Answered step by step

Verified Expert Solution

Question

1 Approved Answer

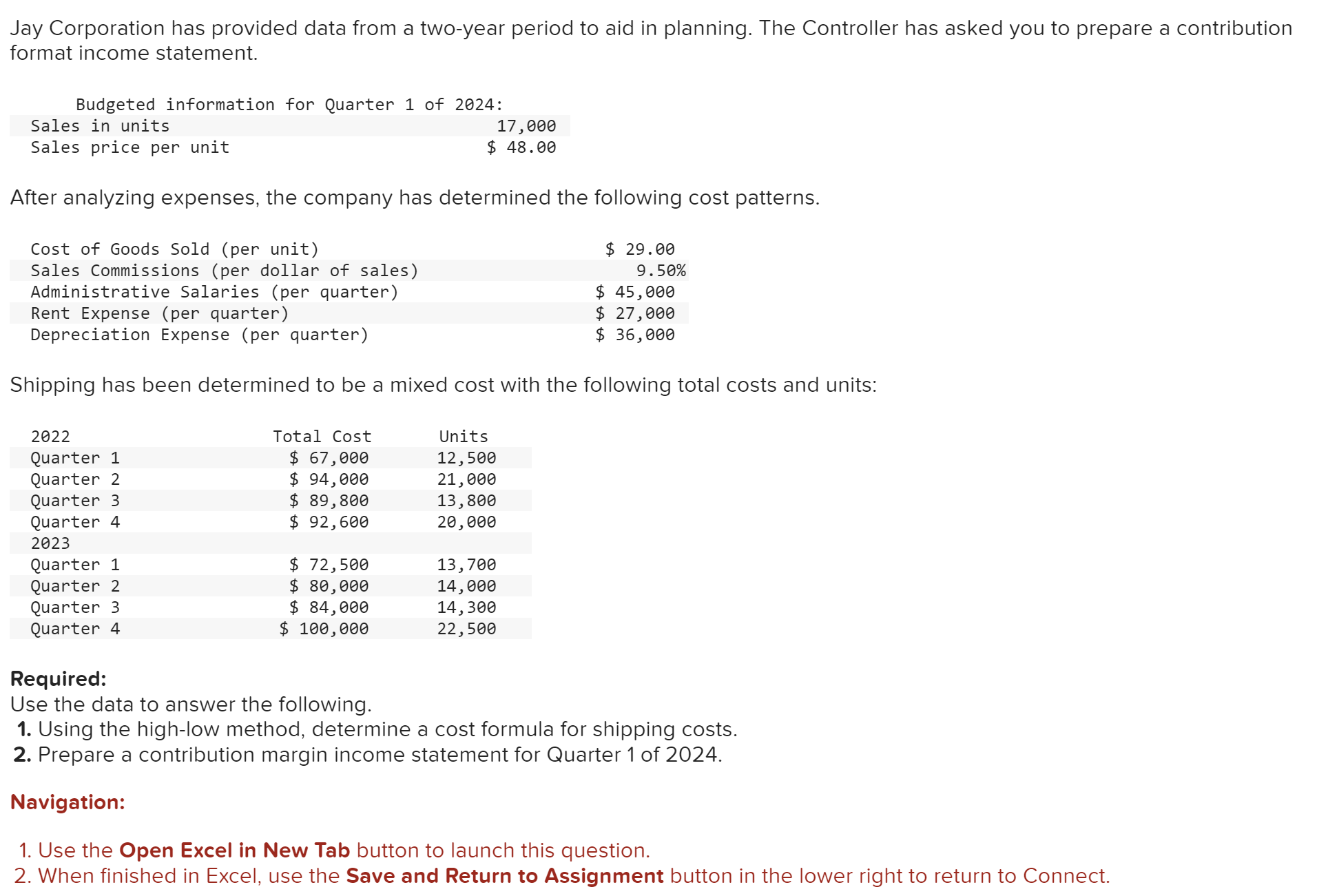

Jay Corporation has decided to prepare contribution income statements for internal planning. After analyzing expenses, the company has determined the following cost patterns. Shipping has

