Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jane targets a house ( non - condo ) for 6 0 0 , 0 0 0 and would like to have the maximum possible

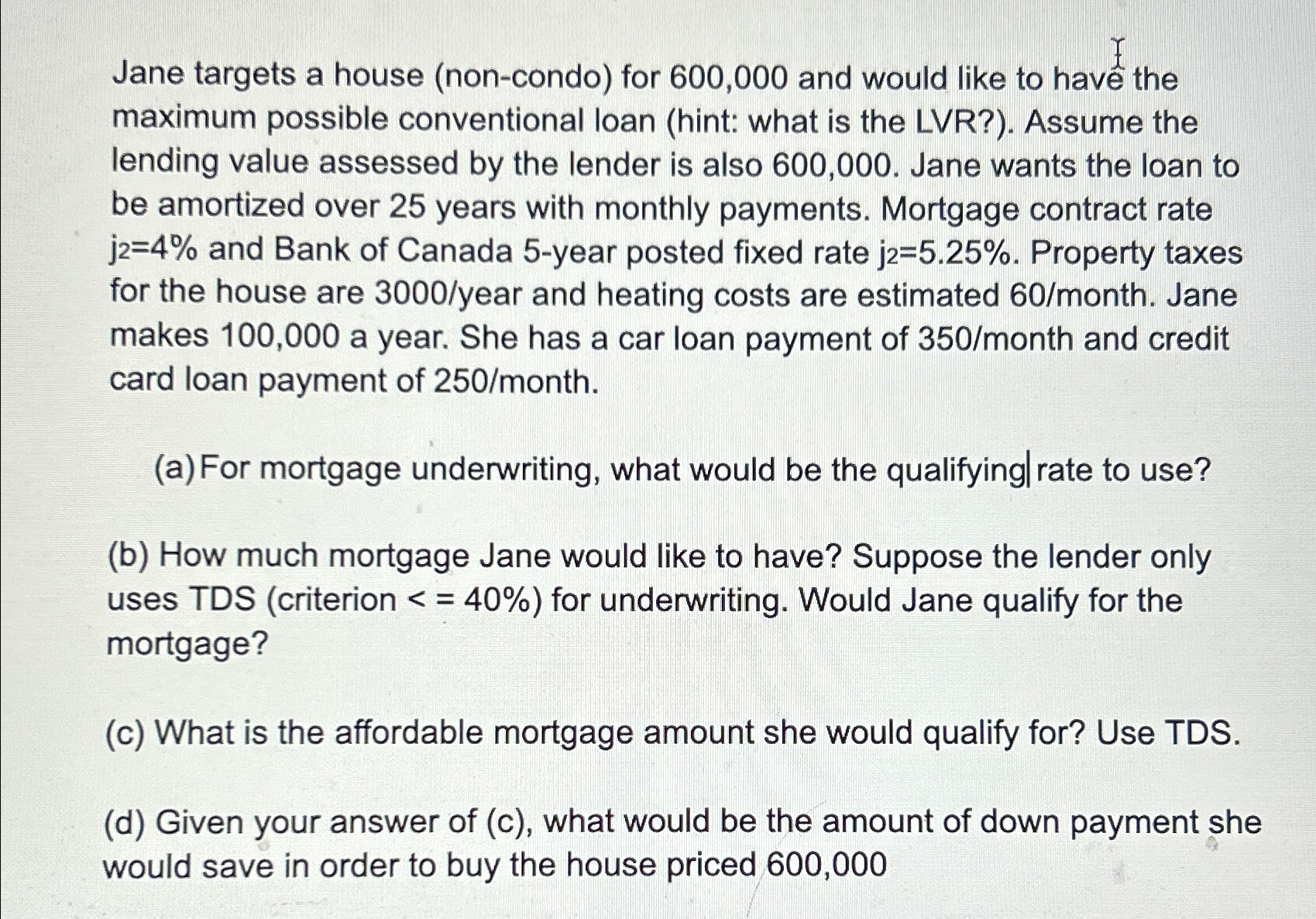

Jane targets a house noncondo for and would like to have the maximum possible conventional loan hint: what is the LVR Assume the lending value assessed by the lender is also Jane wants the loan to be amortized over years with monthly payments. Mortgage contract rate and Bank of Canada year posted fixed rate Property taxes for the house are year and heating costs are estimated month Jane makes a year. She has a car loan payment of month and credit card loan payment of month.

aFor mortgage underwriting, what would be the qualifying rate to use?

b How much mortgage Jane would like to have? Suppose the lender only uses TDS criterion for underwriting. Would Jane qualify for the mortgage?

c What is the affordable mortgage amount she would qualify for? Use TDS

d Given your answer of c what would be the amount of down payment she would save in order to buy the house priced

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started