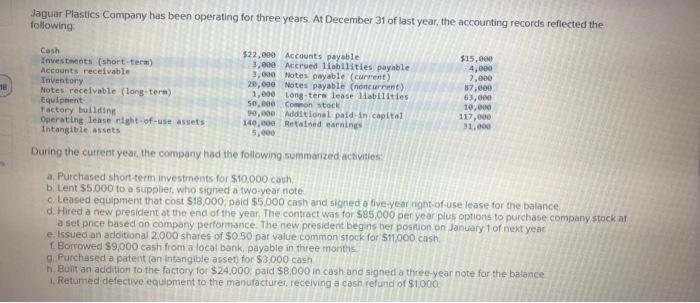

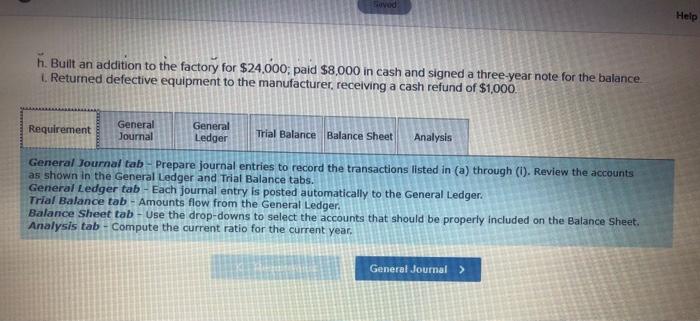

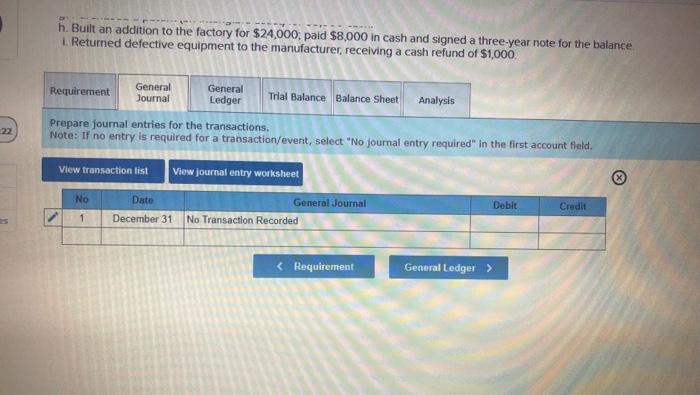

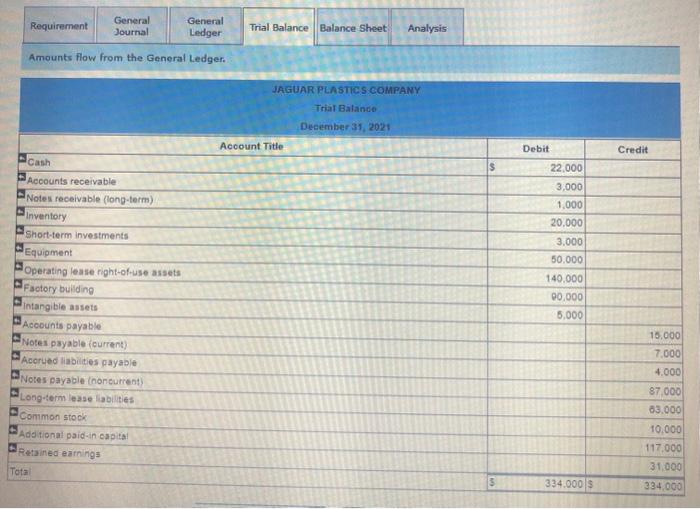

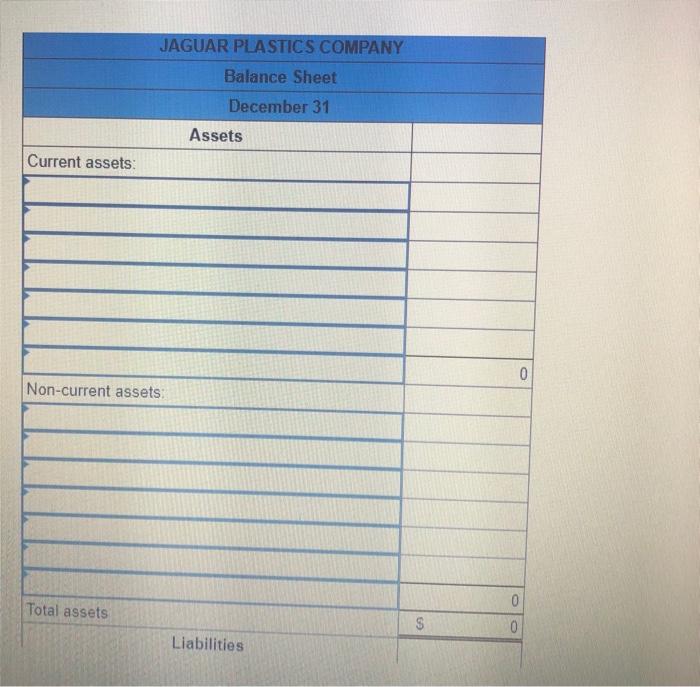

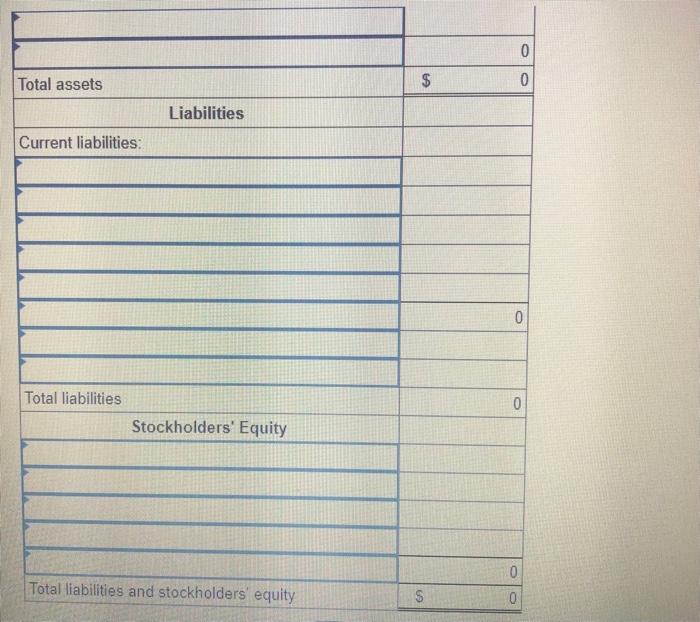

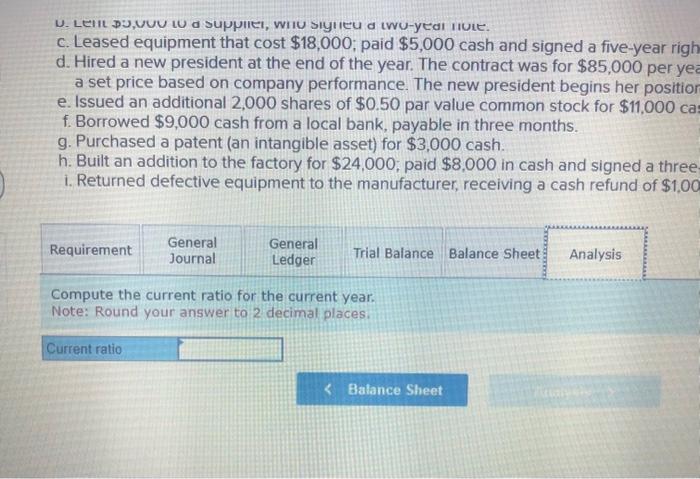

Jaguar Plastics Company has been operating for three years. At December 31 of last year, the accounting records reflected the following During the current yeac, the company had the following summarized activitjes: a. Purchased short-term investments for $10,000 cash. b. Lent $5.000 to a supplier, Who signed a two-year note. c. Leased equipment that cost $18,000, paid $5,000 cash and signed a fiveyear right-of-use lease for the balance. d. Hired a new president at the end of the year. The contract was for 585.000 per year plus options to purchase company stock at a set price based on company performance. The new president begins her poshion on January to next yeat e. Issued an adoitional 2,000 shares of $0,50 par value common stock for $11,000cish f. Borrowed $9,000 cash from a local bank, payable in three monthe 9. Purchased a patent (an intanguble asset) for $3,000cash h. Buit an addition to the factory for $24,000, paid $8,000 in cash and signed a three-year note for the balance 1. Retumed defective equipment to the manufacturer, receiving a cash relund of $1.000. h. Built an addition to the factory for $24,000; paid $8,000 in cash and signed a three-year note for the balance. 