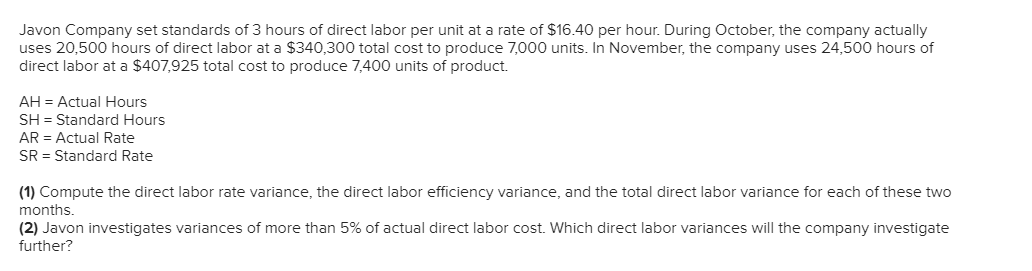

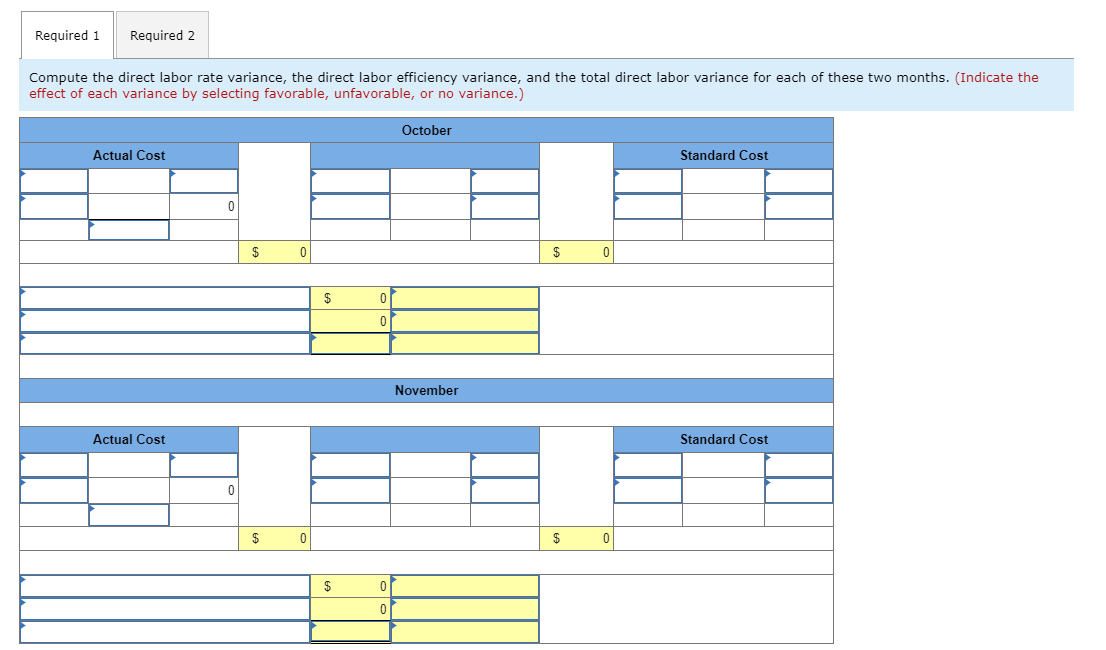

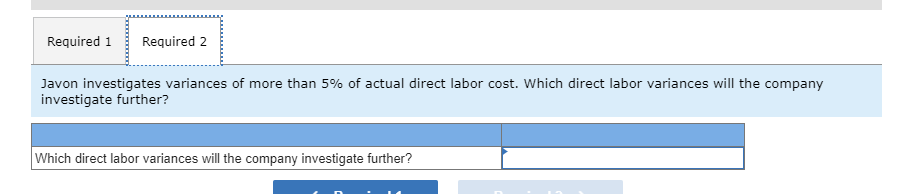

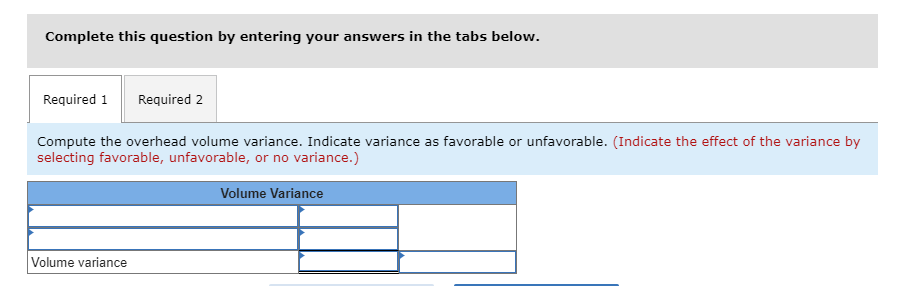

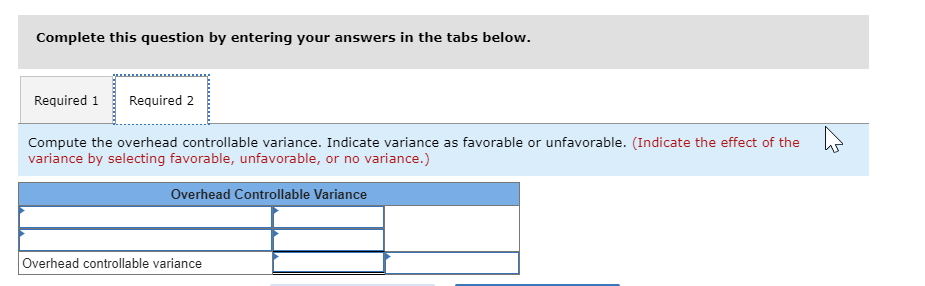

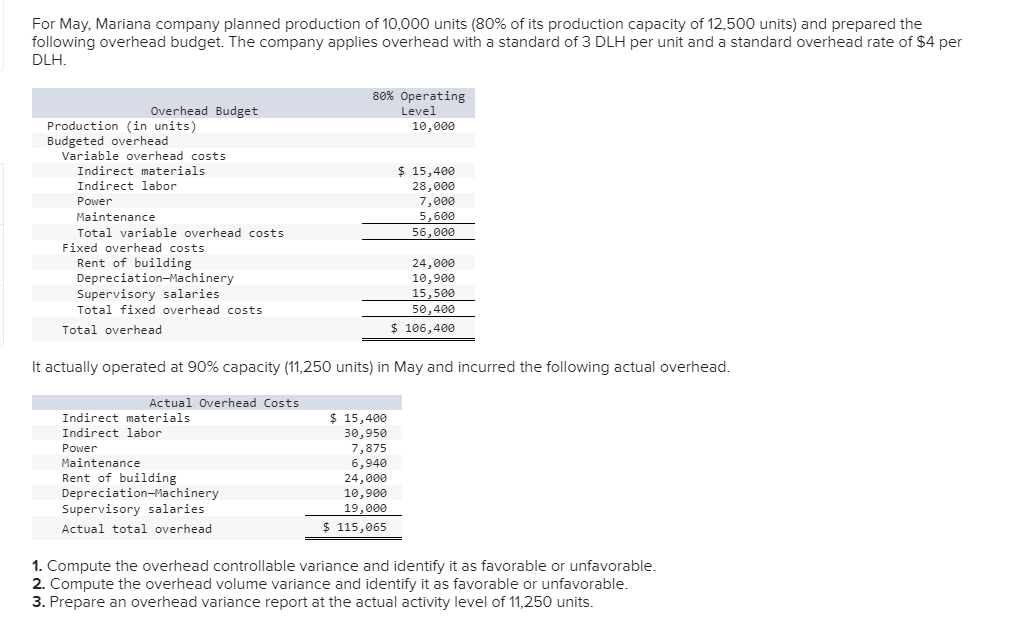

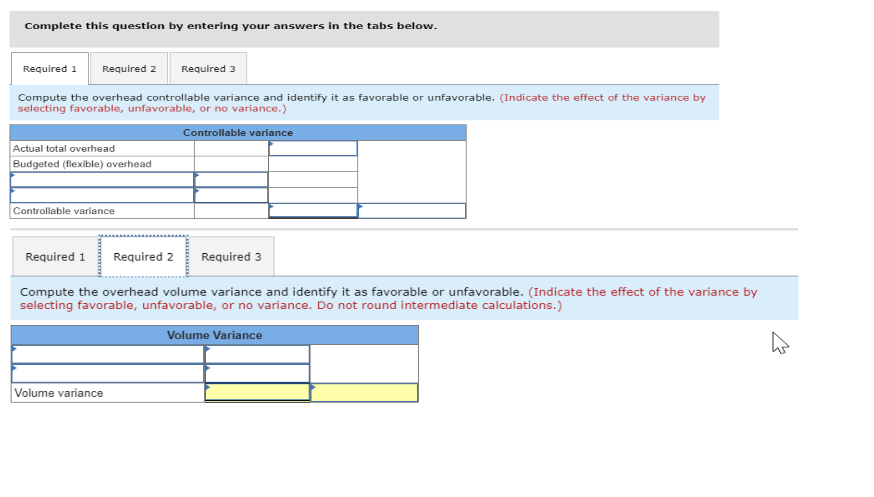

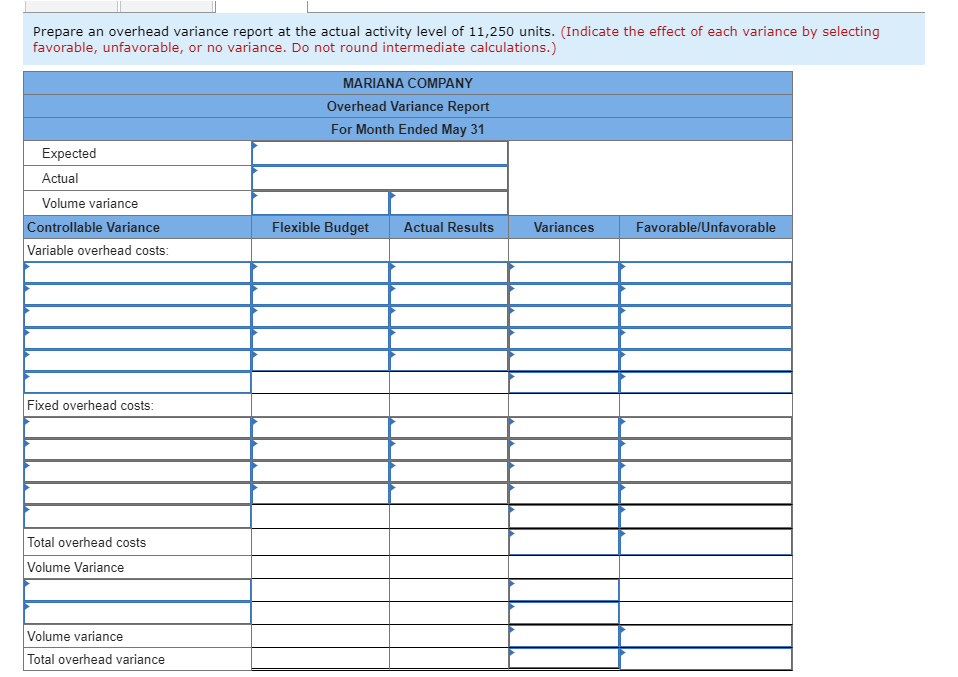

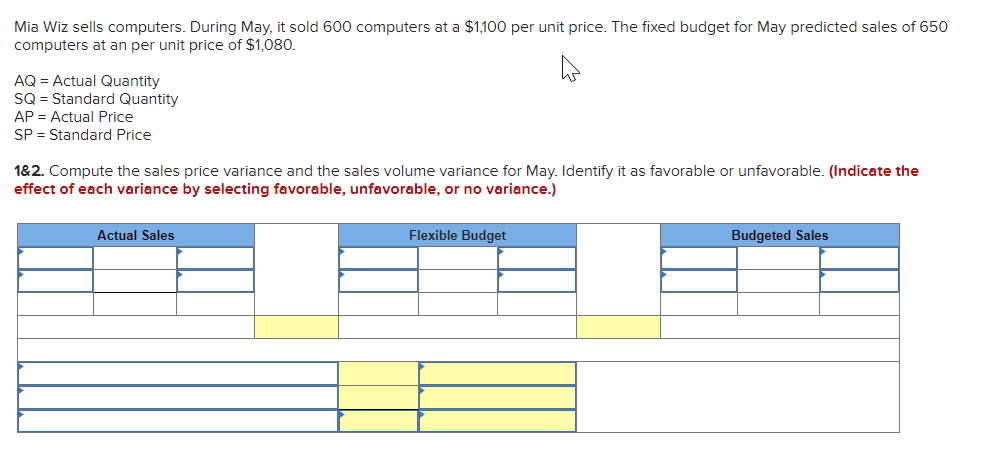

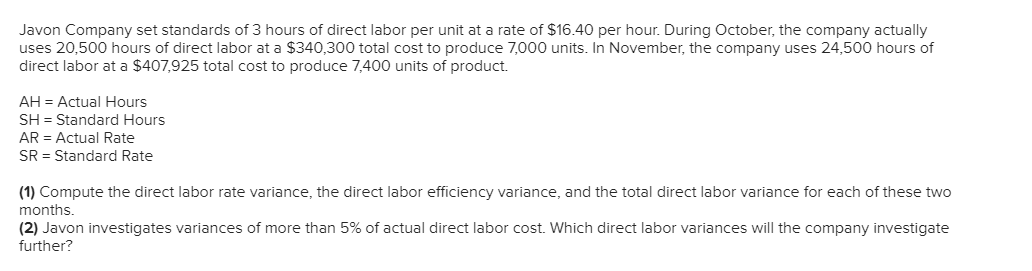

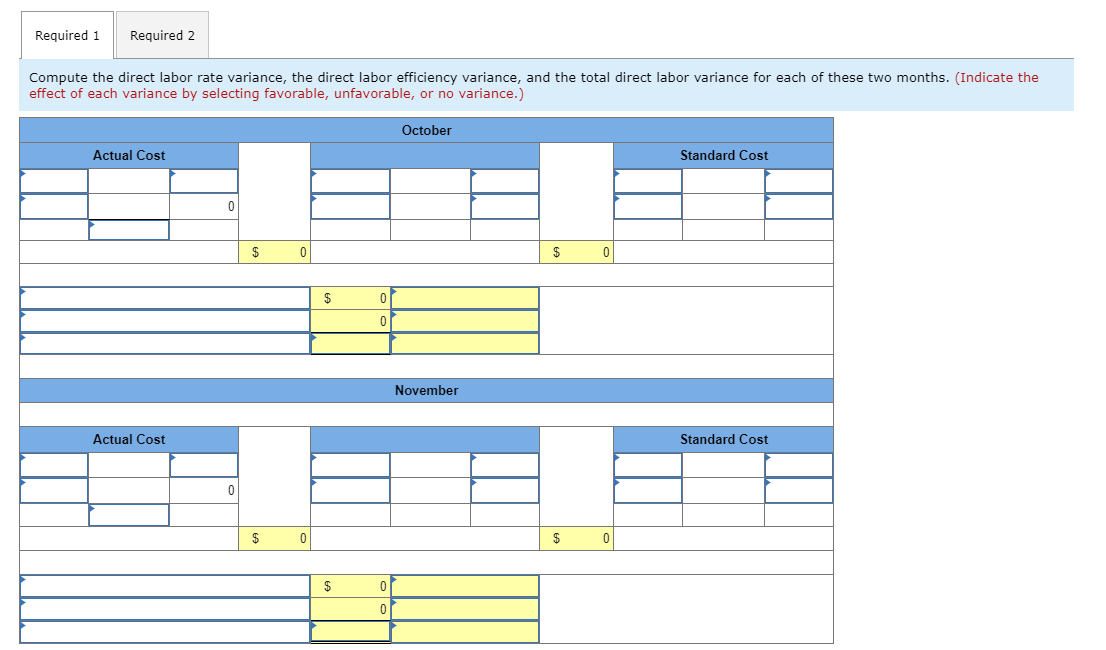

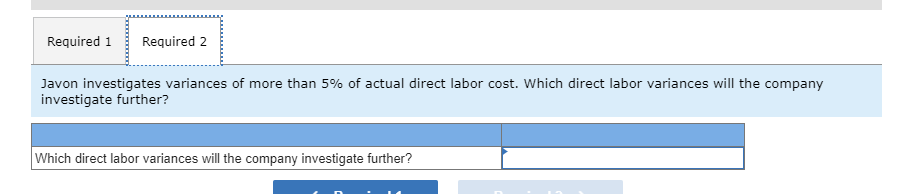

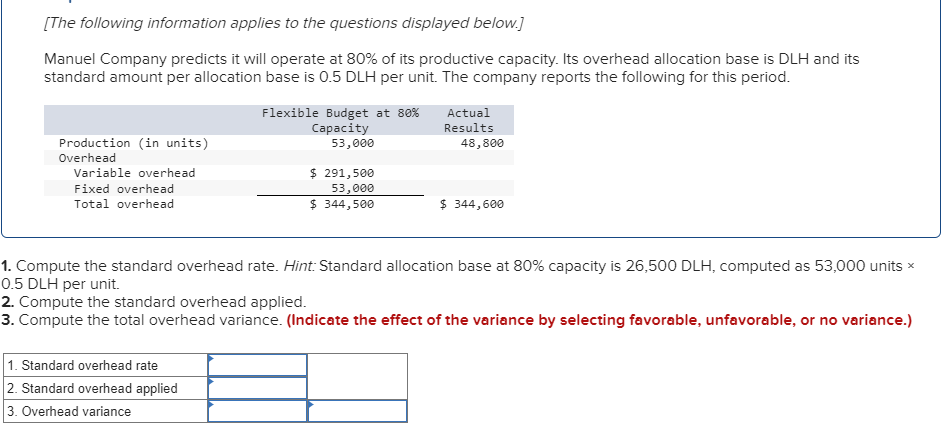

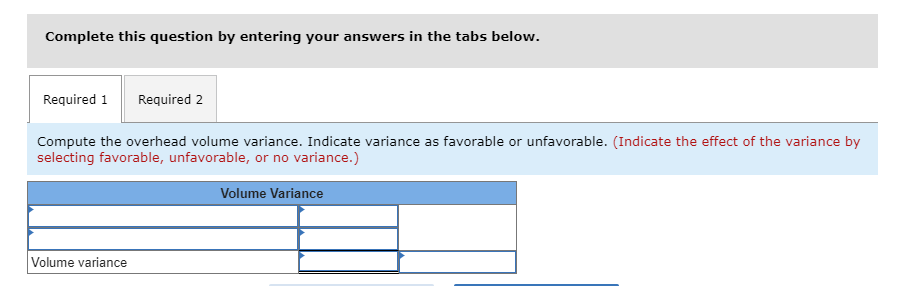

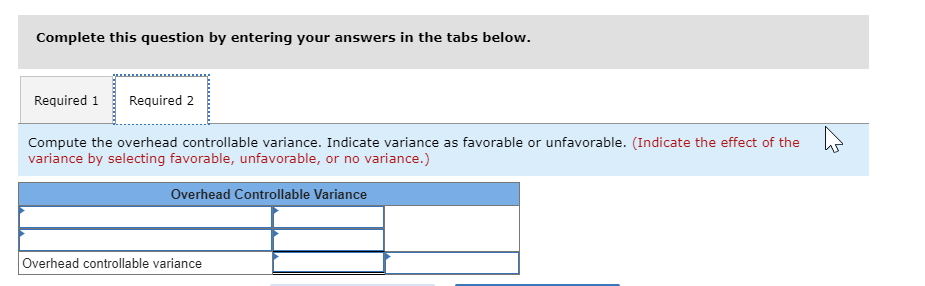

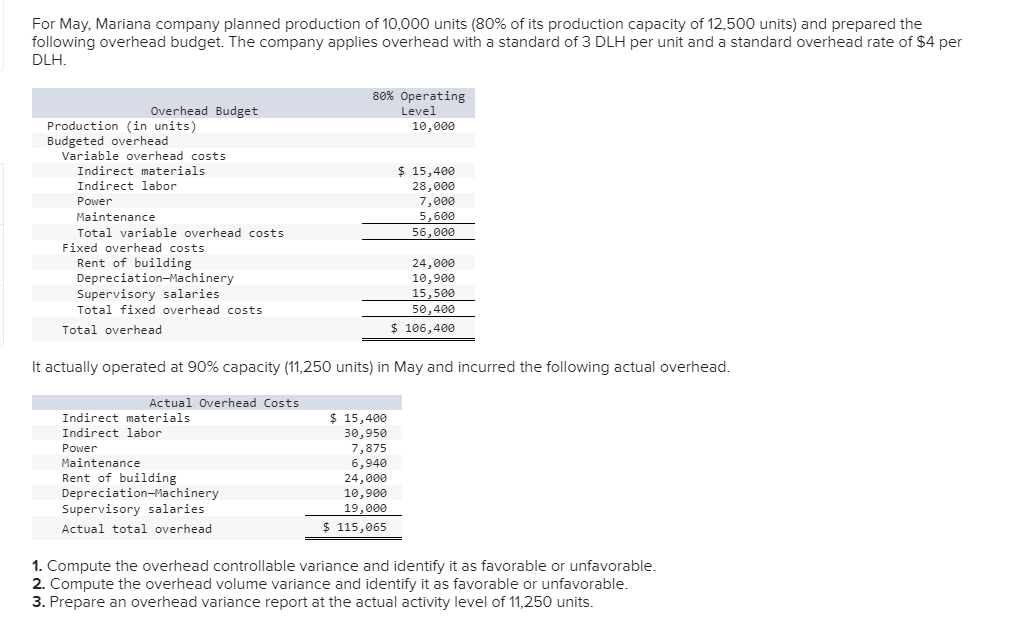

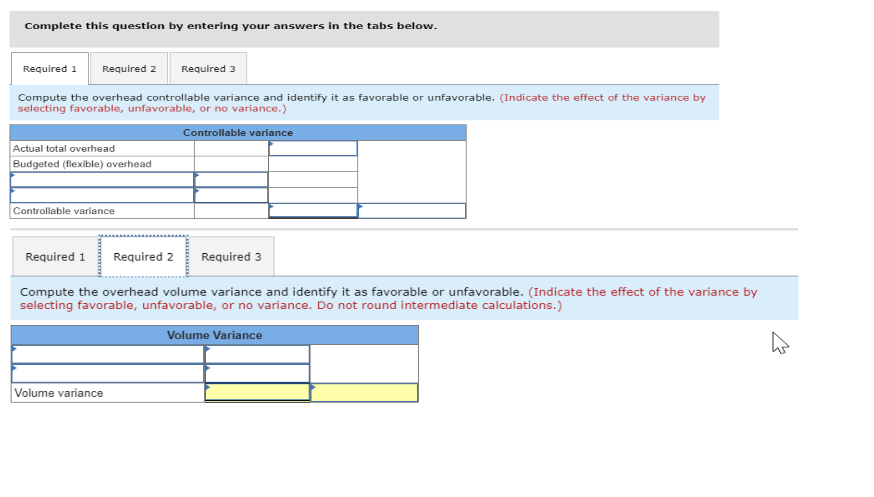

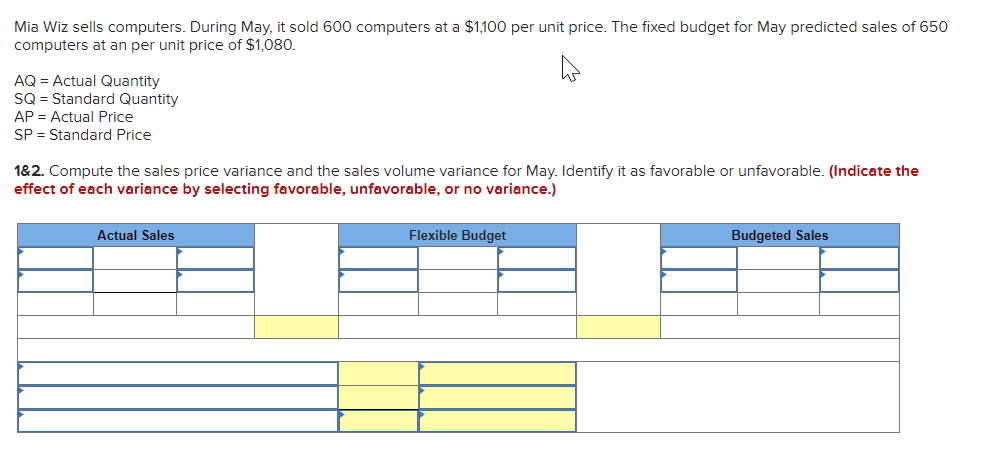

