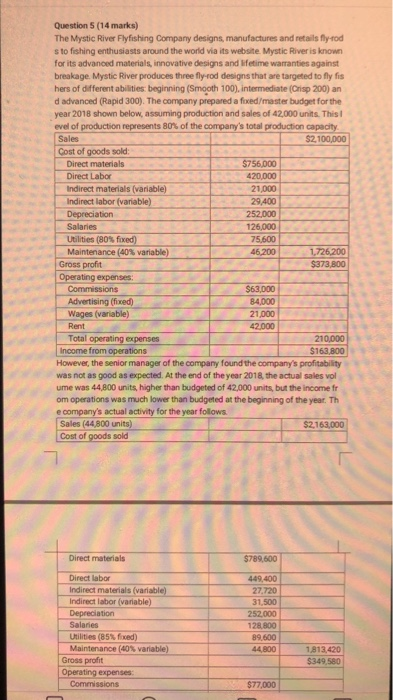

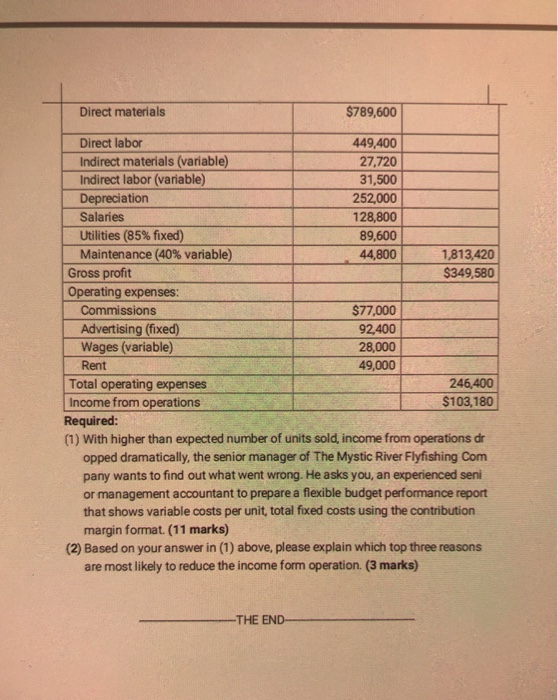

Question 5 (14 marks) The Mystic River Flyfishing Company designs, manufactures and retails fly rod sto fishing enthusiasts around the world via its website. Mystic River is known for its advanced materials, innovative designs and lifetime warranties against breakage. Mystic River produces three fly-rod designs that are targeted to fly fis hers of different abilities: beginning (Smooth 100), intermediate (Crisp 200) an d advanced (Rapid 300). The company prepared a fored/master budget for the year 2018 shown below, assuming production and sales of 42,000 units. This evel of production represents 80% of the company's total production capacity Sales $2,100,000 Cost of goods sold: Direct materials $756,000 Direct Labor 420,000 Indirect materials (variable) 21.000 Indirect labor (variable) 29,400 Depreciation 252,000 Salaries 126,000 Utilities (80% fixed) 75,600 Maintenance (40% variable) 46,200 1.726,200 Gross profit $373,800 Operating expenses: Commissions $63,000 Advertising (fixed) 84,000 Wages (variable) 21,000 Rent 42,000 Total operating expenses 210,000 Income from operations $ 163,800 However, the senior manager of the company found the company's profitability was not as good as expected. At the end of the year 2018, the actual sales vol ume was 44 800 units, higher than budgeted of 42,000 units, but the income fr om operations was much lower than budgeted at the beginning of the year. Th e company's actual activity for the year follows. Sales (44,800 units) $2,163,000 Cost of goods sold Direct materials $789,600 Direct labor Indirect materials (variable) Indirect labor (variable) Depreciation Salaries Utilities (85% foxed) Maintenance (40% variable) Gross profit Operating expenses Commissions 449,400 27.720 31.500 252.000 128,800 89.600 44.800 1813,420 $349,580 $77,000 Direct materials $789,600 Direct labor 449,400 Indirect materials (variable) 27.720 Indirect labor (variable) 31,500 Depreciation 252,000 Salaries 128,800 Utilities (85% fixed) 89,600 Maintenance (40% variable) 44,800 1,813,420 Gross profit $349,580 Operating expenses: Commissions $77,000 Advertising (fixed) 92,400 Wages (variable) 28,000 Rent 49,000 Total operating expenses 246,400 Income from operations $103,180 Required: (1) With higher than expected number of units sold, income from operations de opped dramatically, the senior manager of The Mystic River Flyfishing Com pany wants to find out what went wrong. He asks you, an experienced seni or management accountant to prepare a flexible budget performance report that shows variable costs per unit, total fixed costs using the contribution margin format. (11 marks) (2) Based on your answer in (1) above, please explain which top three reasons are most likely to reduce the income form operation. (3 marks) -THE END