Question

Janet Ludlow is a recently hired analyst. After describing the electric toothbrush industry, her first report focuses on two companies, QuickBrush Company and SmileWhite Corporation,

- Janet Ludlow is a recently hired analyst. After describing the electric toothbrush industry, her first report focuses on two companies, QuickBrush Company and SmileWhite Corporation, and concludes:

QuickBrush is a more profitable company than SmileWhite, as indicated by the 40% sales growth and substantially higher margins it has produced over the last few years. SmileWhites sales and earnings are growing at a 10% rate and produce much lower margins. We do not think SmileWhite is capable of growing faster than its recent growth rate of 10%, whereas QuickBrush can sustain a 30% long-term growth rate.

- Criticize Ludlows analysis and conclusion that QuickBrush is more profitable, as defined by return on equity (ROE), than SmileWhite and that it has a higher sustainable growth rate. Use only the information provided in Tables 1 and 2. Support your criticism by calculating and analyzing:

- The five components that determine ROE.

- The two ratios that determine sustainable growth: ROE and plowback.

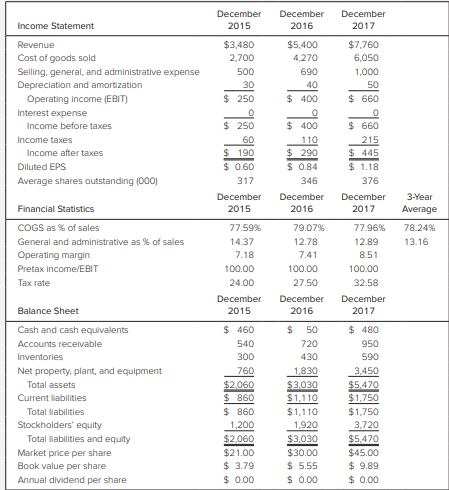

Table 1: QuickBrush Company financial statements: yearly data ($000 except per-share data)

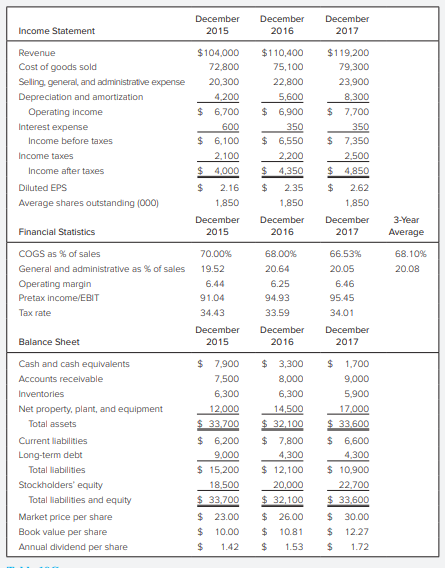

Table 2: SmileWhite Corporation financial statements: yearly data ($000 except per-share data)

- Explain how QuickBrush has produced an average annual earnings per share (EPS) growth rate of 40% over the last two years with an ROE that has been declining. Use only the information provided in Table 1.

- Now assume that you are the banker of both companies. Both companies have applied for a loan of $20 million short-term loan and $30 million long-term loan. Because of liquidity problem you can offer only $50 million loan either of the two companies. Which company do you prefer? Justify your choice by using information contained in the financial statements and calculating relevant ratios.

- Further assume that you are an independent financial analyst. Identify significant strength and weakness of both companies.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started