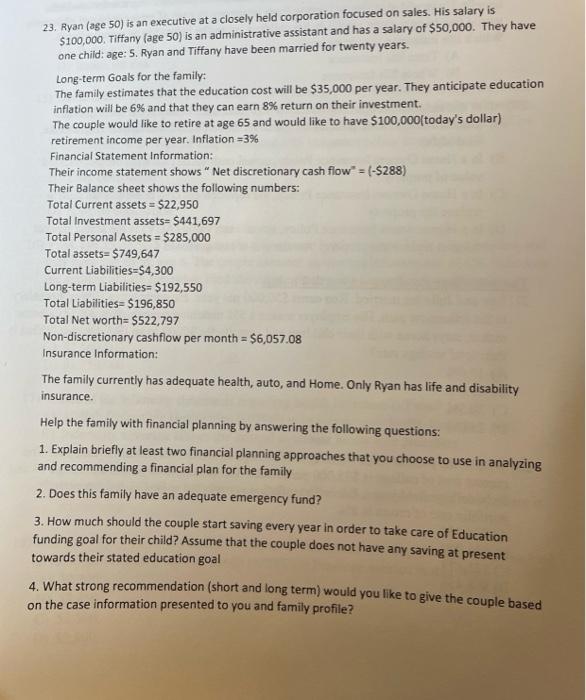

Jackie Griffin are both 37 years old and have been married for 10 years. John is a Geologist who works in a privately held oil production company. Jackie is a stay at home mom, they have one child age 3. The Griffins would like to fund their child's 4 year college education at age of 18. They anticipate college to cost $25,000 in today's dollars. Education inflation is 6% and they expect to earn 8% on their investment. Financial Statement Information: Income Statement: Net discretionary cash flow=(-$21,199) Balance Sheet: Current assets=$10,500 Investment assets= $80,837 Personal use assets=$498,070 Total assets=$589,407 Current Liabilities=$26,974 Long-term liabilities=$317,572 Total Liabilities=$344,546 Total Net worth=$244,861 Non-discretionary cashflow per month = $3,057.08 Insurance Information: The family has adequate health, home, and auto insurance. Only John has Life Insurance through work for $25,000. 1.Explain briefly at least two financial planning approaches that you choose to use in analyzing and recommending a financial plan for the family 2. Based on the information provided in the case, calculate the amount needed to save at the end of each year to provide education funding for their child when he starts college. 3. What qualified education saving account option would you recommend for the couple to fund their child's education? What is the disadvantage of using a UTMA or UGMA account? 4. Based on the information provided what recommendations (short and long term) would you provide for the couple based on the case information and family profile? 23. Ryan (age 50) is an executive at a closely held corporation focused on sales. His salary is $100,000. Tiffany (age 50) is an administrative assistant and has a salary of $50,000. They have one child: age: 5. Ryan and Tiffany have been married for twenty years. Long-term Goals for the family: The family estimates that the education cost will be $35,000 per year. They anticipate education inflation will be 6% and that they can earn 8% return on their investment. The couple would like to retire at age 65 and would like to have $100,000 today's dollar) retirement income per year. Inflation =3% Financial Statement Information: Their income statement shows " Net discretionary cash flow = (-$288) Their Balance sheet shows the following numbers: Total Current assets = $22,950 Total Investment assets= $441,697 Total Personal Assets = $285,000 Total assets= $749,647 Current Liabilities=S4,300 Long-term Liabilities= $192,550 Total Liabilities= $196,850 Total Net worth $522,797 Non-discretionary cashflow per month = $6,057.08 Insurance Information: The family currently has adequate health, auto, and Home. Only Ryan has life and disability insurance. Help the family with financial planning by answering the following questions: 1. Explain briefly at least two financial planning approaches that you choose to use in analyzing and recommending a financial plan for the family 2. Does this family have an adequate emergency fund? 3. How much should the couple start saving every year in order to take care of Education funding goal for their child? Assume that the couple does not have any saving at present towards their stated education goal 4. What strong recommendation (short and long term) would you like to give the couple based on the case information presented to you and family profile? Jackie Griffin are both 37 years old and have been married for 10 years. John is a Geologist who works in a privately held oil production company. Jackie is a stay at home mom, they have one child age 3. The Griffins would like to fund their child's 4 year college education at age of 18. They anticipate college to cost $25,000 in today's dollars. Education inflation is 6% and they expect to earn 8% on their investment. Financial Statement Information: Income Statement: Net discretionary cash flow=(-$21,199) Balance Sheet: Current assets=$10,500 Investment assets= $80,837 Personal use assets=$498,070 Total assets=$589,407 Current Liabilities=$26,974 Long-term liabilities=$317,572 Total Liabilities=$344,546 Total Net worth=$244,861 Non-discretionary cashflow per month = $3,057.08 Insurance Information: The family has adequate health, home, and auto insurance. Only John has Life Insurance through work for $25,000. 1.Explain briefly at least two financial planning approaches that you choose to use in analyzing and recommending a financial plan for the family 2. Based on the information provided in the case, calculate the amount needed to save at the end of each year to provide education funding for their child when he starts college. 3. What qualified education saving account option would you recommend for the couple to fund their child's education? What is the disadvantage of using a UTMA or UGMA account? 4. Based on the information provided what recommendations (short and long term) would you provide for the couple based on the case information and family profile? 23. Ryan (age 50) is an executive at a closely held corporation focused on sales. His salary is $100,000. Tiffany (age 50) is an administrative assistant and has a salary of $50,000. They have one child: age: 5. Ryan and Tiffany have been married for twenty years. Long-term Goals for the family: The family estimates that the education cost will be $35,000 per year. They anticipate education inflation will be 6% and that they can earn 8% return on their investment. The couple would like to retire at age 65 and would like to have $100,000 today's dollar) retirement income per year. Inflation =3% Financial Statement Information: Their income statement shows " Net discretionary cash flow = (-$288) Their Balance sheet shows the following numbers: Total Current assets = $22,950 Total Investment assets= $441,697 Total Personal Assets = $285,000 Total assets= $749,647 Current Liabilities=S4,300 Long-term Liabilities= $192,550 Total Liabilities= $196,850 Total Net worth $522,797 Non-discretionary cashflow per month = $6,057.08 Insurance Information: The family currently has adequate health, auto, and Home. Only Ryan has life and disability insurance. Help the family with financial planning by answering the following questions: 1. Explain briefly at least two financial planning approaches that you choose to use in analyzing and recommending a financial plan for the family 2. Does this family have an adequate emergency fund? 3. How much should the couple start saving every year in order to take care of Education funding goal for their child? Assume that the couple does not have any saving at present towards their stated education goal 4. What strong recommendation (short and long term) would you like to give the couple based on the case information presented to you and family profile