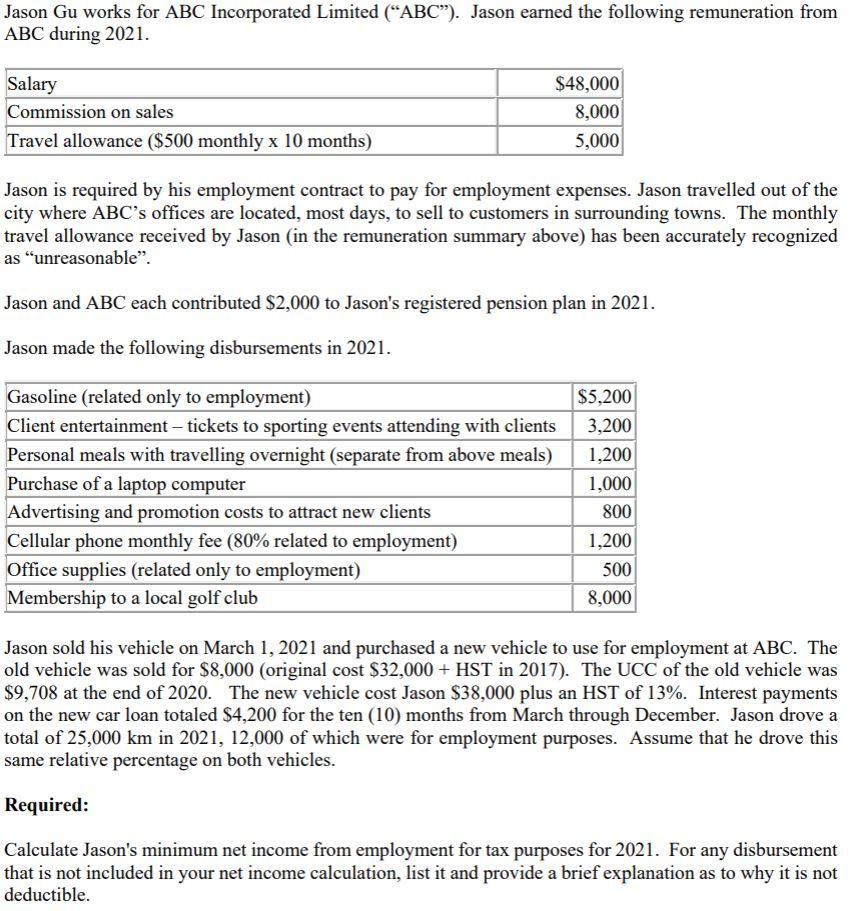

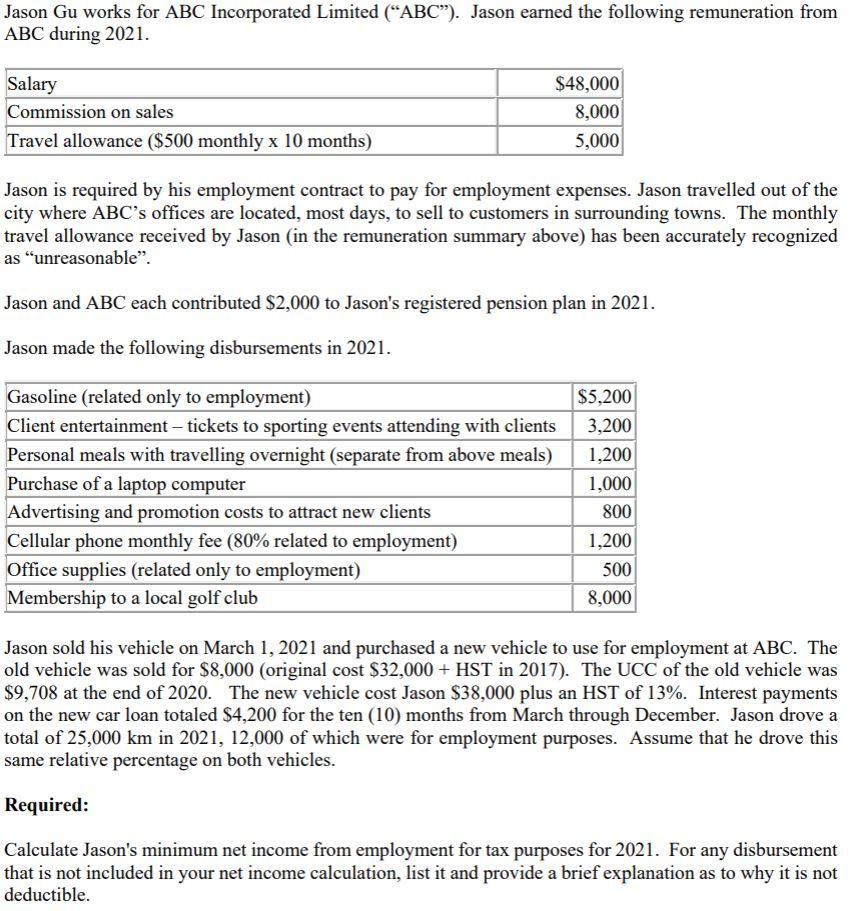

Jason Gu works for ABC Incorporated Limited ("ABC"). Jason earned the following remuneration from ABC during 2021. Salary Commission on sales Travel allowance ($500 monthly x 10 months) $48,000 8,000 5,000 Jason is required by his employment contract to pay for employment expenses. Jason travelled out of the city where ABC's offices are located, most days, to sell to customers in surrounding towns. The monthly travel allowance received by Jason (in the remuneration summary above) has been accurately recognized as "unreasonable". Jason and ABC each contributed $2,000 to Jason's registered pension plan in 2021. Jason made the following disbursements in 2021. Gasoline (related only to employment) Client entertainment - tickets to sporting events attending with clients Personal meals with travelling overnight (separate from above meals) Purchase of a laptop computer Advertising and promotion costs to attract new clients Cellular phone monthly fee (80% related to employment) Office supplies (related only to employment) Membership to a local golf club $5,200 3,200 1,200 1,000 800 1,200 500 8,000 Jason sold his vehicle on March 1, 2021 and purchased a new vehicle to use for employment at ABC. The old vehicle was sold for $8,000 (original cost $32,000 + HST in 2017). The UCC of the old vehicle was $9,708 at the end of 2020. The new vehicle cost Jason $38,000 plus an HST of 13%. Interest payments on the new car loan totaled $4,200 for the ten (10) months from March through December. Jason drove a total of 25,000 km in 2021, 12,000 of which were for employment purposes. Assume that he drove this same relative percentage on both vehicles. Required: Calculate Jason's minimum net income from employment for tax purposes for 2021. For any disbursement that is not included in your net income calculation, list it and provide a brief