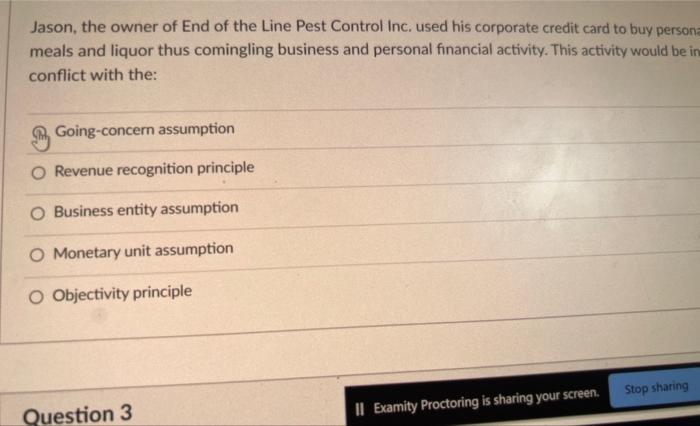

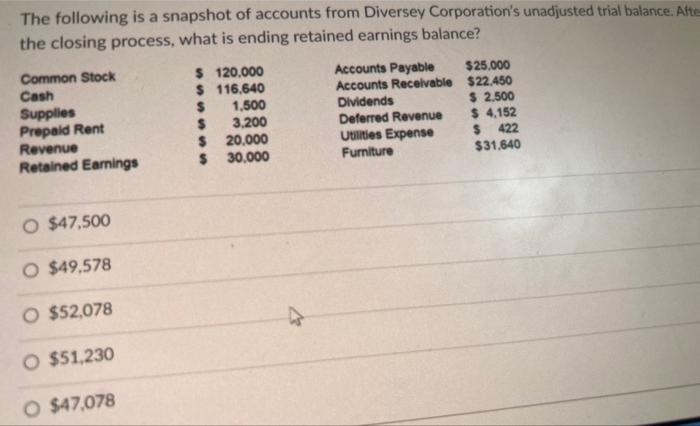

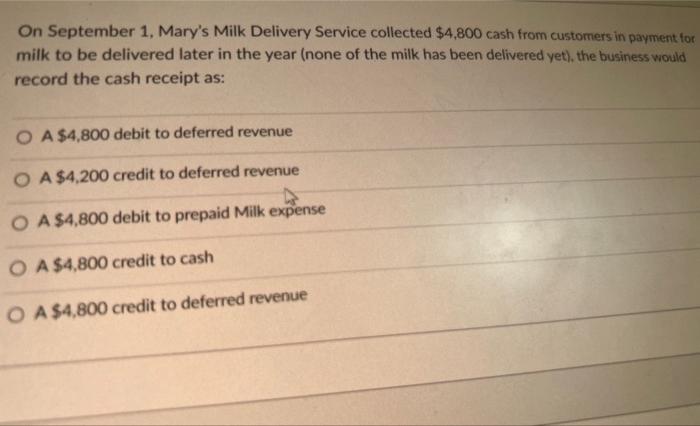

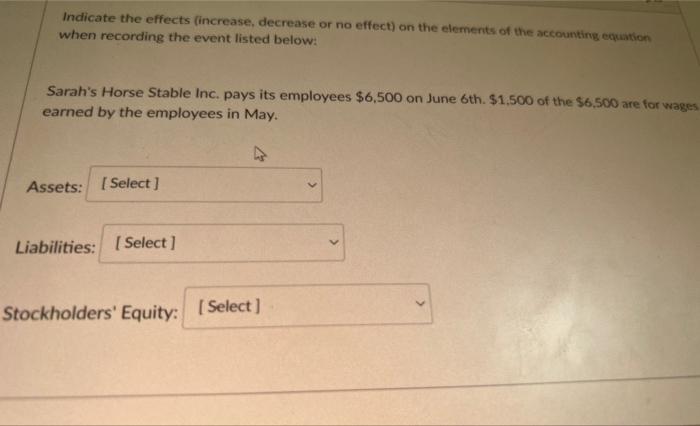

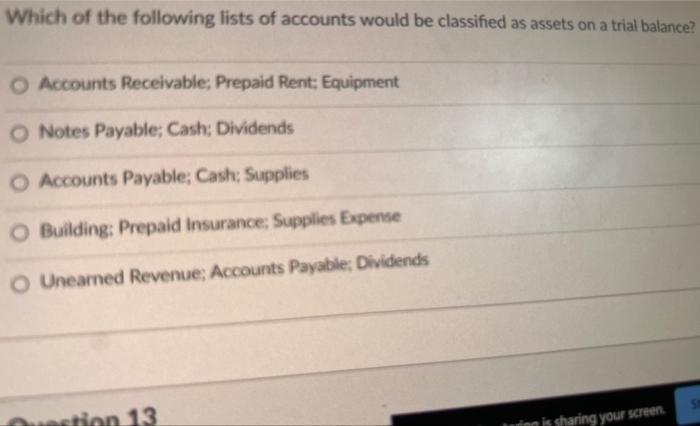

Jason, the owner of End of the Line Pest Control Inc. used his corporate credit card to buy persona meals and liquor thus comingling business and personal financial activity. This activity would be in conflict with the: Going-concern assumption Revenue recognition principle Business entity assumption Monetary unit assumption Objectivity principle The following is a snapshot of accounts from Diversey Corporation's unadjusted trial balance. Afte the closing process, what is ending retained earnings balance? $47,500 $49,578 $52,078 $51,230 $47,078 On September 1, Mary's Milk Delivery Service collected $4,800 cash from customers in payment for milk to be delivered later in the year (none of the milk has been delivered yet), the business would record the cash receipt as: A $4,800 debit to deferred revenue A $4,200 credit to deferred revenue A $4,800 debit to prepaid Milk expense A $4,800 credit to cash A $4,800 credit to deferred revenue Indicate the effects (increase, decrease or no effect) on the elements of the accounting equation when recording the event listed below: Sarah's Horse Stable Inc. pays its employees $6,500 on June 6th. $1,500 of the $6,500 are for wages earned by the employees in May. Assets: Liabilities: ockholders' Equity: Which of the following lists of accounts would be classified as assets on a trial balance? Accounts Receivable; Prepaid Rent; Equipment Notes Payable; Cash; Dividends Accounts Payable; Cash: