Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jacob Turner hired Jen Hatcher as a housekeeper starting on January 2 at $537 per month. Jacob does not withhold any federal taxes housekeeper for

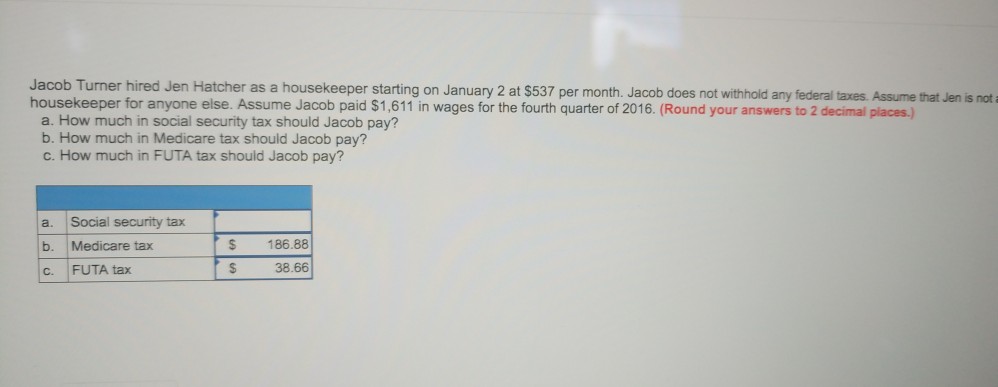

Jacob Turner hired Jen Hatcher as a housekeeper starting on January 2 at $537 per month. Jacob does not withhold any federal taxes housekeeper for anyone else. Assume Jacob paid $1,611 in wages for the fourth quarter of 2016. (Round your answers to 2 decimal places.) a. How much in social security tax should Jacob pay? b. How much in Medicare tax should Jacob pay? c. How much in FUTA tax should Jacob pay? a. Social security tax b. Medicare tax C. FUTA tax S 186.88 38.66

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started