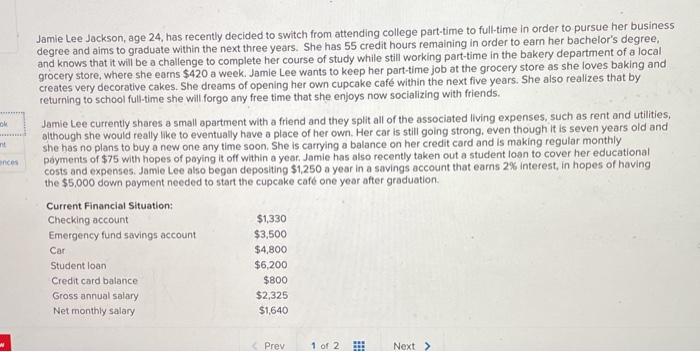

Jamie Lee Jackson, age 24, has recently decided to switch from attending college part-time to full-time in order to pursue her business degree and aims to graduate within the next three years. She has 55 credit hours remaining in order to earn her bachelor's degree, and knows that it will be a challenge to complete her course of study while still working part-time in the bakery department of a local grocery store, where she earns $420 a week. Jamie Lee wants to keep her part-time job at the grocery store as she loves baking and creates very decorative cakes. She dreams of opening her own cupcake caf within the next five years. She also realizes that by returning to school full-time she will forgo any free time that she enjoys now socializing with friends. Jamie Lee currently shares a small apartment with a friend and they split all of the associated living expenses, such as rent and utilities, although she would really like to eventually have a place of her own. Her car is still going strong, even though it is seven years old and she has no plans to buy a new one any time soon. She is carrying a balance on her credit card and is making regular monthly payments of $75 with hopes of paying it off within a year, Jamie has also recently taken out a student loan to cover her educational costs and expenses. Jomie Lee also begon depositing $1,250 a year in a savings account that earns 2% Interest, in hopes of having the $5,000 down payment needed to start the cupcake caf one year after graduation Current Financial Situation: Checking account $1,330 Emergency fund savings account $3,500 Car $4,800 Student loan $6,200 Credit card balance $800 Gross annual salary $2,325 Net monthly salary $1,640 Prev 1 of 2 Next > Jamie Lee Jackson, age 24, has recently decided to switch from attending college part-time to full-time in order to pursue her business degree and aims to graduate within the next three years. She has 55 credit hours remaining in order to earn her bachelor's degree, and knows that it will be a challenge to complete her course of study while still working part-time in the bakery department of a local grocery store, where she earns $420 a week. Jamie Lee wants to keep her part-time job at the grocery store as she loves baking and creates very decorative cakes. She dreams of opening her own cupcake caf within the next five years. She also realizes that by returning to school full-time she will forgo any free time that she enjoys now socializing with friends. Jamie Lee currently shares a small apartment with a friend and they split all of the associated living expenses, such as rent and utilities, although she would really like to eventually have a place of her own. Her car is still going strong, even though it is seven years old and she has no plans to buy a new one any time soon. She is carrying a balance on her credit card and is making regular monthly payments of $75 with hopes of paying it off within a year, Jamie has also recently taken out a student loan to cover her educational costs and expenses. Jomie Lee also begon depositing $1,250 a year in a savings account that earns 2% Interest, in hopes of having the $5,000 down payment needed to start the cupcake caf one year after graduation Current Financial Situation: Checking account $1,330 Emergency fund savings account $3,500 Car $4,800 Student loan $6,200 Credit card balance $800 Gross annual salary $2,325 Net monthly salary $1,640 Prev 1 of 2 Next >