Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Janes Company provided the following information on intangible assets: a. A patent was purchased from the Lou Company for $1,550,000 on January 1,2022 . Janes

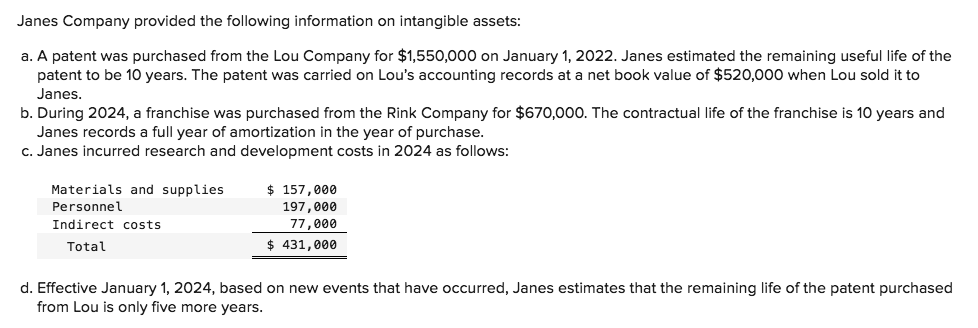

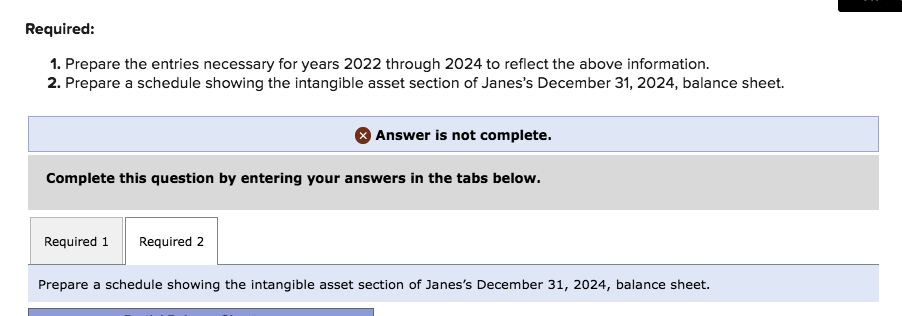

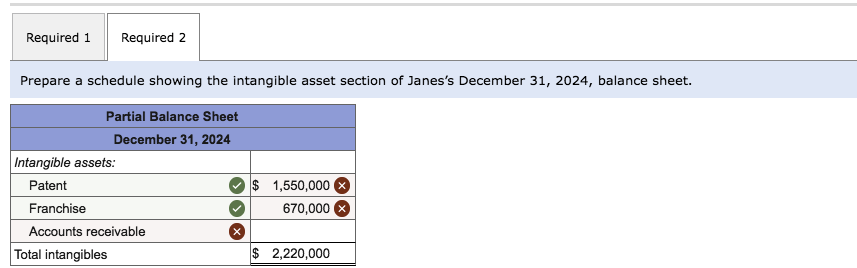

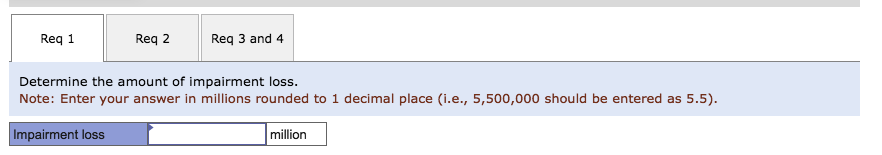

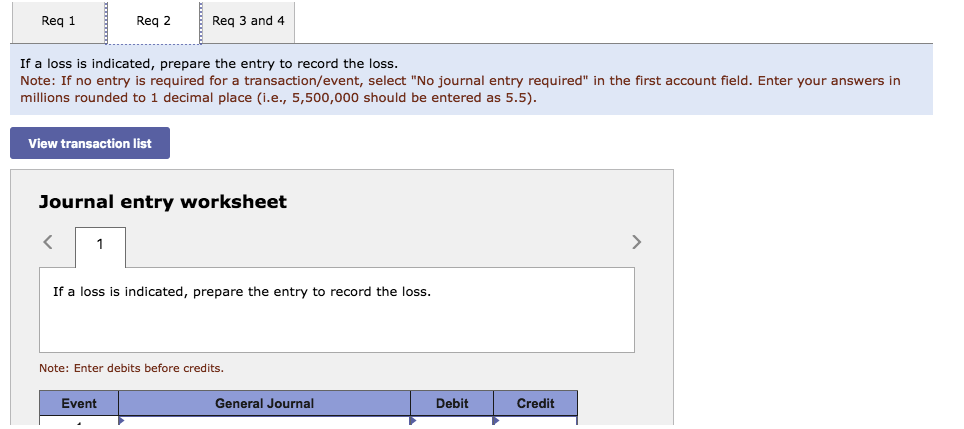

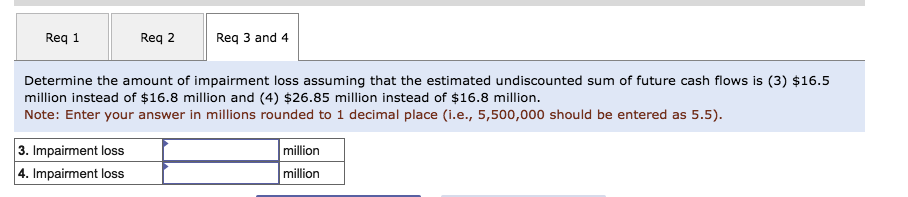

Janes Company provided the following information on intangible assets: a. A patent was purchased from the Lou Company for $1,550,000 on January 1,2022 . Janes estimated the remaining useful life of the patent to be 10 years. The patent was carried on Lou's accounting records at a net book value of $520,000 when Lou sold it to Janes. b. During 2024, a franchise was purchased from the Rink Company for $670,000. The contractual life of the franchise is 10 years and Janes records a full year of amortization in the year of purchase. c. Janes incurred research and development costs in 2024 as follows: d. Effective January 1, 2024, based on new events that have occurred, Janes estimates that the remaining life of the patent purchased from Lou is only five more years. Required: 1. Prepare the entries necessary for years 2022 through 2024 to reflect the above information. 2. Prepare a schedule showing the intangible asset section of Janes's December 31,2024 , balance sheet. Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a schedule showing the intangible asset section of Janes's December 31,2024 , balance sheet General Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for the product manufactured at the Arizona site, an impairment test is deemed appropriate. Management has acquired the following information for the assets at the plant: Cost Accumulated depreciation General's estimate of the total cash flows to be generated by selling the products manufactured at its Arizona plant, not discounted to present value $41.5 million $15.1 million $16.8 milion The fair value of the Arizona plant is estimated to be $15.5 million. Required: 1. Determine the amount of impairment loss. 2. If a loss is indicated, prepare the entry to record the loss. 3. \& 4. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $16.5 million instead of $16.8 million and (4) $26.85 million instead of $16.8 million. Determine the amount of impairment loss. Note: Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). If a loss is indicated, prepare the entry to record the loss. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Journal entry worksheet Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $16.5 million instead of $16.8 million and (4) $26.85 million instead of $16.8 million. Note: Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5)