1. Returned defective equipment to the manufacturer, receiving a cash refund of $1,000. General Journal tab-Prepare journal entries to record the transactions listed in (a) through (i). Review the accounts as shown in the General Ledger and Trial Balance tabs. General Ledger tab - Each journal entry is posted automatically to the General Ledger. Trial Balance tab - Amounts flow from the General Ledger. Balance Sheet tab - Use the drop-downs to select the accounts that should be properly included on the Balance Sheet. Analysis tab-Compute the current ratio for the current year. h. Built an addition to the factory for $24,000; paid $8,000 in cash and signed a three-year note for the balance 1. Returned defective equipment to the manufacturer, receiving a cash refund of $1,000. repare journal entries for the transactions. ote: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Amounts flow from the General Ledger. c. Leased equipment that cost $18,000; paid $5,000 cash and signed a five-year righ d. Hired a new president at the end of the year. The contract was for $85,000 per yea a set price based on company performance. The new president begins her positior e. Issued an additional 2,000 shares of $0.50 par value common stock for $11,000 ca: f. Borrowed $9,000 cash from a local bank, payable in three months. g. Purchased a patent (an intangible asset) for $3,000 cash. h. Built an addition to the factory for $24,000; paid $8,000 in cash and signed a three i. Returned defective equipment to the manufacturer, receiving a cash refund of $1,00 Compute the current ratio for the current year. Note: Round your answer to 2 decimal places