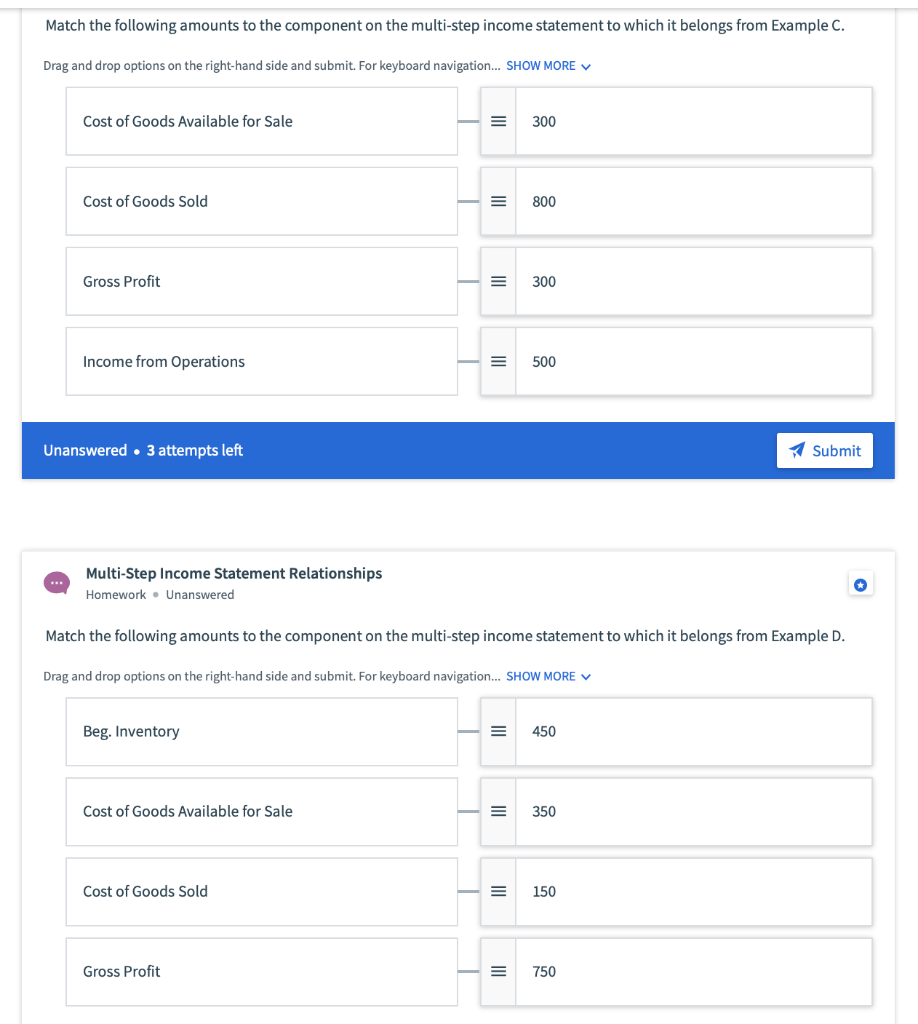

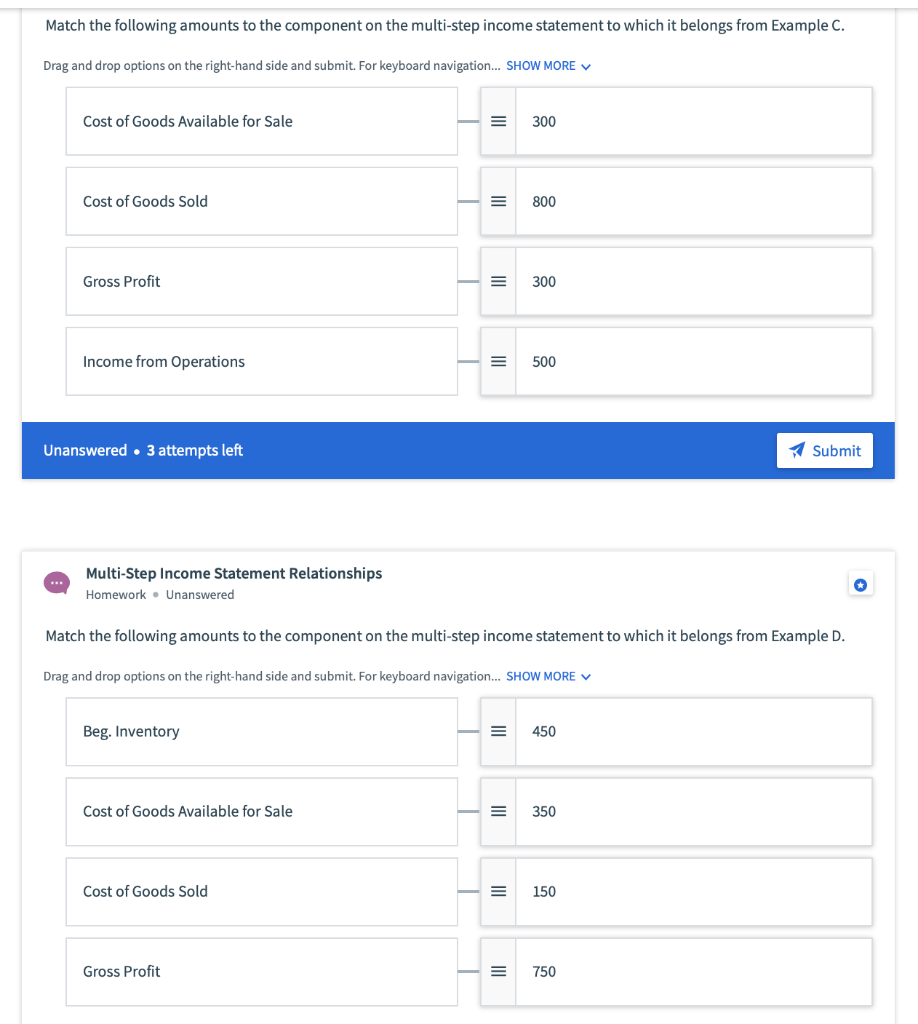

- Match the following amounts to the component on the multi-step income statement to which it belongs from Example C

- Match the following amounts to the component on the multi-step income statement to which it belongs from Example D

(example below)

