Question

Jane is a junior investment adviser of Vanda Capital and recently met with a high net worth client, Sebastien, to prepare an investment policy statement.

Jane is a junior investment adviser of Vanda Capital and recently met with a high net worth client, Sebastien, to prepare an investment policy statement. At the meeting, Sebastien does not reveal any quantifiable return and risk objectives and Jane was only able to cobble together the following notes in order to draft a client profile:

Sebastien Vetermier is a 40-year-old tenured professor living in the United States, with investable assets of USD20 million. His annual salary for the coming year will be USD200,000 and is expected to increase at a rate of 3% per year. Tenure grants him permanent employment until the age of 70 and protects him from being fired without just cause. Of his investable assets, Sebastien needs about $2 million three months from now in order to make a charitable donation to help in the fight against infectious diseases. He is not a big spender but is concerned about the general increase in the prices of goods and services over time. Furthermore, Sebastien would like a portfolio that can be liquidated quickly and at fair value. He also wants the portfolio to be diversified, with fixed income-like asset classes contributing around 30% of his total (i.e., financial + human) capital.

When Jane was conducting due diligence, she chanced upon a risk-free rate of 2% and the following formula on her colleagues desk:Future value of growing annuity at the end of period t = [C/(r g)][(1+r)t (1+g)t], where C is the cash flow one period from now, r is the discount rate, g is the rate at which cash flows grow from period to period, and t is the number of periods.

(a)Calculate todays value of Sebastiens human capital and justify your assumption(s), if any.

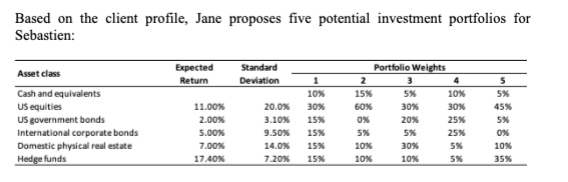

Based on the client profile, Jane proposes five potential investment portfolios for Sebastien: Expected Return Standard Deviation 5 5% 45% Asset class Cash and equivalents US equities US government bonds International corporate bonds Domestic physical real estate Hedge funds 1 10% 30% 15% 15% 15% 15% 11.00% 2.00% 5.00% 7.00% 17.40% 0% Portfolio Weights 2 4 15% 5% 10% 60% 30% 30% 20% 25% 5% 25% 10% 30% 5% 10% 10% SX 20.0% 3.10% 9.50% 14.0% 7.20% 5% 5% OX 10% 35% Based on the client profile, Jane proposes five potential investment portfolios for Sebastien: Expected Return Standard Deviation 5 5% 45% Asset class Cash and equivalents US equities US government bonds International corporate bonds Domestic physical real estate Hedge funds 1 10% 30% 15% 15% 15% 15% 11.00% 2.00% 5.00% 7.00% 17.40% 0% Portfolio Weights 2 4 15% 5% 10% 60% 30% 30% 20% 25% 5% 25% 10% 30% 5% 10% 10% SX 20.0% 3.10% 9.50% 14.0% 7.20% 5% 5% OX 10% 35%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started