Answered step by step

Verified Expert Solution

Question

1 Approved Answer

jacklyn hargrove is the owner of six Pickwick restaurants please give me solution of e-n options as I could only found a-d answers ... why

jacklyn hargrove is the owner of six Pickwick restaurants

please give me solution of e-n options as I could only found a-d answers ... why I would subscribe this if I would be aware that how to solve last ones??.

at least provide answers if complete question can not be solved

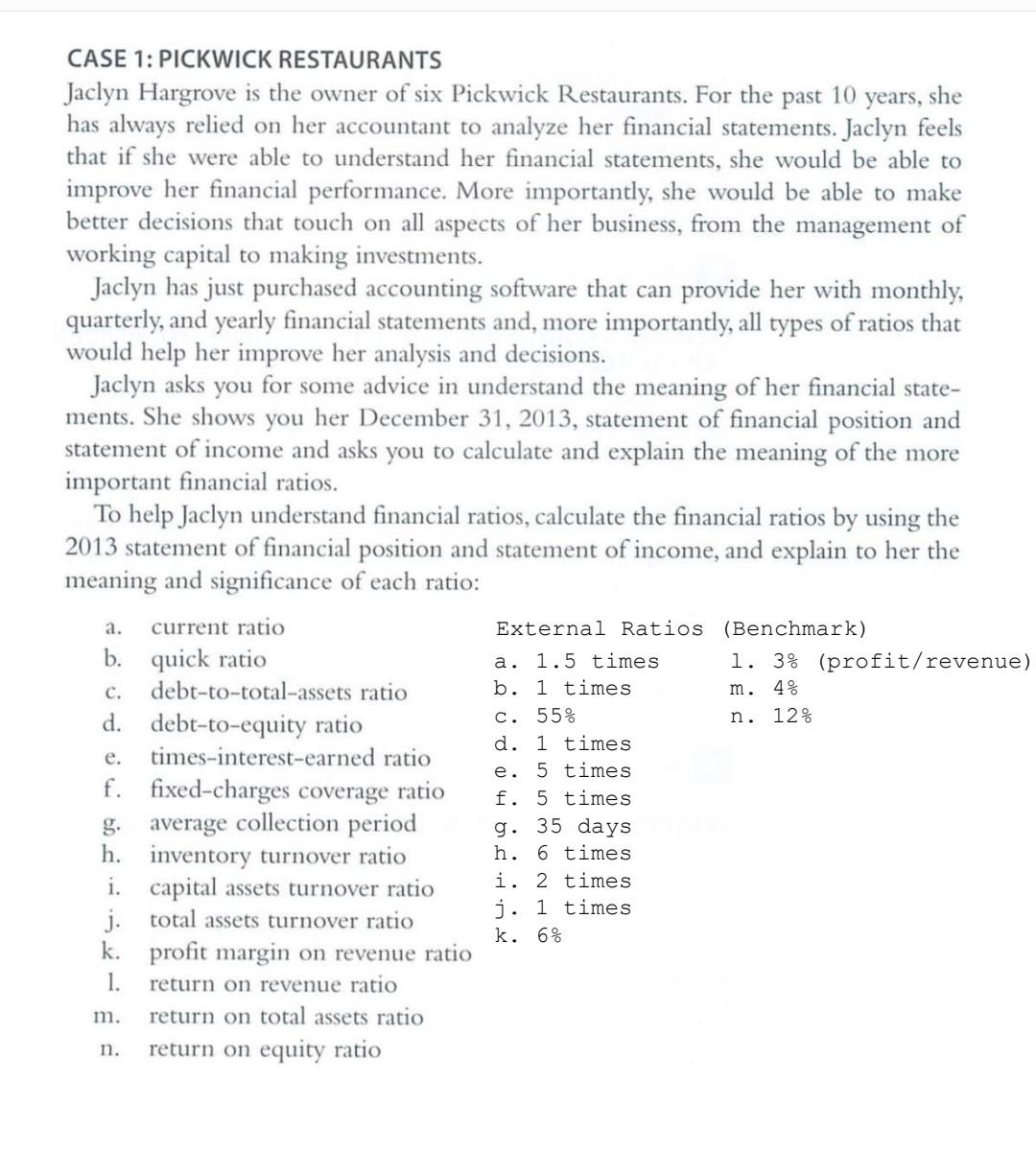

ohav... CANADA AFTER 12TH O... SABRINA CENARIO CASE STIONWICK RESTAURANTS Hugrows the sweet sex Plekwick Restaurants for the past 10 yeunahe w salyre her financial statemena Jachyt feel kunderneand her financial seanument, she would be able to nice Meme mportantly, she would be able to make wwporuke of her busmaa, jom the mananen Name UNTUK worthwane shuar dan provide her with manche , rtntl, i t f race dur e des Jackym uka na Be warnem anderen the meansk od her timane de ka 31. HERE u lindi ponti WENDE AN Walte detare the most TE the glue the last tal retten by se home Wie To tekpanna wild barcual ratka, alete the inancial rate the singer 2011 poden akad atentie of vice, and explain to her de mama wa mastaan EN SANTA MARIA maar www. de www www. CASE 1: PICKWICK RESTAURANTS Jaclyn Hargrove is the owner of six Pickwick Restaurants. For the past 10 years, she has always relied on her accountant to analyze her financial statements. Jaclyn feels that if she were able to understand her financial statements, she would be able to improve her financial performance. More importantly, she would be able to make better decisions that touch on all aspects of her business, from the management of working capital to making investments. Jaclyn has just purchased accounting software that can provide her with monthly, quarterly, and yearly financial statements and, more importantly, all types of ratios that would help her improve her analysis and decisions. Jaclyn asks you for some advice in understand the meaning of her financial state- ments. She shows you her December 31, 2013, statement of financial position and statement of income and asks you to calculate and explain the meaning of the more important financial ratios. To help Jaclyn understand financial ratios, calculate the financial ratios by using the 2013 statement of financial position and statement of income, and explain to her the meaning and significance of each ratio: current ratio External Ratios (Benchmark) b. quick ratio 1. 