Supplies Building: Prepaid Insurance: Supplies Expense Uneamed Revenue; Accounts Payable: Dividends Jason, the owner of End of the Line Pest Control Inc. used his corporate credit card to buy persona meals and liquor thus comingling business and personal financial activity. This activity would be in conflict with the: Going-concern assumption Revenue recognition principle Business entity assumption Monetary unit assumption Objectivity principle The following is a snapshot of accounts from Diversey Corporation's unadjusted trial balance. Afte the closing process, what is ending retained earnings balance? $47,500 $49,578 $52,078 $51,230 $47,078 On September 1, Mary's Milk Delivery Service collected $4,800 cash from customers in payment for milk to be delivered later in the year (none of the milk has been delivered yet), the business would record the cash receipt as: A $4,800 debit to deferred revenue A $4,200 credit to deferred revenue A $4,800 debit to prepaid Milk expense A $4,800 credit to cash A $4,800 credit to deferred revenue Indicate the effects (increase, decrease or no effect) on the elements of the accounting equation when recording the event listed below: Sarah's Horse Stable Inc. pays its employees $6,500 on June 6th. $1,500 of the $6,500 are for wages earned by the employees in May. Assets: Liabilities: ockholders' Equity: Which of the following lists of accounts would be classified as assets on a trial balance? Accounts Receivable; Prepaid Rent; Equipment Notes Payable; Cash; Dividends Accounts Payable; Cash: Supplies Building: Prepaid Insurance: Supplies Expense Uneamed Revenue; Accounts Payable: Dividends