Question

Jamie has taken over as new Controller of Pluto Enterprises Inc, a revolutionary education and entertainment business in BC. The companys Despite not having a

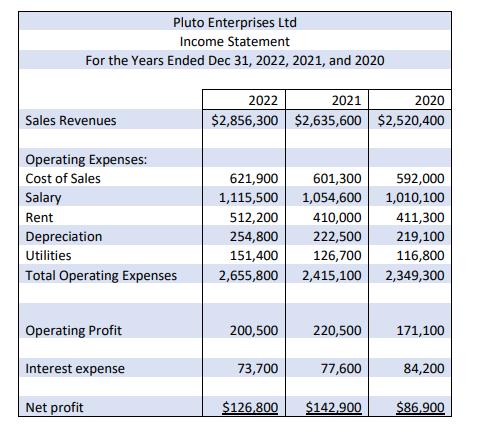

Jamie has taken over as new Controller of Pluto Enterprises Inc, a revolutionary education and entertainment business in BC. The company’s Despite not having a strong accounting background, Jamie is looking to looking to lead the way in making some long overdue changes to the organization. He has been with Pluto for almost three years, so he has some ideas on how to improve processes. Jamie’s direct supervisor, Sosha, also doesn’t have an accounting background. When the previous CFO retired suddenly last month, Sosha was immediately promoted to the Chief Financial Officer role. She, in turn, promoted Jamie, who had been in the finance department and had helped her with a few projects, to Controller. The Controller role was a new one created by Sosha to help deal with the company’s growing accounting demands. Since Sosha had worked as an administrative assistant to the previous CFO for five years, Jamie had assumed she was fit to take over, but he is wondering if perhaps the company is lacking accounting expertise/leadership. Seeing how the only other accounting employee in Pluto is Jenna, an Accounting Assistant working under him, Jamie wonders if an external candidate would be better suited for his Controller role. Here are Pluto’s income statements over the past three years:

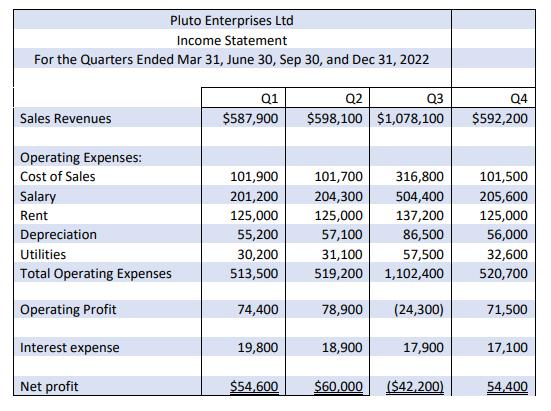

Additionally, here are Pluto’s past four quarterly income statements:

Jamie wants to include budgeting processes as part of regular business activities at the end of each quarter. Currently, Pluto’s business management assumes things will remain the same from quarter to quarter and makes things work as circumstances change. Jamie wants advice on how to improve on this process and implement budgeting processes for the upcoming year (it is currently the first week of January 2023). An important factor for him is being able to do performance analysis at the end of each quarter. He is looking for specific details around best budgeting and performance evaluation practices.

Pluto has been offered an opportunity to partner up with a chain of private schools in a 10-year project which would provide engaging sessions about the solar system to fourth graders. Accepting the opportunity would mean an immediate investment of $400,000 by Pluto. Those funds can be borrowed from the bank at a rate of 4.45% per annum. The expected returns of the partnership are as follows:

o $30,000 first-year income, with 80% going to Pluto and 20% to the private schools

• 20% year-over-year growth in income in years 2 through 5, with 90% going to Pluto

• 10% year-over-year growth in income in years 6 through 10, with 95% going to Pluto

Jamie’s new contract promises that he will receive, as a year-end bonus, 1% of all growth in Pluto’s pretax net income over the prior year. Hence, he is excited about expanding operations and taking on the project. He is also wondering if there are certain accounting policies that can be implemented to increase income on paper, even if no major changes are made in the business.

Before he accepts the private school offer, Jamie wants an in-depth analysis of this investment opportunity including all pros and cons, as well as ethical factors. He isn’t sure about tax implications to the company and himself, but he knows Pluto currently pays an 11% corporate tax rate.

Advise Jamie on his career path and the current outlook on Pluto Enterprises. Produce a business report, including comprehensive analysis, recommendations, and any questions you may need to ask your client.

Pluto Enterprises Ltd Income Statement For the Years Ended Dec 31, 2022, 2021, and 2020 2022 2021 2020 Sales Revenues $2,856,300 $2,635,600 $2,520,400 Operating Expenses: Cost of Sales 621,900 601,300 592,000 Salary 1,115,500 1,054,600 1,010,100 Rent 512,200 410,000 411,300 Depreciation Utilities 254,800 222,500 219,100 151,400 126,700 116,800 Total Operating Expenses 2,655,800 2,415,100 2,349,300 Operating Profit 200,500 220,500 171,100 Interest expense 73,700 77,600 84,200 Net profit $126,800 $142,900 $86,900

Step by Step Solution

3.49 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Pluto should partner with the private school for a gain of 62900 using the NPV Method Budgeting shou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started