Question

Janice Tax, an accountant for Flee Corp., earned $122,700 from January to June. In July she earned $8,000. Assuming a FICA tax rate of

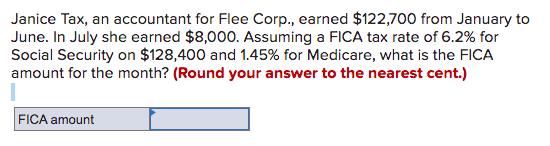

Janice Tax, an accountant for Flee Corp., earned $122,700 from January to June. In July she earned $8,000. Assuming a FICA tax rate of 6.2% for Social Security on $128,400 and 1.45% for Medicare, what is the FICA amount for the month? (Round your answer to the nearest cent.) FICA amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating FICA Tax for Janice in July Heres how to calculate the FICA tax for Janice in July Socia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To AccountingAn Integrated Approach

Authors: Penne Ainsworth, Dan Deines

8th Edition

1119600103, 9781119600107

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App