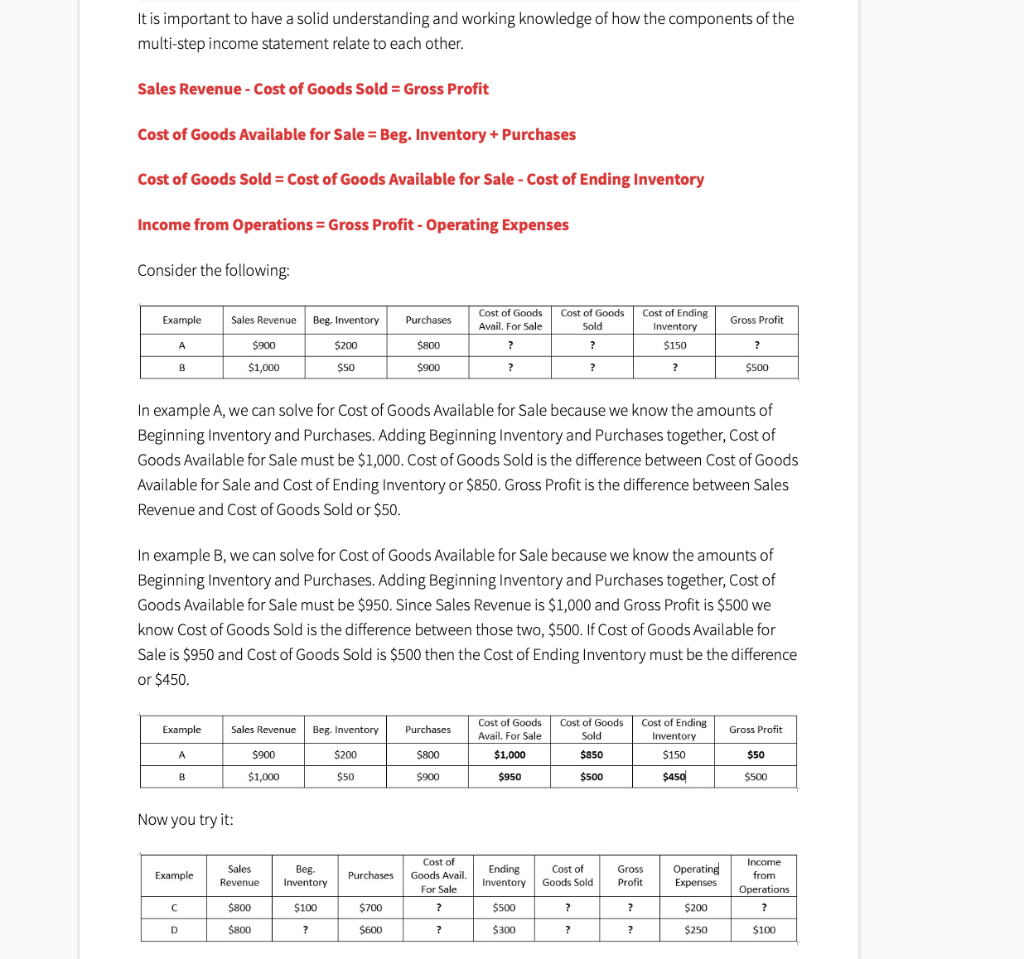

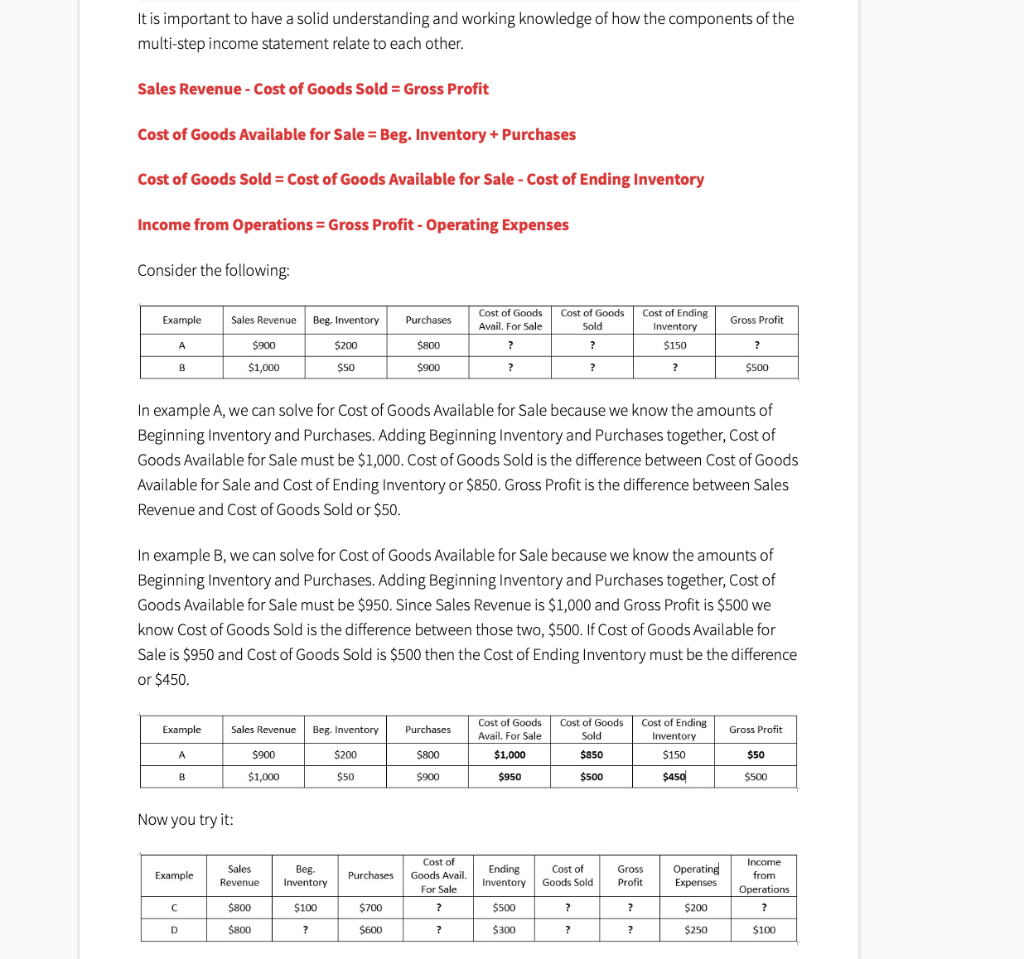

It is important to have a solid understanding and working knowledge of how the components of the multi-step income statement relate to each other. Sales Revenue - Cost of Goods Sold = Gross Profit Cost of Goods Available for Sale = Beg. Inventory + Purchases Cost of Goods Sold = Cost of Goods Available for Sale - Cost of Ending Inventory Income from Operations = Gross Profit - Operating Expenses Consider the following: Example Purchases Cost of Goods Avail. For Sale Gross Profit Cost of Goods Sold ? Sales Revenue Beg. Inventory $900 $200 $1,000 $50 Cost of Ending Inventory $150 $800 ? ? B $900 ? ? ? $500 In example A, we can solve for Cost of Goods Available for Sale because we know the amounts of Beginning Inventory and Purchases. Adding Beginning Inventory and Purchases together, Cost of Goods Available for Sale must be $1,000. Cost of Goods Sold is the difference between Cost of Goods Available for Sale and Cost of Ending Inventory or $850. Gross Profit is the difference between Sales Revenue and Cost of Goods Sold or $50. In example B, we can solve for Cost of Goods Available for Sale because we know the amounts of Beginning Inventory and Purchases. Adding Beginning Inventory and Purchases together, Cost of Goods Available for Sale must be $950. Since Sales Revenue is $1,000 and Gross Profit is $500 