Answered step by step

Verified Expert Solution

Question

1 Approved Answer

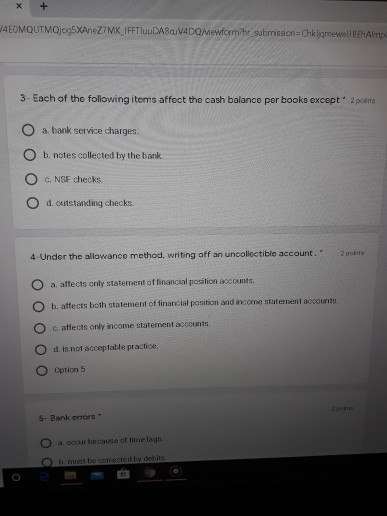

JAEOMQUTMQj05XAneZZMK IFTIUUDAB VADO Mewform?hr submission ChkligmeweunerAlma 3. Each of the following items affect the cash balance por books except O a bank service charges O

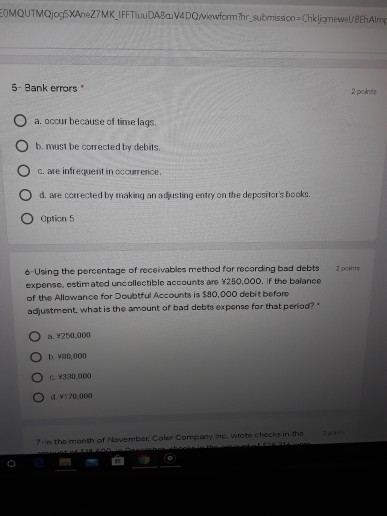

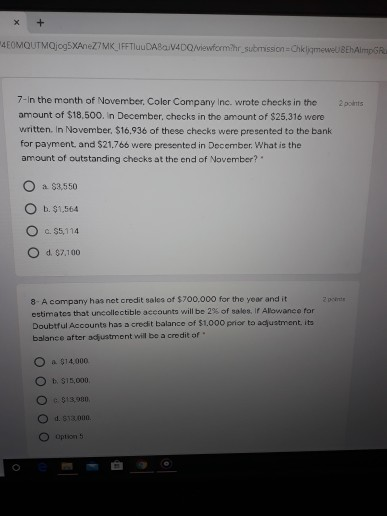

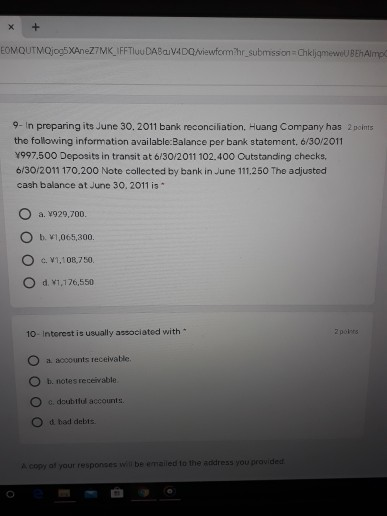

JAEOMQUTMQj05XAneZZMK IFTIUUDAB VADO Mewform?hr submission ChkligmeweunerAlma 3. Each of the following items affect the cash balance por books except O a bank service charges O b. notes collected by the bank. O c. NSF checks d. outstanding checks. 4-Under the allowance method, writing off an uncollectible account. 2 pants O a. affects only statement of financial position accounts. O h, affects both statement of financial position and income statement accounts O affects only income statement accounts O d is not acceptable practice. Options 5- Bank errors O O a cour because of time lags. must be corrected by debits EOMQUTMQg5XAneZ7MK_1FFTIUUDAB VADO/ewformur_submission Chljomew BhAny 5- Bank errors 2 points O a. occur because of time lags. O b. must be corrected by debits. O c. are infrequentin occurrence. O d. are corrected by making an adjusting entry on the depositor's books. O Option 5 points 6-Using the percentage of receivables method for recording bad debts expense, estimated uncollectible accounts are V250,000. If the balance of the Allowance for Doubtful Accounts is $80,000 debit before adjustment, what is the amount of bad debts expense for that period? O a. 1250,000 b. 80,000 O O O Y330,000 d. 120,000 7 in the month of November Coler Company in wrote chocks in the x + AEOMOUTMQ05XAneZ7MK_1FFTUUDAB V4DQ/viewformir submission ChimewBAIR 7-in the month of November, Color Company Inc. wrote checks in the amount of $18,500. In December, chocks in the amount of $25,316 wore written in November. $16.936 of these checks were presented to the bank for payment, and $21.766 were presented in December. What is the amount of outstanding checks at the end of November? O a $3,550 O . $1.564 O c. $5,114 Od 57.100 8. A company has not credit sales of $700.000 for the year and it estimates that uncollectible accounts will be 29 of sales. If Allowance for Doubtful Accounts has a credit balance of $1,000 prior to adjustment.it balance after adjustment will be a credit of $14,000 O O O O . $15,000 $13.000 d. $13.000. Options X + EOMQUTQjop5 XaneZ7MK_1FFIUUDAB V4 Doniewformir submission Chkliamew.Beh Almos 9- in preparing its June 30, 2011 bank reconciliation. Huang Company has 2 points the following information available:Balance per bank statement. 6/30/2011 Y997.500 Deposits in transit at 6/30/2011 102.400 Outstanding checks. 6/30/2011 170.200 Note collected by bank in June 111.250 The adjusted cash balance at June 30, 2011 is a. 7929,700 O b 1,065,300. O O .V1,108,750 d. 11,176,550 10 - Interest is usually associated with O a accounts receivable O b. notes receivable O doubtful accounts Od bad debts. A copy of your responses will be emailed to the address you provided

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started