Jaclyn Biggs, who files as a head of household, never paid AMT before 2016. In 2016, her $197,900 taxable income included $178,000 ordinary income and a $19,900 capital gain taxed at 15 percent. Her 2016 AMTI in excess of her exemption amount was $218,175. (Round your intermediate calculations and final answers to the nearest whole dollar amount.)

a. Compute Jaclyns total income tax for 2016.

b. Assume that Jaclyn has a $5,200 minimum tax credit carryforward from 2016. Her 2017 taxable income is $179,100, all of which is ordinary income. Her 2017 AMTI in excess of her exemption amount is $146,900. Compute Jaclyns total tax for 2017 (use the 2016 tax rates) and her minimum tax carryforward into 2018.

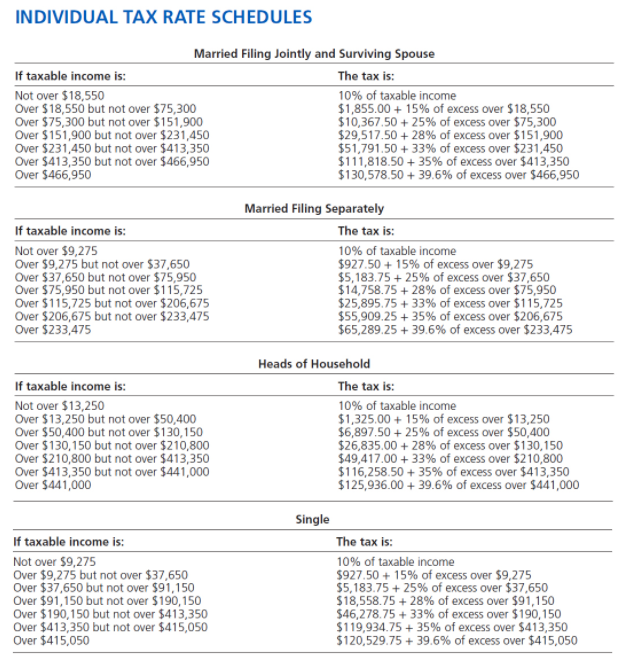

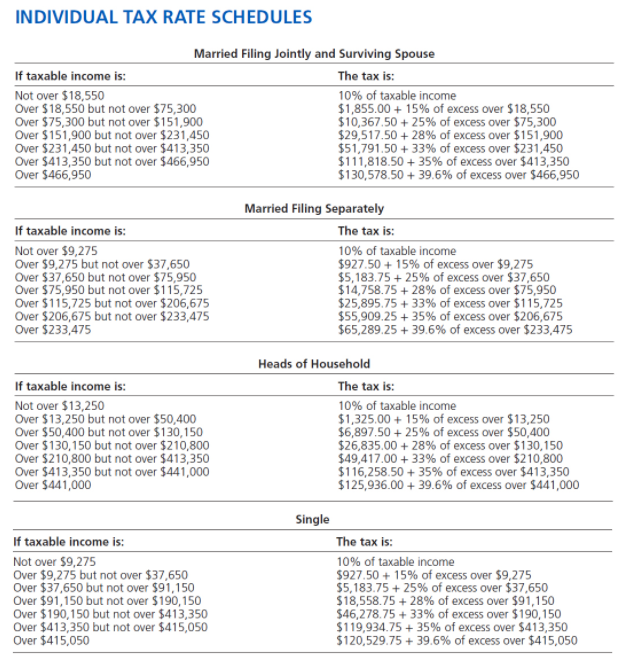

INDIVIDUAL TAX RATE SCHEDULES Married Filing Jointly and Surviving Spouse If taxable income is: The tax is: 10% of taxable income Not over $18,550 Over $18,550 but not over $75,300 $1,855.00 15% of excess over S18,550 $10.367,50 25% of excess over $75,300 Over $75,300 but not over $151,900 Over $151,900 but not over $231,450 $29,517.50 28% of excess over $151,900 Over $231,450 but not over $413,350 $51,791.50 33% of excess over $231,450 Over $413,350 but not over $466,950 $111,818.50 35% of excess over $413,350 $130,578.50 39.6% of excess over $466,950 Over $466,950 Married Filing Separately The tax is: If taxable income is: Not over $9,275 10% of taxable income Over $9,275 but not over S37,650 $927.50 15% of excess over $9,275 Over $37,650 but not over $75,950 $5,183.75 25% of excess over $37,650 Over $75,950 but not over $115,725 $14,758.75 28% of excess over $75,950 Over $115,725 but not over $206,675 $25,895.75 33% of excess over $115,725 Over $206,675 but not over $233,475 $55,909.25 35% of excess over $206,675 Over $233,475 $65,289.25 39.6% of excess over $233,475 Heads of Household If taxable income is: The tax is: Not over $13,250 10% of taxable income $1,325.00 15% of excess over $13,250 Over $13,250 but not over $50,400 Over $50,400 but not over $130,150 $6,897.50 25% of excess over $50,400 Over $130,150 but not over $210,800 $26,835.00 28% of excess over $130,150 Over $210,800 but not over $413,350 $49,417.00 33% of excess over $210,800 Over $413,350 but not over $441,000 $116,258.50 35% of excess over $413,350 Over $441,000 $125,936.00 39.6% of excess over S441,000 Single If taxable income is: The tax is: Not over $9,275 10% of taxable income Over $9,275 but not over $37,650 $927.50 15% of excess over $9,275 $5,183.75 25% of excess over $37,650 Over $37,650 but not over $91,150 Over $91,150 but not over $190,150 S18,558.75 28% of excess over $91,150 $46,278.75 33% of excess over $190,150 Over $190,150 but not over $413,350 Over $413,350 but not over $415,050 $119,934.75 35% of excess over $413,350 Over $415,050 $120,529.75 39.6% of excess over $415,050