Javon Company set standards of 3 hours of direct labor per unit at a rate of $16.40 per hour. During October, the company actually uses 20,500 hours of direct labor at a $340,300 total cost to produce 7,000 units. In November, the company uses 24,500 hours of direct labor at a $407,925 total cost to produce 7,400 units of product. AH = Actual Hours SH = Standard Hours AR = Actual Rate SR = Standard Rate (1) Compute the direct labor rate variance, the direct labor efficiency variance, and the total direct labor variance for each of these two months. (2) Javon investigates variances of more than 5% of actual direct labor cost. Which direct labor variances will the company investigate further? Required 1 Required 2 Compute the direct labor rate variance, the direct labor efficiency variance, and the total direct labor variance for each of these two months. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) October Actual Cost Standard Cost 0 $ 0 $ 0 $ 0 November Actual Cost Standard Cost 0 $ 0 $ 0 $ 0 Required 1 Required 2 Javon investigates variances of more than 5% of actual direct labor cost. Which direct labor variances will the company investigate further? Which direct labor variances will the company investigate further? [The following information applies to the questions displayed below.) Manuel Company predicts it will operate at 80% of its productive capacity. Its overhead allocation base is DLH and its standard amount per allocation base is 0.5 DLH per unit. The company reports the following for this period. Flexible Budget at 80% Capacity 53,000 Actual Results 48,800 Production (in units) Overhead Variable overhead Fixed overhead Total overhead $ 291,500 53,000 $ 344,500 $ 344,600 1. Compute the standard overhead rate. Hint: Standard allocation base at 80% capacity is 26,500 DLH, computed as 53,000 units 0.5 DLH per unit. 2. Compute the standard overhead applied. 