Janes Company provided the following information on intangible assets: a. A patent was purchased from the Lou Company for $1,550,000 on January 1,2022 . Janes estimated the remaining useful life of the patent to be 10 years. The patent was carried on Lou's accounting records at a net book value of $520,000 when Lou sold it to Janes. b. During 2024, a franchise was purchased from the Rink Company for $670,000. The contractual life of the franchise is 10 years and Janes records a full year of amortization in the year of purchase. c. Janes incurred research and development costs in 2024 as follows: d. Effective January 1, 2024, based on new events that have occurred, Janes estimates that the remaining life of the patent purchased from Lou is only five more years. Required: 1. Prepare the entries necessary for years 2022 through 2024 to reflect the above information. 2. Prepare a schedule showing the intangible asset section of Janes's December 31,2024 , balance sheet. Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a schedule showing the intangible asset section of Janes's December 31,2024 , balance sheet General Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for the product manufactured at the Arizona site, an impairment test is deemed appropriate. Management has acquired the following information for the assets at the plant: Cost Accumulated depreciation General's estimate of the total cash flows to be generated by selling the products manufactured at its Arizona plant, not discounted to present value $41.5 million $15.1 million $16.8 milion The fair value of the Arizona plant is estimated to be $15.5 million. Required: 1. Determine the amount of impairment loss. 2. If a loss is indicated, prepare the entry to record the loss. 3. \& 4. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $16.5 million instead of $16.8 million and (4) $26.85 million instead of $16.8 million. Determine the amount of impairment loss. Note: Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). If a loss is indicated, prepare the entry to record the loss. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Journal entry worksheet Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $16.5 million instead of $16.8 million and (4) $26.85 million instead of $16.8 million. Note: Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started