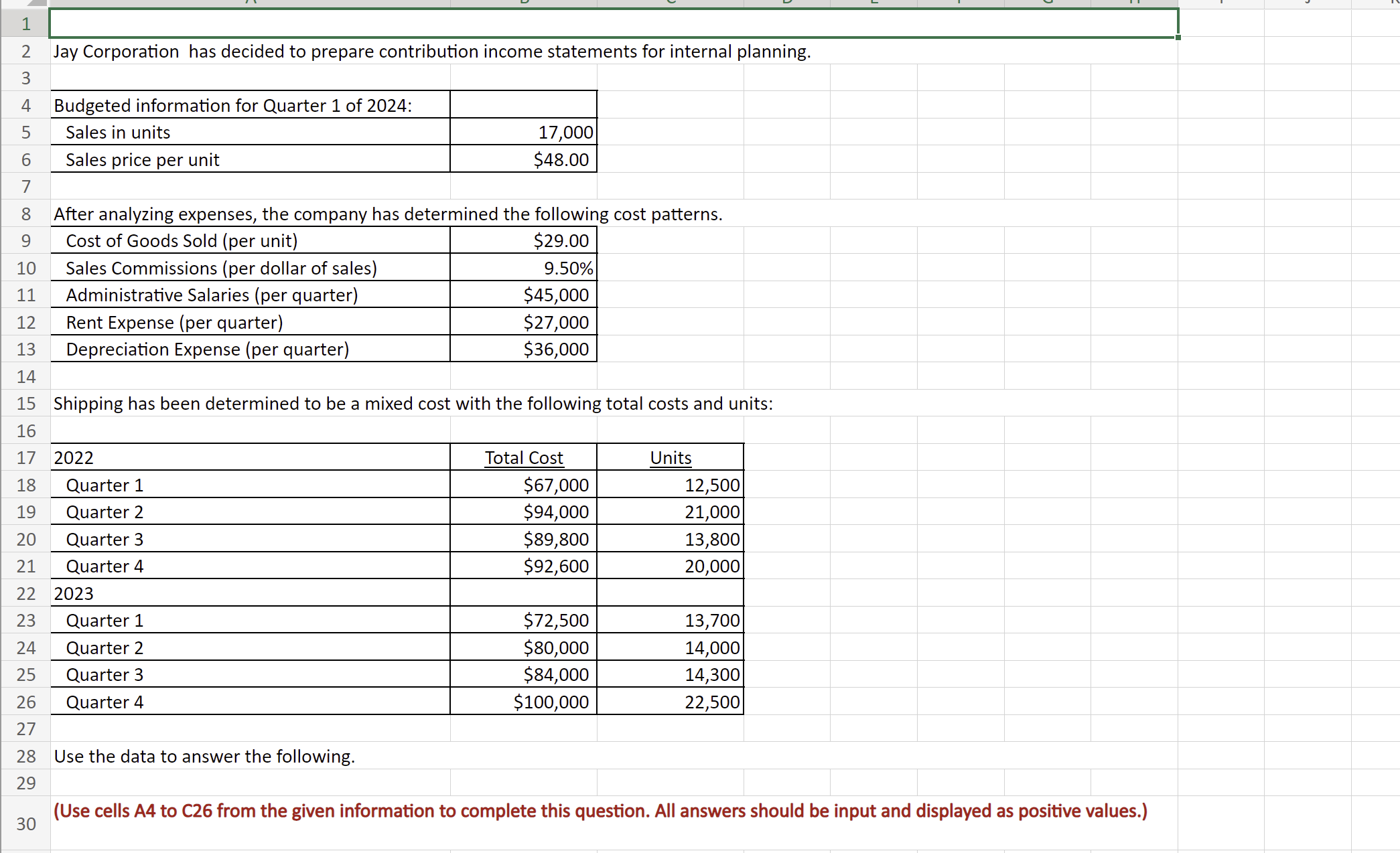

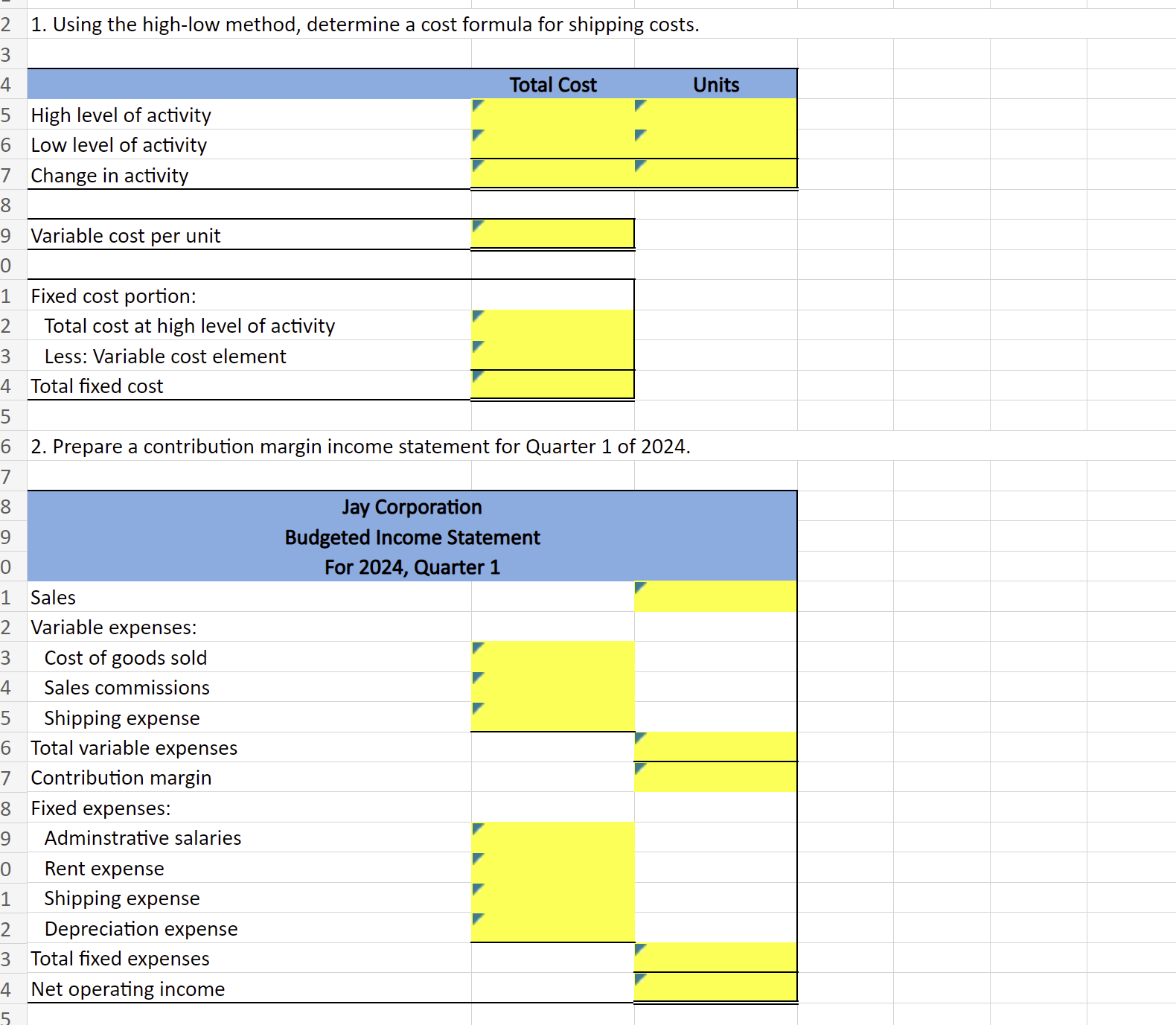

Jay Corporation has decided to prepare contribution income statements for internal planning. After analyzing expenses, the company has determined the following cost patterns. Shipping has been determined to be a mixed cost with the following total costs and units: Use the data to answer the following. (Use cells A4 to C26 from the given information to complete this question. All answers should be input and displayed as positive values.) Jay Corporation has provided data from a two-year period to aid in planning. The Controller has asked you to prepare a contribution format income statement. After analyzing expenses, the company has determined the following cost patterns. Shipping has been determined to be a mixed cost with the following total costs and units: Required: Use the data to answer the following. 1. Using the high-low method, determine a cost formula for shipping costs. 2. Prepare a contribution margin income statement for Quarter 1 of 2024. Navigation: 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect. 2 1. Using the high-low method, determine a cost formula for shipping costs. \begin{tabular}{l} High level of activity \\ Low level of activity \\ Change in activity \\ \hline Variable cost per unit \\ \hline Fixed cost portion: \\ Total cost at high level of activity \\ Less: Variable cost element \end{tabular} 2. Prepare a contribution margin income statement for Quarter 1 of 2024. Jay Corporation Budgeted Income Statement For 2024, Quarter 1 Sales Variable expenses: Cost of goods sold Sales commissions Shipping expense Total variable expenses Contribution margin Fixed expenses: Adminstrative salaries Rent expense Shipping expense Depreciation expense Total fixed expenses Net operating income

