Question

Javier Arino is a senior manager with the North American group of Cortez Products. He has just received the financial information he requested about a

Javier Arino is a senior manager with the North American group of Cortez Products. He has just received the financial information he requested about a new product proposal from one of his division managers. The product, which goes under the code name Caliente-X, has undergone market research nests and the division manager is excited about its potential, Javier asked for and received the following information:

The company believes that the product's life cycle is only four years. That is, the firm will consider only cash flows in the next four years.

The project requires an initial cash investment outlay of $10 million, which will be depreciated on a straight line basis over the next years.

The project will require an initial net working capital outlay of $200,000 which can be recovered at the end of the project.

The firm's marginal tax rate it 40 percent; the cost of capital is 16 percent.

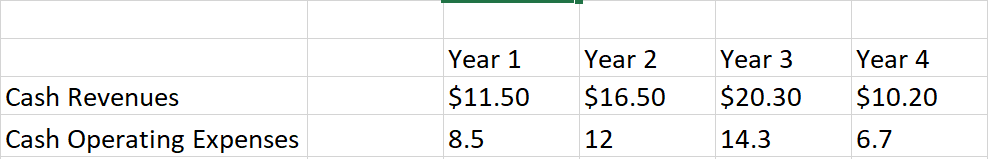

Cash revenues and cash operating expenses for the next four years are expected to be (in millions of dollars):

Questions:

1. Suppose the opportunity cost of capital for new product introductions at Cortez Products is 16 percent. What is the NPV of Caliente-X?

2. What is the IRR on the Caliente-X investment proposal?

3. What is the MIRR?

4. What is the payback period for Caliente-X?

5. Should Javier accept the project?

6. Suppose Cortex Products has 1 million shares of outstanding common stock. If Javier decides to go ahead with Caliente-X, what should happen to the per share market price of Cortes Products when the project is announced to the public?

Year 1 $11.50 Year 2 $16.50 Year 3 $20.30 Year 4 $10.20 Cash Revenues Cash Operating Expenses 8.5 12 14.3 6.7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started