Question

Jackson Flocks Inc. processes Turkeys into four products for sale on the wholesale market: Breasts Smoked legs and thighs Whole Turkeys Necks and wings for

Jackson Flocks Inc. processes Turkeys into four products for sale on the wholesale market:

Breasts

Smoked legs and thighs

Whole Turkeys

Necks and wings for soup

The costs to get the products to the point where they can be separately identified total $10,000,000. Additional Information follows:

Product: Lbs Produced: Cost after split-off: Selling price per pound

- Breasts: 1,000,000: $200,000: $2

- Smoked legs and thighs: 2,500,000: 500,000: 4

- Whole Turkeys: 2,000,000: 425,000: 3

- Necks and wings: 500,000: 350,000: 5

Feathers are sold at the split-off point as a by-product for $1,000,000 which lower the joint costs allocated.

Based on the information given for Jackson Flocks:

- allocate the joint processing costs to the four products using:

- Sales value at split-off method

- Physical-measure method (volume in units)

- NRV method

The following is my original answers that I submitted with my professor's comments, but I don't understand what I need to do to fix the answers because the textbook isn't very helpful.

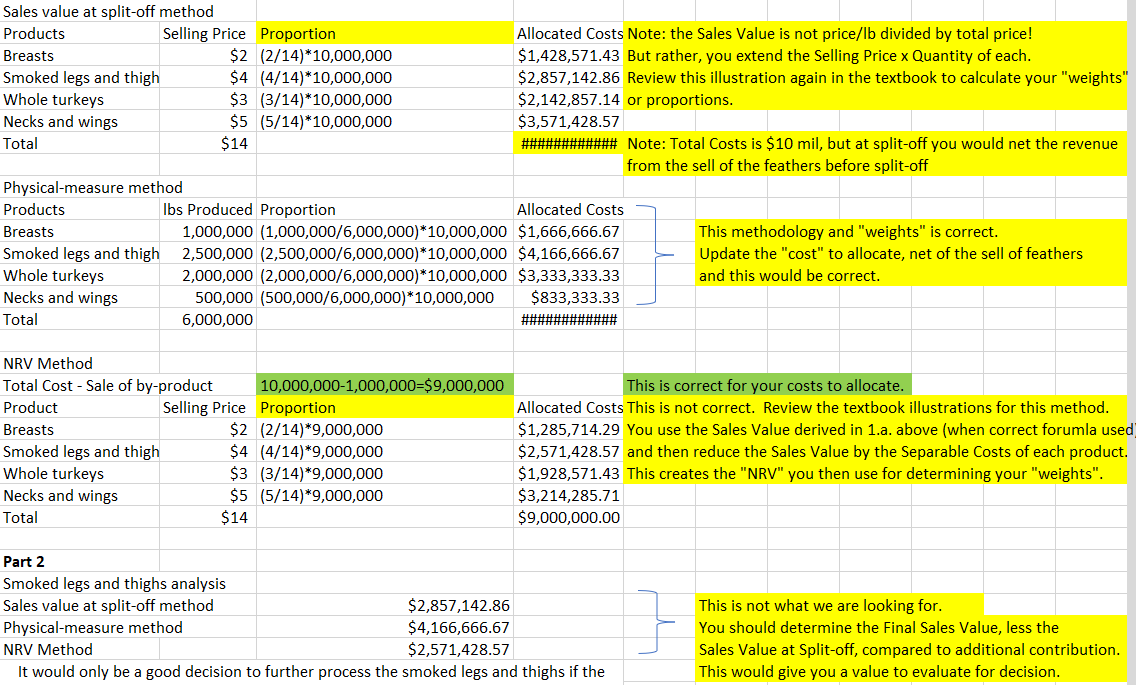

Allocated Costs Note: the Sales Value is not price/lb divided by total price! $1,428,571.43 But rather, you extend the Selling Price x Quantity of each. $2,857,142.86 Review this illustration again in the textbook to calculate your "weights" $2,142,857.14 or proportions. Sales value at split-off method Products Selling Price Proportion Breasts Smoked legs and thigh $2 (2/14)*10,000,000 $4 (4/14)*10,000,000 Whole turkeys $3 (3/14)*10,000,000 Necks and wings Total $5 (5/14)*10,000,000 $14 $3,571,428.57 Physical-measure method Products Breasts Whole turkeys lbs Produced Proportion Allocated Costs 1,000,000 (1,000,000/6,000,000)*10,000,000 $1,666,666.67 2,500,000 (2,500,000/6,000,000)*10,000,000 $4,166,666.67 2,000,000 (2,000,000/6,000,000)*10,000,000 $3,333,333.33 500,000 (500,000/6,000,000)*10,000,000 6,000,000 Smoked legs and thigh Necks and wings Total NRV Method Total Cost - Sale of by-product Product Selling Price Proportion Breasts $2 (2/14)*9,000,000 Smoked legs and thigh $4 (4/14)*9,000,000 Whole turkeys $3 (3/14)*9,000,000 Necks and wings Total $5 (5/14)*9,000,000 $14 $833,333.33 Note: Total Costs is $10 mil, but at split-off you would net the revenue from the sell of the feathers before split-off This methodology and "weights" is correct. Update the "cost" to allocate, net of the sell of feathers and this would be correct. 10,000,000-1,000,000 $9,000,000 This is correct for your costs to allocate. Allocated Costs This is not correct. Review the textbook illustrations for this method. $1,285,714.29 You use the Sales Value derived in 1.a. above (when correct forumla used) $2,571,428.57 and then reduce the Sales Value by the Separable Costs of each product. $1,928,571.43 This creates the "NRV" you then use for determining your "weights". $3,214,285.71 $9,000,000.00 Part 2 Smoked legs and thighs analysis Sales value at split-off method Physical-measure method NRV Method $2,857,142.86 $4,166,666.67 $2,571,428.57 It would only be a good decision to further process the smoked legs and thighs if the This is not what we are looking for. You should determine the Final Sales Value, less the Sales Value at Split-off, compared to additional contribution. This would give you a value to evaluate for decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started