3% (profit/revenue) c. debt-to-total-assets ratio b. 1 times d. debt-to-equity ratio times-interest-earned ratio f. fixed-charges coverage ratio average collection period g. 35 days h. inventory turnover ratio h. 6 times i. capital assets turnover ratio j. 1 times j. total assets turnover ratio k profit margin on revenue ratio 1. return on revenue ratio return on total assets ratio return on equity ratio a. a. 1.5 times m. 4% n. 12% e. c. 55% d. 1 times e. 5 times f. 5 times g. i. 2 times k. 6% m. n. ohav... CANADA AFTER 12TH O... SABRINA CENARIO CASE STIONWICK RESTAURANTS Hugrows the sweet sex Plekwick Restaurants for the past 10 yeunahe w salyre her financial statemena Jachyt feel kunderneand her financial seanument, she would be able to nice Meme mportantly, she would be able to make wwporuke of her busmaa, jom the mananen Name UNTUK worthwane shuar dan provide her with manche , rtntl, i t f race dur e des Jackym uka na Be warnem anderen the meansk od her timane de ka 31. HERE u lindi ponti WENDE AN Walte detare the most TE the glue the last tal retten by se home Wie To tekpanna wild barcual ratka, alete the inancial rate the singer 2011 poden akad atentie of vice, and explain to her de mama wa mastaan EN SANTA MARIA maar www. de www www. CASE 1: PICKWICK RESTAURANTS Jaclyn Hargrove is the owner of six Pickwick Restaurants. For the past 10 years, she has always relied on her accountant to analyze her financial statements. Jaclyn feels that if she were able to understand her financial statements, she would be able to improve her financial performance. More importantly, she would be able to make better decisions that touch on all aspects of her business, from the management of working capital to making investments. Jaclyn has just purchased accounting software that can provide her with monthly, quarterly, and yearly financial statements and, more importantly, all types of ratios that would help her improve her analysis and decisions. Jaclyn asks you for some advice in understand the meaning of her financial state- ments. She shows you her December 31, 2013, statement of financial position and statement of income and asks you to calculate and explain the meaning of the more important financial ratios. To help Jaclyn understand financial ratios, calculate the financial ratios by using the 2013 statement of financial position and statement of income, and explain to her the meaning and significance of each ratio: current ratio External Ratios (Benchmark) b. quick ratio 1. 3% (profit/revenue) c. debt-to-total-assets ratio b. 1 times d. debt-to-equity ratio times-interest-earned ratio f. fixed-charges coverage ratio average collection period g. 35 days h. inventory turnover ratio h. 6 times i. capital assets turnover ratio j. 1 times j. total assets turnover ratio k profit margin on revenue ratio 1. return on revenue ratio return on total assets ratio return on equity ratio a. a. 1.5 times m. 4% n. 12% e. c. 55% d. 1 times e. 5 times f. 5 times g. i. 2 times k. 6% m. n

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started