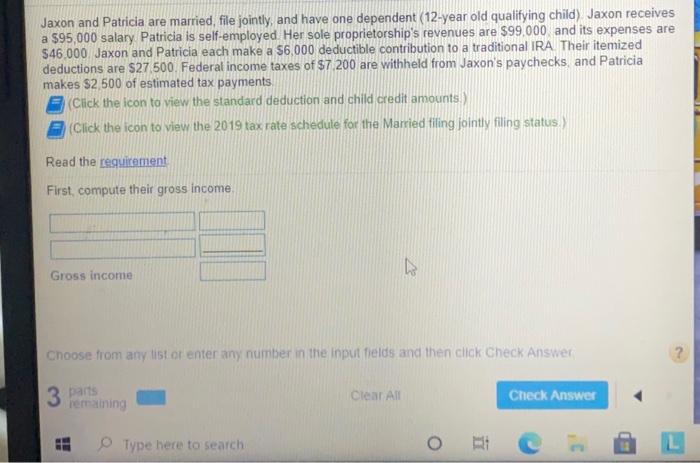

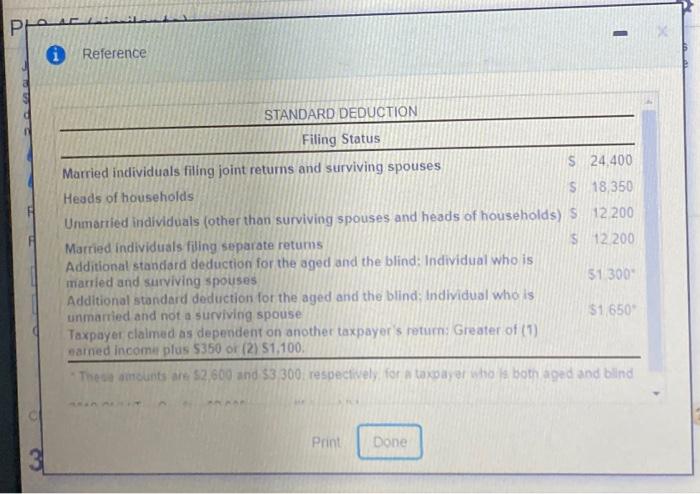

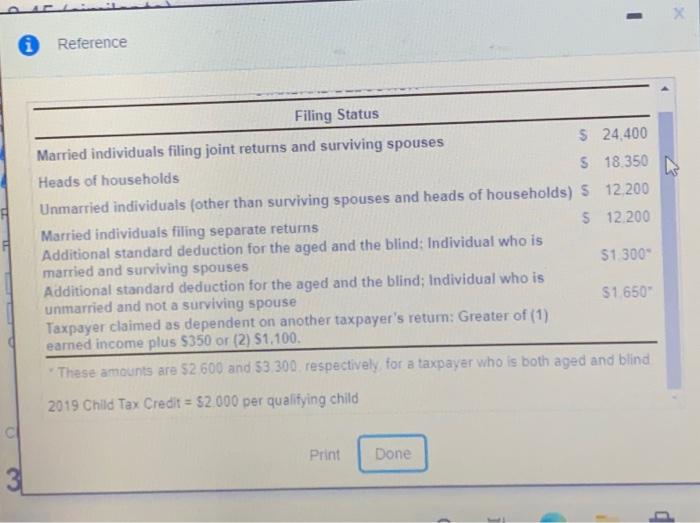

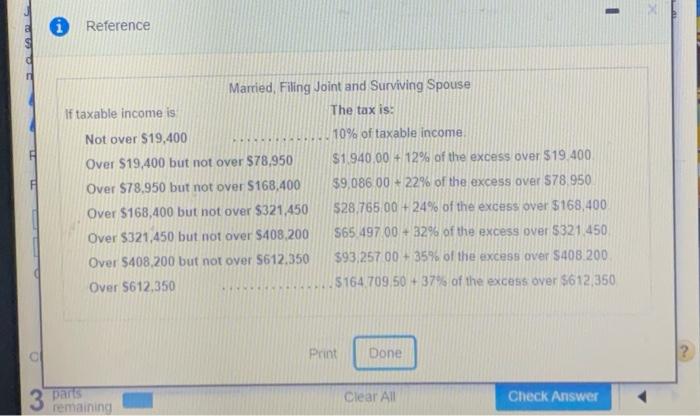

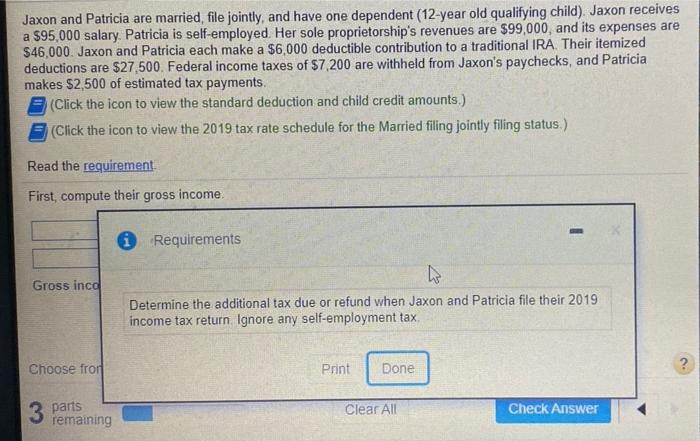

Jaxon and Patricia are married, file jointly, and have one dependent (12-year old qualifying child) Jaxon receives a $95,000 salary Patricia is self-employed Her sole proprietorship's revenues are $99,000 and its expenses are $46.000 Jaxon and Patricia each make a $6,000 deductible contribution to a traditional IRA Their itemized deductions are $27.500. Federal income taxes of $7 200 are withheld from Jaxon's paychecks and Patricia makes $2.500 of estimated tax payments (Click the icon to view the standard deduction and child credit amounts (Click the icon to view the 2019 tax rate schedule for the Married filing jointly filing status Read the requirement First, compute their gross income Gross income Choose from any list of enter any number in the input fields and then click Check Answer 3 par Clear All Check Answer remaining Type here to search oc PHA 4 - Reference STANDARD DEDUCTION Filing Status Married individuals filing joint returns and surviving spouses S 24 400 Heads of households S18,350 Unmarried individuals (other than surviving spouses and heads of households) S. 12 200 Married individuals filing separate retums S 12.200 Additional standard deduction for the aged and the blind: Individual who is married and surviving spouses 51 300 Additional standard deduction for the aged and the blind: Individual who is unmarried and not a surviving spouse $1,650 Taxpayer claimed as dependent on another taxpayer's retur: Greater of (1) earned income plus 5350 or (2) $1,100, The amounts are $2,600 and $3 300 respectively for a taxpayer who is both aged and blind Print Done Reference Filing Status Married individuals filing joint returns and surviving spouses $ 24,400 Heads of households S 18.350 Unmarried individuals (other than surviving spouses and heads of households) 5 