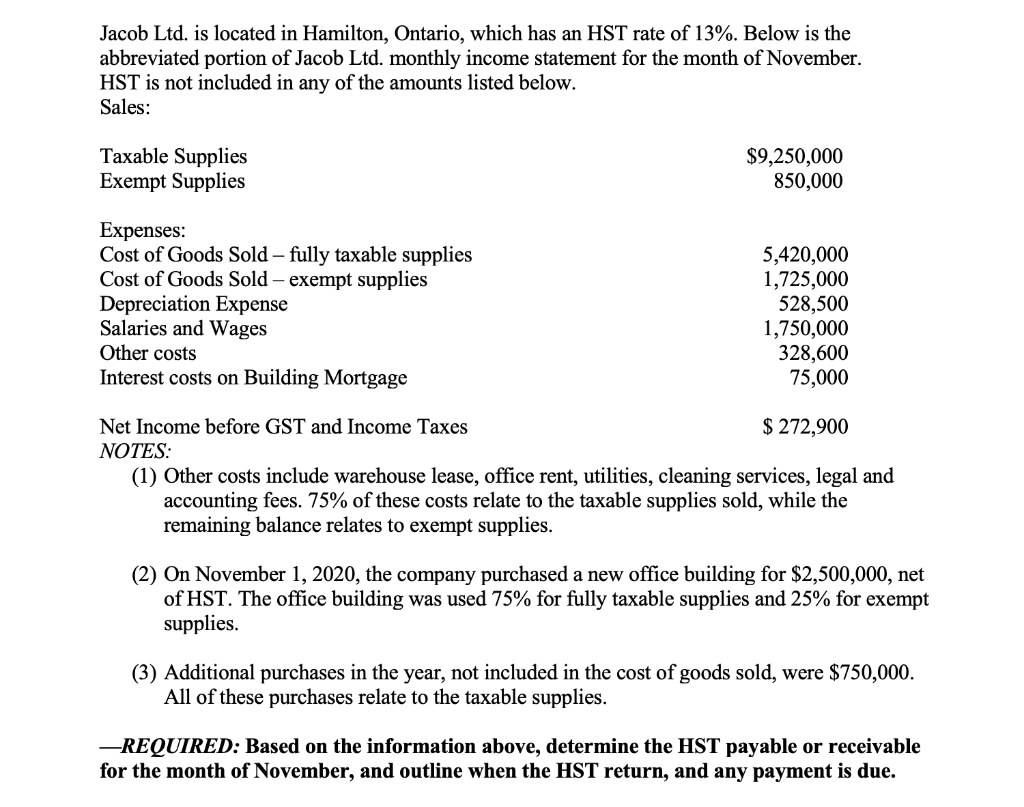

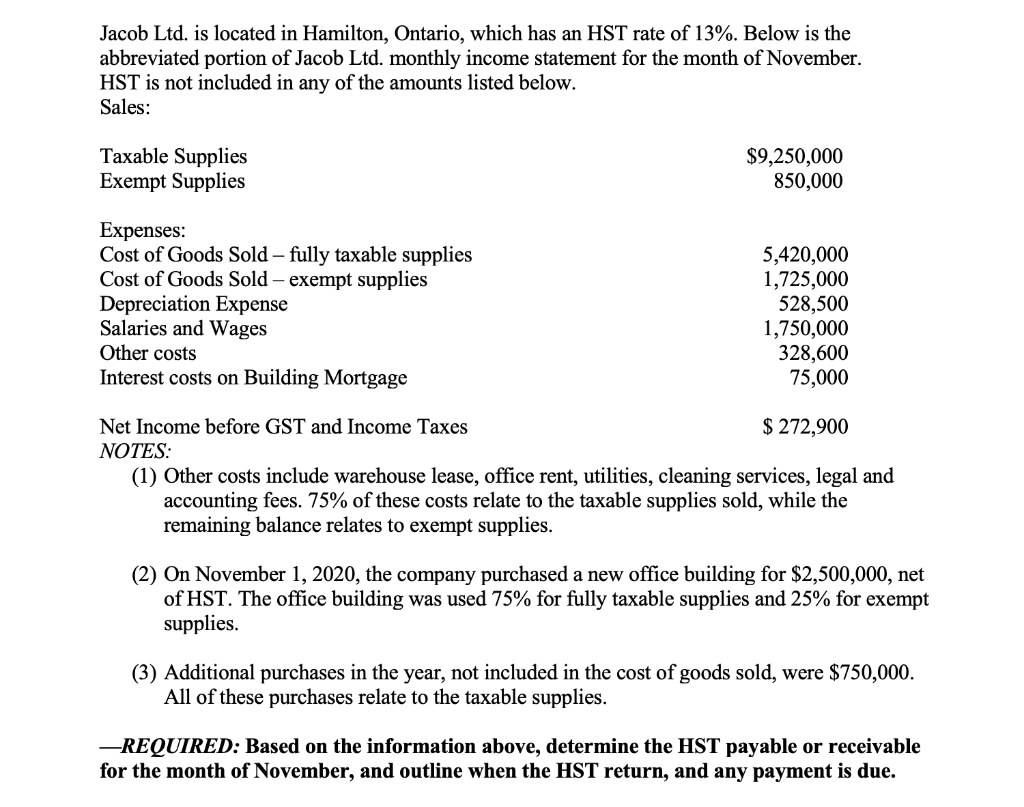

Jacob Ltd. is located in Hamilton, Ontario, which has an HST rate of 13%. Below is the abbreviated portion of Jacob Ltd. monthly income statement for the month of November. HST is not included in any of the amounts listed below. Sales: Taxable Supplies Exempt Supplies $9,250,000 850,000 Expenses: Cost of Goods Sold - fully taxable supplies Cost of Goods Sold - exempt supplies Depreciation Expense Salaries and Wages Other costs Interest costs on Building Mortgage 5,420,000 1,725,000 528,500 1,750,000 328,600 75,000 Net Income before GST and Income Taxes $ 272,900 NOTES: (1) Other costs include warehouse lease, office rent, utilities, cleaning services, legal and accounting fees. 75% of these costs relate to the taxable supplies sold, while the remaining balance relates to exempt supplies. (2) On November 1, 2020, the company purchased a new office building for $2,500,000, net of HST. The office building was used 75% for fully taxable supplies and 25% for exempt supplies. (3) Additional purchases in the year, not included in the cost of goods sold, were $750,000. All of these purchases relate to the taxable supplies. -REQUIRED: Based on the information above, determine the HST payable or receivable for the month of November, and outline when the HST return, and any payment is due. Jacob Ltd. is located in Hamilton, Ontario, which has an HST rate of 13%. Below is the abbreviated portion of Jacob Ltd. monthly income statement for the month of November. HST is not included in any of the amounts listed below. Sales: Taxable Supplies Exempt Supplies $9,250,000 850,000 Expenses: Cost of Goods Sold - fully taxable supplies Cost of Goods Sold - exempt supplies Depreciation Expense Salaries and Wages Other costs Interest costs on Building Mortgage 5,420,000 1,725,000 528,500 1,750,000 328,600 75,000 Net Income before GST and Income Taxes $ 272,900 NOTES: (1) Other costs include warehouse lease, office rent, utilities, cleaning services, legal and accounting fees. 75% of these costs relate to the taxable supplies sold, while the remaining balance relates to exempt supplies. (2) On November 1, 2020, the company purchased a new office building for $2,500,000, net of HST. The office building was used 75% for fully taxable supplies and 25% for exempt supplies. (3) Additional purchases in the year, not included in the cost of goods sold, were $750,000. All of these purchases relate to the taxable supplies. -REQUIRED: Based on the information above, determine the HST payable or receivable for the month of November, and outline when the HST return, and any payment is due