explanation as to why it is not deductible. Jason Gu works for ABC Incorporated Limited ("ABC"). Jason earned the following remuneration from ABC during 2021. Salary Commission on sales Travel allowance ($500 monthly x 10 months) $48,000 8,000 5,000 Jason is required by his employment contract to pay for employment expenses. Jason travelled out of the city where ABC's offices are located, most days, to sell to customers in surrounding towns. The monthly travel allowance received by Jason (in the remuneration summary above) has been accurately recognized as "unreasonable". Jason and ABC each contributed $2,000 to Jason's registered pension plan in 2021. Jason made the following disbursements in 2021. Gasoline (related only to employment) Client entertainment - tickets to sporting events attending with clients Personal meals with travelling overnight (separate from above meals) Purchase of a laptop computer Advertising and promotion costs to attract new clients Cellular phone monthly fee (80% related to employment) Office supplies (related only to employment) Membership to a local golf club $5,200 3,200 1,200 1,000 800 1,200 500 8,000 Jason sold his vehicle on March 1, 2021 and purchased a new vehicle to use for employment at ABC. The old vehicle was sold for $8,000 (original cost $32,000 + HST in 2017). The UCC of the old vehicle was $9,708 at the end of 2020. The new vehicle cost Jason $38,000 plus an HST of 13%. Interest payments on the new car loan totaled $4,200 for the ten (10) months from March through December. Jason drove a total of 25,000 km in 2021, 12,000 of which were for employment purposes. Assume that he drove this same relative percentage on both vehicles. Required: Calculate Jason's minimum net income from employment for tax purposes for 2021. For any disbursement that is not included in your net income calculation, list it and provide a brief explanation as to why it is not deductible