Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jamie enjoys researching, buying, and selling stock. She purchased 500 shares of Sterile Inc. stock on March 10, Year 12 for $5,000. Unfortunately, Sterile Inc's

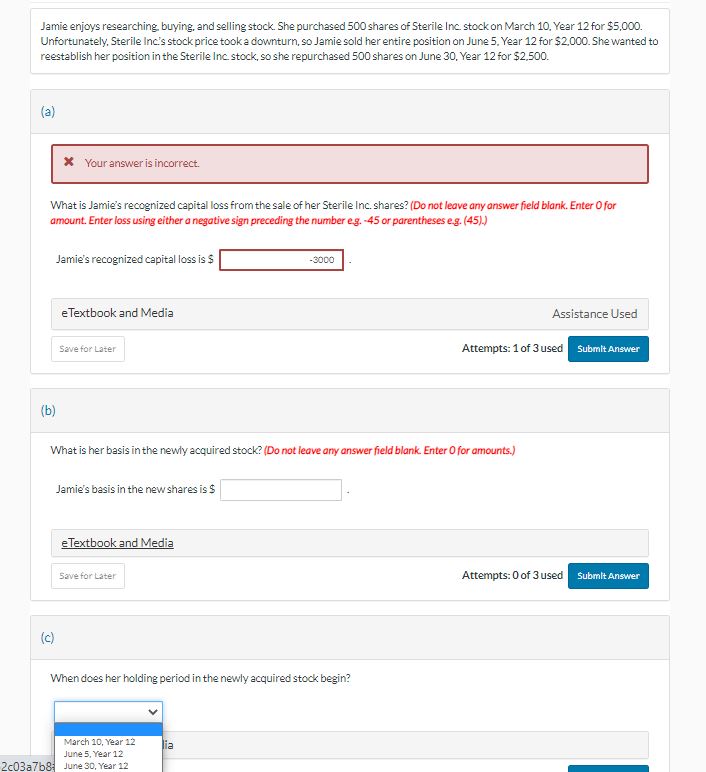

Jamie enjoys researching, buying, and selling stock. She purchased 500 shares of Sterile Inc. stock on March 10, Year 12 for $5,000. Unfortunately, Sterile Inc's stock price took a downturn, so Jamie sold her entire position on June 5, Year 12 for $2,000. She wanted to reestablish her position in the Sterile Inc. stock, so she repurchased 500 shares on June 30 , Year 12 for $2,500. (a) What is Jamie's recognized capital loss from the sale of her Sterile Inc. shares? (Do not leave any answer field blank. Enter 0 for amount. Enter loss using either a negative sign preceding the number eg. -45 or parentheses eg. (45).) Jamie's recognized capital loss is $ eTextbook and Media Assistance Used Attempts: 1 of 3 used (b) What is her basis in the newly acquired stock? (Do not leave any answer field blank. Enter 0 for amounts.) Jamie's basis in the new shares is $ eTextbook and Media Attempts: 0 of 3 used (c) When does her holding period in the newly acquired stock begin

Jamie enjoys researching, buying, and selling stock. She purchased 500 shares of Sterile Inc. stock on March 10, Year 12 for $5,000. Unfortunately, Sterile Inc's stock price took a downturn, so Jamie sold her entire position on June 5, Year 12 for $2,000. She wanted to reestablish her position in the Sterile Inc. stock, so she repurchased 500 shares on June 30 , Year 12 for $2,500. (a) What is Jamie's recognized capital loss from the sale of her Sterile Inc. shares? (Do not leave any answer field blank. Enter 0 for amount. Enter loss using either a negative sign preceding the number eg. -45 or parentheses eg. (45).) Jamie's recognized capital loss is $ eTextbook and Media Assistance Used Attempts: 1 of 3 used (b) What is her basis in the newly acquired stock? (Do not leave any answer field blank. Enter 0 for amounts.) Jamie's basis in the new shares is $ eTextbook and Media Attempts: 0 of 3 used (c) When does her holding period in the newly acquired stock begin Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started