Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jamie Winters is 40 years old and has never been married. Jamie currently earns $100,000 as an employee and has managed to save $100,000 towards

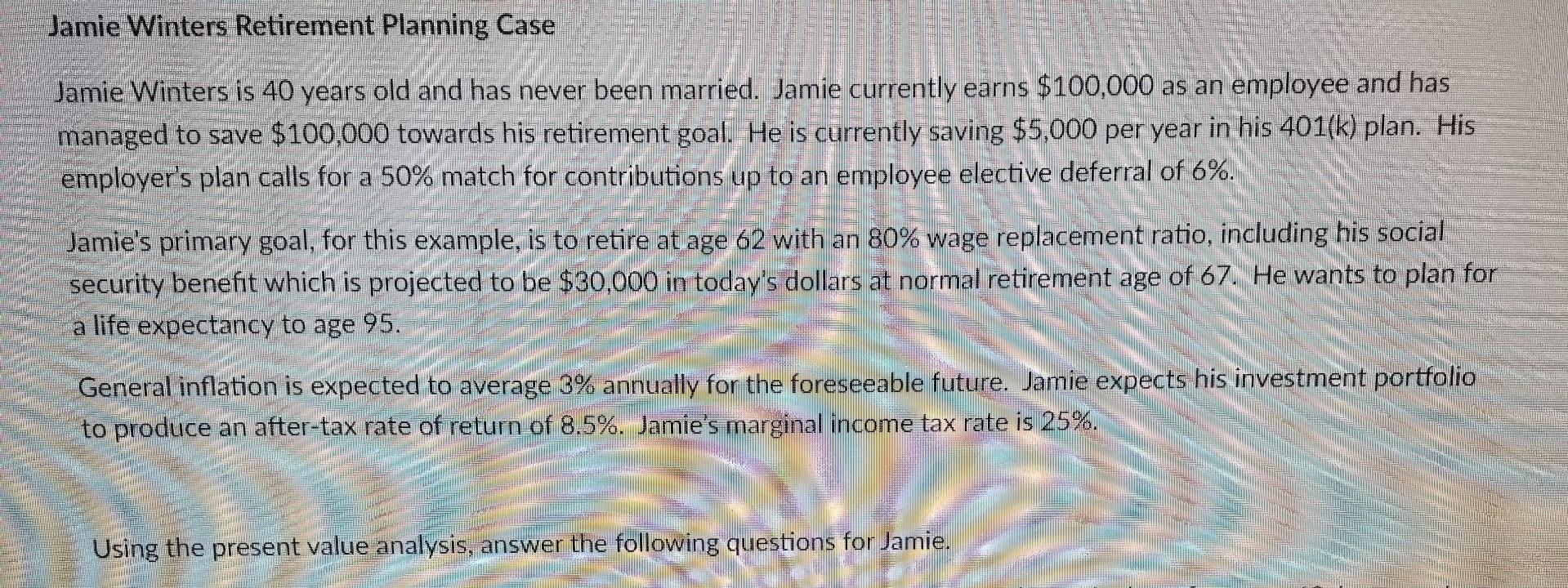

Jamie Winters is 40 years old and has never been married. Jamie currently earns $100,000 as an employee and has managed to save $100,000 towards his retirement goal. He is currently saving $5,000 per year in his 401(k) plan. His employer's plan calls for a 50% match for contributions up to an employee elective deferral of 6%. Jamie's primary goal, for this example, is to retire at age 62 with an 80% wage replacement ratio, including his social security benefit which is projected to be $30,000 in today's dollars at normal retirement age of 67 . He wants to plan for a life expectancy to age 95. General inflation is expected to average 3% annually for the foreseeable future. Jamie expects his investment portfolio to produce an after-tax rate of return of 8.5%. Jamie's marginal income tax rate is 25%. Using the present value analysis, answer the following questions for Jamie. 4. If the answer to \#3 is the amount of money Jamie will need to have accumulated by the time he retires at age 62 , how much should he currently have in his retirement savings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started