Answered step by step

Verified Expert Solution

Question

1 Approved Answer

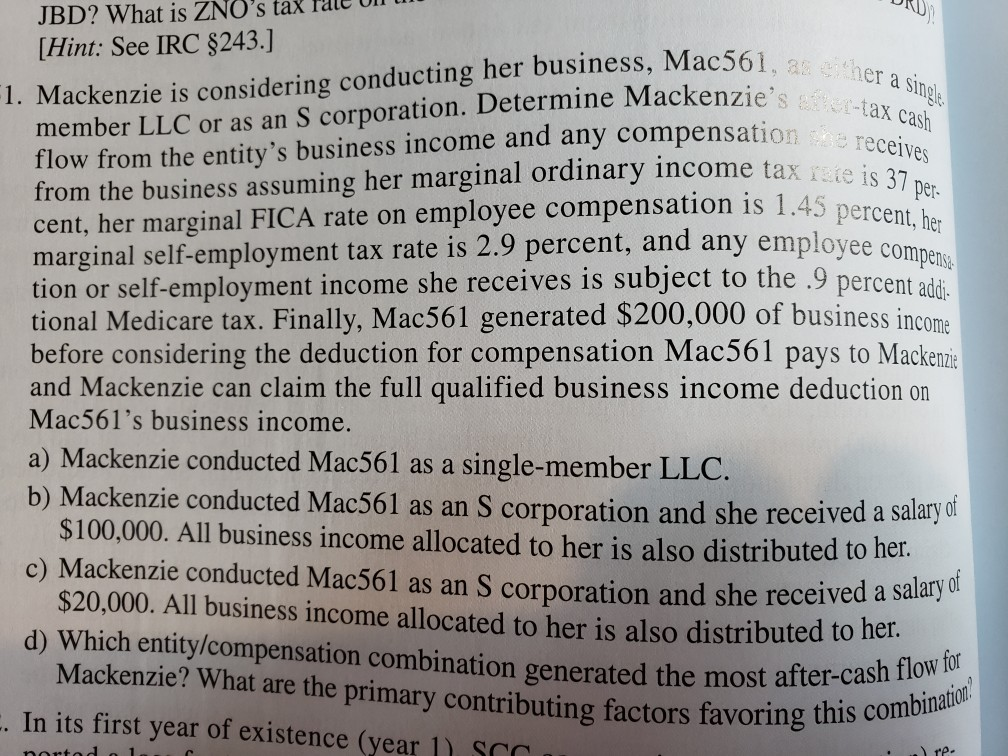

JBD? What is ZNO's tax [Hint: See IRC $243.] 1. Mackenzie is considering conducting her business, Mac561, a eiher a single member LLC or as

JBD? What is ZNO's tax [Hint: See IRC $243.] 1. Mackenzie is considering conducting her business, Mac561, a eiher a single member LLC or as an S corporation. Determine Mackenzie's -tax cash from the business assuming her marginal ordinary income tax rate is 31 per- marginal self-employment tax rate is 2.9 percent, and any employee compense flow from the entity's business income and any compensation be receives employee compensation is 1.45 percent, he cent, her marginal FICA rate on self-employment income she receives is subject to the .9 percent ad tion or tional Medicare tax. Finally, Mac561 generated $200,000 of business income before considering the deduction for compensation Mac561 pays to Mackenzie and Mackenzie can claim the full qualified business income deduction on Mac561's business income a) Mackenzie conducted Mac561 as a single-member LLC. b) Mackenzie conducted Mac561 as an S corporation and she received a salary of $100,000. All business income allocated to her is also distributed to her. c) Mackenzie conducted Mac561 as an S corporation and she received a salary of $20,000. All business income allocated to her is also distributed to her. d) Which entity/compensation combination generated the most after-cash flow for Mackenzie? What are the primary contributing factors favoring this combination. . In its first year of existence (year 1) SC ) re- nortod o 1 JBD? What is ZNO's tax [Hint: See IRC $243.] 1. Mackenzie is considering conducting her business, Mac561, a eiher a single member LLC or as an S corporation. Determine Mackenzie's -tax cash from the business assuming her marginal ordinary income tax rate is 31 per- marginal self-employment tax rate is 2.9 percent, and any employee compense flow from the entity's business income and any compensation be receives employee compensation is 1.45 percent, he cent, her marginal FICA rate on self-employment income she receives is subject to the .9 percent ad tion or tional Medicare tax. Finally, Mac561 generated $200,000 of business income before considering the deduction for compensation Mac561 pays to Mackenzie and Mackenzie can claim the full qualified business income deduction on Mac561's business income a) Mackenzie conducted Mac561 as a single-member LLC. b) Mackenzie conducted Mac561 as an S corporation and she received a salary of $100,000. All business income allocated to her is also distributed to her. c) Mackenzie conducted Mac561 as an S corporation and she received a salary of $20,000. All business income allocated to her is also distributed to her. d) Which entity/compensation combination generated the most after-cash flow for Mackenzie? What are the primary contributing factors favoring this combination. . In its first year of existence (year 1) SC ) re- nortod o 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started