3. Compute the total overhead variance. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance.) 1. Standard overhead rate 2. Standard overhead applied 3. Overhead variance Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the overhead volume variance. Indicate variance as favorable or unfavorable. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance.) Volume Variance Volume variance Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the overhead controllable variance. Indicate variance as favorable or unfavorable. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance.) ho Overhead Controllable Variance Overhead controllable variance For May, Mariana company planned production of 10,000 units (80% of its production capacity of 12,500 units) and prepared the following overhead budget. The company applies overhead with a standard of 3 DLH per unit and a standard overhead rate of $4 per DLH. 80% Operating Level 10,000 Overhead Budget Production (in units) Budgeted overhead Variable overhead costs Indirect materials Indirect labor Power Maintenance Total variable overhead costs Fixed overhead costs Rent of building Depreciation-Machinery Supervisory salaries Total fixed overhead costs Total overhead $ 15,400 28,000 7,000 5,600 56,000 24,000 10,900 15,500 50,400 $ 106,400 It actually operated at 90% capacity (11,250 units) in May and incurred the following actual overhead. Actual Overhead Costs Indirect materials Indirect labor Power Maintenance Rent of building Depreciation-Machinery Supervisory salaries Actual total overhead $ 15,400 30,950 7,875 6,940 24,000 10,900 19,000 $ 115,065 1. Compute the overhead controllable variance and identify it as favorable or unfavorable. 