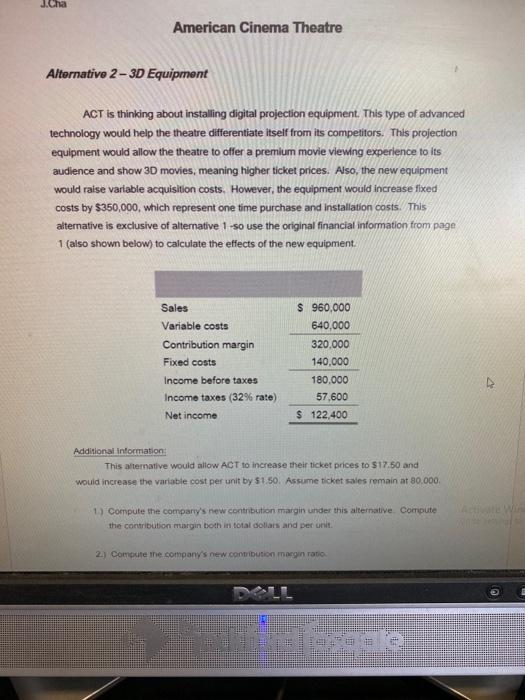

J.Cha American Cinema Theatre Alternative 2-3D Equipment ACT is thinking about installing digital projection equipment. This type of advanced technology would help the theatre differentiate itself from its competitors. This projection equipment would allow the theatre to offer a premium movie viewing experience to its audience and show 3D movies, meaning higher ticket prices. Also, the new equipment would raise variable acquisition costs. However, the equipment would increase fixed costs by $350,000, which represent one time purchase and installation costs. This alternative is exclusive of alternative 1 -so use the original financial information from page 1 (also shown below) to calculate the effects of the new equipment. Sales Variable costs Contribution margin Fixed costs Income before taxes Income taxes (32% rate) $ 960.000 640,000 320.000 140,000 180.000 57,600 Net income $ 122,400 Additional information: This alternative would allow ACT to increase their ticket prices to $17.50 and would increase the variable cost per unit by $1.50. Assume ticket sales remain at 80.000 1) Compute the company's new contribution margin under this alternative Compute the contribution margin both in total dollars and per unit 2.) Compute me company's new contribution margin ratio to ele Additional Information: This alternative would allow ACT to increase their ticket prices to $17.50 and would increase the variable cost per unit by $1.50. Assume ticket sales remain at 80,000. 1.) Compute the company's new contribution margin under this alternative. Compute the contribution margin both in total dollars and per unit. 2.) Compute the company's new contribution margin ratio. 5 ACCT 102 Group Project J.Cha 3.) Compute the break-even point in sales dollars. How many tickets will need to be sold? 4) Compute the new operating leverage. What does this figure mean? Why is it important to management? 5.) If the company wishes the theatre to generate net income (after-tax) of $170.000, what is the amount of sales that needs to be generated? How many tickets will then need to be sold? Prepare a contribution margin statement for this step and verify that your after-tax net income in fact equals $170.000 w Allaceative 2 Regniment continued Page 6 of 9 4.) Compute the new operating leverage. What does this figure mean? Why is it important to management? 5.) If the company wishes the theatre to generate net income (after-tax) of $170,000, what is the amount of sales that needs to be generated? How many tickets will then need to be sold? Prepare a contribution margin statement for this step and verify that your after-tax net income in fact equals $170,000. Alternative 2 Requirements (continued) 6.) Assume that the company expects ticket sales to decline 20% next year with no change in ticket price. Prepare forecasted financial results for next year following the format of the contribution margin income statement as shown above (assume a 32% tax rate, and that any loss before taxes yields a 32% tax savings) 7.) Assume that the company expects ticket sales to increase 20% next year with no change in ticket price. Prepare forecasted financial results for next year following the format of the contribution margin income statement as shown above (assume 32% tax rate, and that any loss before taxes yields a 32% tax savings) 8.) I sales greatly increase, which type of theatre would experience a greater Increase in profit (discount or 3D)? What if ticket sales declined-which theatre would experience a greater loss or reduction in Income? Explain why. How does your calculation from (4) support your point? 9.) Are there any monetary or non monetary advantages of installing this superior equipment? 6 ACCT 102 Group Project J.Cha 10. Since no advertising budget is available under this alternative, what are some creative and low-cost methods the company could employ to help advertise the change to their theatre? 11.)Compute the Profit Margin and Return on Assets assuming average total assets of $2,500,000. Industry averages are 12% and 5% respectively, 4