we know Cost of Goods Sold is the difference between those two, $500. If Cost of Goods Available for Sale is $950 and Cost of Goods Sold is $500 then the cost of Ending Inventory must be the difference or $450. Example Purchases Cost of Goods Sold Cost of Ending Gross Profit Cost of Goods Avail. For Sale $1,000 Inventory A Sales Revenue Beg. Inventory $900 $200 $1,000 $50 $800 $850 $150 $50 B $900 $950 $500 $450 $500 Now you try it: Example Sales Revenue - Inventory Cost of Goods Avail. For Sale Purchases Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses Income from Operations ? $800 $100 $700 ? $500 ? ? $200 D $800 ? $600 ? $300 ? ? $250 $100 Match the following amounts to the component on the multi-step income statement to which it belongs from Example C. Drag and drop options on the right-hand side and submit. For keyboard navigation... SHOW MORE Cost of Goods Available for Sale III 300 Cost of Goods Sold - 800 Gross Profit = 1 300 Income from Operations - III 500 Unanswered. 3 attempts left Submit Multi-Step Income Statement Relationships Homework. Unanswered Match the following amounts to the component on the multi-step income statement to which it belongs from Example D. Drag and drop options on the right-hand side and submit. For keyboard navigation... SHOW MORE V | Beg. Inventory III 450 Cost of Goods Available for Sale 1 = 350 Cost of Goods Sold - III 150 Gross Profit | 750