2. Compute the overhead volume variance and identify it as favorable or unfavorable. 3. Prepare an overhead variance report at the actual activity level of 11,250 units. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the overhead controllable variance and identify it as favorable or unfavorable. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance.) Controllable variance Actual total overhead Budgeted (flexible) overhead Controllable variance Required 1 Required 2 Required 3 Compute the overhead volume variance and identify it as favorable or unfavorable. (Indicate the effect of the variance by selecting favorable, unfavorable, or no variance. Do not round intermediate calculations.) Volume Variance ho Volume variance Prepare an overhead variance report at the actual activity level of 11,250 units. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Do not round intermediate calculations.) MARIANA COMPANY Overhead Variance Report For Month Ended May 31 Expected Actual Volume variance Controllable Variance Variable overhead costs: Flexible Budget Actual Results Variances Favorable/Unfavorable Fixed overhead costs: Total overhead costs Volume Variance Volume variance Total overhead variance Mia Wiz sells computers. During May, it sold 600 computers at a $1,100 per unit price. The fixed budget for May predicted sales of 650 computers at an per unit price of $1,080. W AQ = Actual Quantity SQ = Standard Quantity AP = Actual Price SP = Standard Price 1&2. Compute the sales price variance and the sales volume variance for May. Identify it as favorable or unfavorable. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.) Actual Sales Flexible Budget Budgeted Sales