Jay Corporation has decided to prepare contribution income statements for internal planning. After analyzing expenses, the company has determined the following cost patterns. Shipping has been determined to be a mixed cost with the following total costs and units: Use the data to answer the following. (Use cells A4 to C26 from the given information to complete this question. All answers should be input and displayed as positive values.) Jay Corporation has provided data from a two-year period to aid in planning. The Controller has asked you to prepare a contribution format income statement. After analyzing expenses, the company has determined the following cost patterns. Shipping has been determined to be a mixed cost with the following total costs and units: Required: Use the data to answer the following. 1. Using the high-low method, determine a cost formula for shipping costs. 2. Prepare a contribution margin income statement for Quarter 1 of 2024. Navigation: 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect. 2 1. Using the high-low method, determine a cost formula for shipping costs. \begin{tabular}{l} High level of activity \\ Low level of activity \\ Change in activity \\ \hline Variable cost per unit \\ \hline Fixed cost portion: \\ Total cost at high level of activity \\ Less: Variable cost element \end{tabular} 2. Prepare a contribution margin income statement for Quarter 1 of 2024. Jay Corporation Budgeted Income Statement For 2024, Quarter 1 Sales Variable expenses: Cost of goods sold Sales commissions Shipping expense Total variable expenses Contribution margin Fixed expenses: Adminstrative salaries Rent expense Shipping expense Depreciation expense Total fixed expenses Net operating income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started