Question

Janine is 55 and has a good job. She currently has $150,000 in a traditional IRA. She believes her IRA will grow at an annual

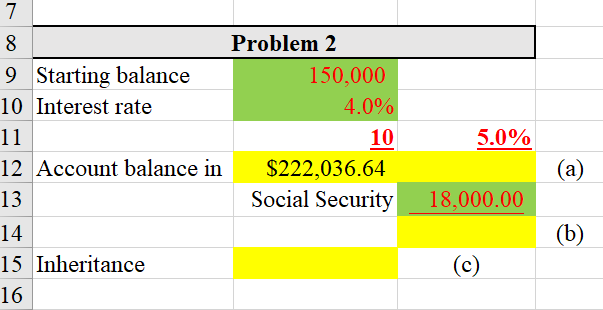

Janine is 55 and has a good job. She currently has $150,000 in a traditional IRA. She believes her IRA will grow at an annual rate of 4.0%. She estimates that she will need a annual income of $32,000 when she retires. She knows that to get that income, she should withdraw no more than 5% of her retirement savings (she plans to leave what's left over of her retirement account to her daughter as inheritance.) She expects Social Security to kick in $18,000 per year. Ignore taxes.

a) How much will her IRA be worth when she retires at 65? At 5%, how much can she take out of yearly for her expenses? I

b) How much income will she have per month if she combines the IRA withdrawals and Social Security?

c) Assuming she passes away at age 83, how much will her daughter inherit?

11 5.0% 7 8 Problem 2 9 Starting balance 150,000 10 Interest rate 4.0% 10 12 Account balance in $222,036.64 13 Social Security 14 15 Inheritance 16 (a) 18,000.00 (b) (c)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started