Answered step by step

Verified Expert Solution

Question

1 Approved Answer

James (aged 33) and his wife, Jennie (aged 30), have just purchased a new condominium for $550,000. They plan to take a 80% mortgage

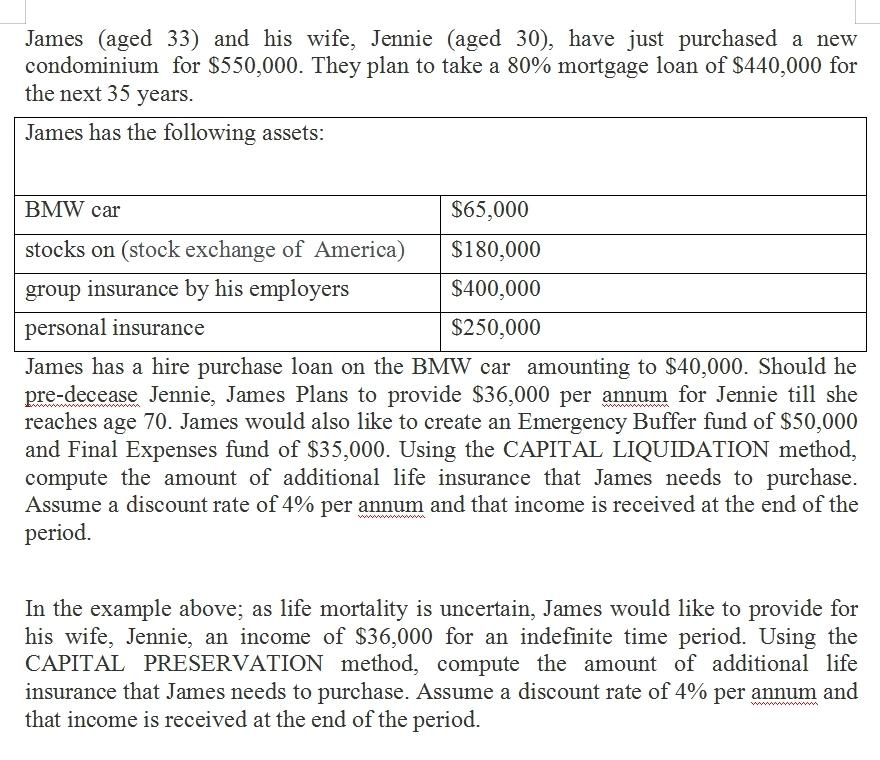

James (aged 33) and his wife, Jennie (aged 30), have just purchased a new condominium for $550,000. They plan to take a 80% mortgage loan of $440,000 for the next 35 years. James has the following assets: BMW car $65,000 stocks on (stock exchange of America) $180,000 group insurance by his employers $400,000 personal insurance $250,000 James has a hire purchase loan on the BMW car amounting to $40,000. Should he pre-decease Jennie, James Plans to provide $36,000 per annum for Jennie till she reaches age 70. James would also like to create an Emergency Buffer fund of $50,000 and Final Expenses fund of $35,000. Using the CAPITAL LIQUIDATION method, compute the amount of additional life insurance that James needs to purchase. Assume a discount rate of 4% per annum and that income is received at the end of the period. wwwwwwwwwww In the example above; as life mortality is uncertain, James would like to provide for his wife, Jennie, an income of $36,000 for an indefinite time period. Using the CAPITAL PRESERVATION method, compute the amount of additional life insurance that James needs to purchase. Assume a discount rate of 4% per annum and that income is received at the end of the period.

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Using the CAPITAL LIQUIDATION method James would need to purchase an additional life insuranc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started