12.200 Married individuais filing separate returns $ 12.200 Additional standard deduction for the aged and the blind: Individual who is married and surviving spouses 51 300 Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse $1650" Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) S1,100. These amounts are 52 600 and 53 300 respectively for a taxpayer who is both aged and blind 2019 Child Tax Credit = $2.000 per qualifying child Print Done - 0 Reference Married, Filing Joint and Surviving Spouse If taxable income is The tax is Not over $19,400 10% of taxable income Over $19,400 but not over $78,950 $1.940.00 + 12% of the excess over $19 400 Over $78.950 but not over $168.400 39,086 00 +22% of the excess over $78,950 Over $168,400 but not over $321.450 528.765.00 +24% of the excess over $168,400 Over $321,450 but not over $408.200 565 497 00 + 32% of the excess over $321,450 Over $408.200 but not over $612,350 $93,257 00 + 35% of the excess over $408.200 Over 5612,350 $164 709.50 +37% of the excess over $612,350 Print Done 3 parts Clear All Check Answer remaining Jaxon and Patricia are married, file jointly, and have one dependent (12-year old qualifying child). Jaxon receives a $95,000 salary. Patricia is self-employed. Her sole proprietorship's revenues are $99,000, and its expenses are $46,000. Jaxon and Patricia each make a $6,000 deductible contribution to a traditional IRA Their itemized deductions are $27.500. Federal income taxes of $7 200 are withheld from Jaxon's paychecks, and Patricia makes $2,500 of estimated tax payments. (Click the icon to view the standard deduction and child credit amounts.) (Click the icon to view the 2019 tax rate schedule for the Married filing jointly filing status.) Read the requirement First, compute their gross income. i Requirements Gross inca Determine the additional tax due or refund when Jaxon and Patricia file their 2019 income tax return Ignore any self-employment tax Choose fror Print Done 3 parts Clear All Check Answer remaining