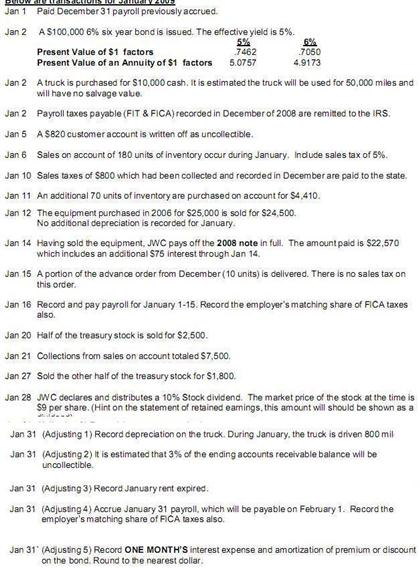

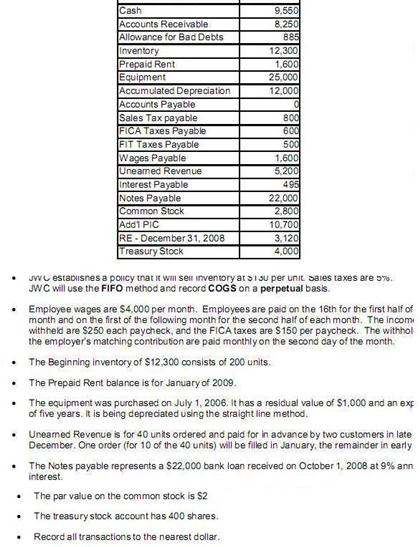

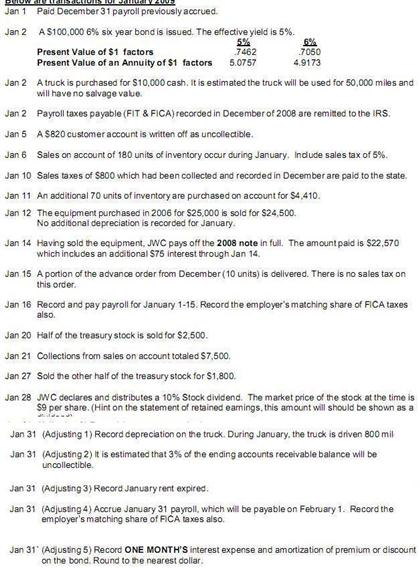

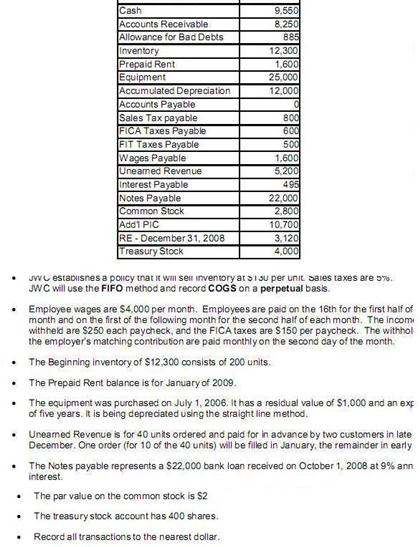

Jan 1 Paid December 31 payroll previously accrued Jan 2 A S100.000 6% six year bone is issued. The effective yield is 5%. Present Value of $1 factors Present Value of an Annuity of $1 factors Jan 2 A truck is purchased for $10,000 cash, It is estimated the truck will be used tor 50.000 miles and will have no salvage value. Jan 2 Payroll taxes payable (FIT & FICA) recorded in December of 2008 are remitted to the IRS Jan 5 A $820 customer account is written off as uncollectible. Jan 6 Sales on account of 180 units of inventory occur during January. Induce sales tax of 5%. Jan 10 Sales taxes of $800 which had been collected and recorded in December are paid to the state. Jan 11 An additional 70 units of inventory are purchased on account for $4,410 Jan 12 The equipment purchased in 2006 for $25,000 is sold for $24,500 No additional depreciation is recorded for January. Jan 14 Having sold the equipment. JWC pays off the 2008 note in full. The amount paid is $22.570 which includes an additional $75 interest through Jan 14 Jan 15 A portion of the advance order from December (10 units) is delivered. There is no sales tax on this order. Jan 16 Record and pay payroll for January 1-15. Record the employer's matching share of RCA taxes also. Jan 20 Half of the treasury stock is sold for $2,500. Jan 21 Collections from sales on account totaled $7,500. Jan 27 Sold the other half of the treasury stock for $1,800. Jan 28 JWC declares and distributes a 10% Stock dividend. The market price of the stock at the time is $9 per share. (Hint on the statement of retained earnings, this amount will should be shown as a Jan 31 (Adjusting 1) Record deprecation on the truck During January, the truck is driven 800 mil Jan 31 (Adjusting 2) It is estimated that 3% at the ending accounts receivable balance will be uncollectible Jan 31 (Adjusting 3) Record January rent expired: Jan 31 (Adjusting4) Accrue January 31 payroll, which will: be payable on February 1. Record the employer's matching share of FICA taxes also Jan 31 (Adjusting 5) Record ONE MONTH'S interest expense and amortization of premium or discount on the bond Round to re nearest dollar. JWC establishes a policy that it will sent inventory at per unit Sales taxes are 5%. JWC will use the FIFO method and record COGS on a perpetual basis Employee wages are $4,000 per month. Employees are paid on the 16th for (he first half of month and on the first of the following month for the second half of each month The Income withheld are S250 each paycheck, and the FlCA taxes are $150 per paycheck. The without the employer's matching contribution are paid monthly on the second flay of the month. The Beginning inventory of $12,300 consists of 200 units. The Prepaid Rent balance is for January of 2009 The equipment was purchased on July 1,2006. It has a residual value of $1,000 and an exp of five years. It is being depredated using the straight line method. Unearned Revenue is for 40 units ordered and paid for in advance by two customers in late December. One order (for 10 of the 40 units) will be filled in January, the remainder in early. The Notes payable represents a $22,000 bank loan received on October 1, 2008 at 9% an interest The par value on the common stock is $2. The