Question

January 2: Filed articles of incorporation with the state and issued 100,000 shares of capital stock. Cash of $100,000 is received from the new owners

January 2: Filed articles of incorporation with the state and issued 100,000 shares of capital stock. Cash of $100,000 is received from the new owners for the shares.

January 3: Purchased a warehouse and land for $79,000 in cash. An appraiser values the land at $20,000 and the warehouse at $59,000. If an amount box does not require an entry, leave it blank.

January 4: Signed a three-year promissory note at Third State Bank in the amount of $49,000.

January 6: Purchased five new delivery trucks for a total of $45,000 in cash

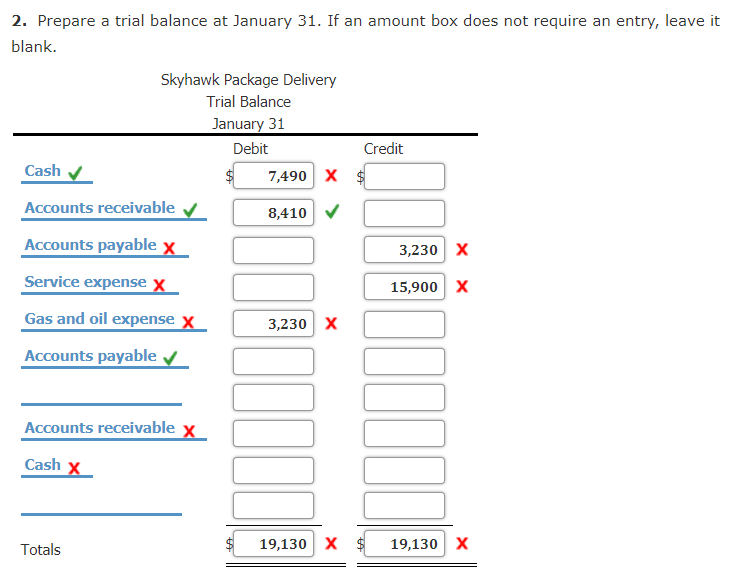

January 31: Performed services on account that amounted to $15,900 during the month.

January 31: Cash amounting to $7,490 was received from customers on account during the month.

January 31: Established an open account at a local service station at the beginning of the month. Purchases of gas and oil during January amounted to $3,230. Skyhawk has until the 10th of the following month to pay its bill.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started