Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jane owns a small restaurant in the heart of Toronto. She wants to hire Jim to X manage the restaurant. Jim has zero wealth.

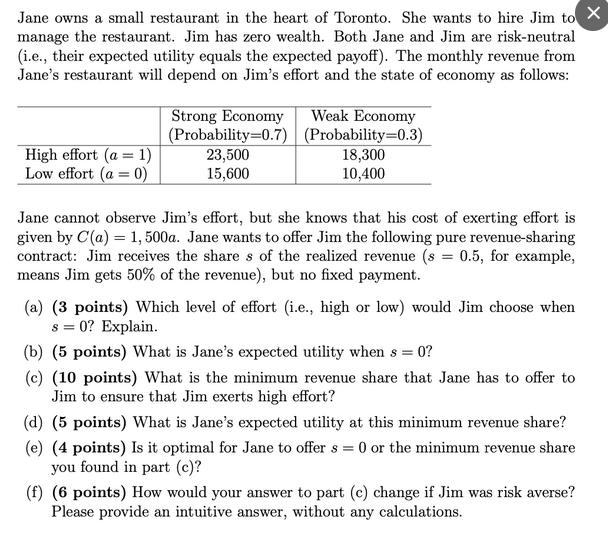

Jane owns a small restaurant in the heart of Toronto. She wants to hire Jim to X manage the restaurant. Jim has zero wealth. Both Jane and Jim are risk-neutral (i.e., their expected utility equals the expected payoff). The monthly revenue from Jane's restaurant will depend on Jim's effort and the state of economy as follows: Strong Economy Weak Economy (Probability=0.7) | (Probability=0.3) High effort (a = 1) Low effort (a 0) = 23,500 15,600 18,300 10,400 Jane cannot observe Jim's effort, but she knows that his cost of exerting effort is given by C(a) = 1, 500a. Jane wants to offer Jim the following pure revenue-sharing contract: Jim receives the shares of the realized revenue (s = 0.5, for example, means Jim gets 50% of the revenue), but no fixed payment. (a) (3 points) Which level of effort (i.e., high or low) would Jim choose when s = 0? Explain. (b) (5 points) What is Jane's expected utility when s = 0? (c) (10 points) What is the minimum revenue share that Jane has to offer to Jim to ensure that Jim exerts high effort? (d) (5 points) What is Jane's expected utility at this minimum revenue share? (e) (4 points) Is it optimal for Jane to offer s = 0 or the minimum revenue share you found in part (c)? (f) (6 points) How would your answer to part (c) change if Jim was risk averse? Please provide an intuitive answer, without any calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started