treasury stock account has 400 shares. Record all transactions to the nearest dollar. Jan 1 Paid December 31 payroll previously accrued Jan 2 A S100.000 6% six year bone is issued. The effective yield is 5%. Present Value of $1 factors Present Value of an Annuity of $1 factors Jan 2 A truck is purchased for $10,000 cash, It is estimated the truck will be used tor 50.000 miles and will have no salvage value. Jan 2 Payroll taxes payable (FIT & FICA) recorded in December of 2008 are remitted to the IRS Jan 5 A $820 customer account is written off as uncollectible. Jan 6 Sales on account of 180 units of inventory occur during January. Induce sales tax of 5%. Jan 10 Sales taxes of $800 which had been collected and recorded in December are paid to the state. Jan 11 An additional 70 units of inventory are purchased on account for $4,410 Jan 12 The equipment purchased in 2006 for $25,000 is sold for $24,500 No additional depreciation is recorded for January. Jan 14 Having sold the equipment. JWC pays off the 2008 note in full. The amount paid is $22.570 which includes an additional $75 interest through Jan 14 Jan 15 A portion of the advance order from December (10 units) is delivered. There is no sales tax on this order. Jan 16 Record and pay payroll for January 1-15. Record the employer's matching share of RCA taxes also. Jan 20 Half of the treasury stock is sold for $2,500. Jan 21 Collections from sales on account totaled $7,500. Jan 27 Sold the other half of the treasury stock for $1,800. Jan 28 JWC declares and distributes a 10% Stock dividend. The market price of the stock at the time is $9 per share. (Hint on the statement of retained earnings, this amount will should be shown as a Jan 31 (Adjusting 1) Record deprecation on the truck During January, the truck is driven 800 mil Jan 31 (Adjusting 2) It is estimated that 3% at the ending accounts receivable balance will be uncollectible Jan 31 (Adjusting 3) Record January rent expired: Jan 31 (Adjusting4) Accrue January 31 payroll, which will: be payable on February 1. Record the employer's matching share of FICA taxes also Jan 31 (Adjusting 5) Record ONE MONTH'S interest expense and amortization of premium or discount on the bond Round to re nearest dollar. JWC establishes a policy that it will sent inventory at per unit Sales taxes are 5%. JWC will use the FIFO method and record COGS on a perpetual basis Employee wages are $4,000 per month. Employees are paid on the 16th for (he first half of month and on the first of the following month for the second half of each month The Income withheld are S250 each paycheck, and the FlCA taxes are $150 per paycheck. The without the employer's matching contribution are paid monthly on the second flay of the month. The Beginning inventory of $12,300 consists of 200 units. The Prepaid Rent balance is for January of 2009 The equipment was purchased on July 1,2006. It has a residual value of $1,000 and an exp of five years. It is being depredated using the straight line method. Unearned Revenue is for 40 units ordered and paid for in advance by two customers in late December. One order (for 10 of the 40 units) will be filled in January, the remainder in early. The Notes payable represents a $22,000 bank loan received on October 1, 2008 at 9% an interest The par value on the common stock is $2. The treasury stock account has 400 shares. Record all transactions to the nearest dollar