Answered step by step

Verified Expert Solution

Question

1 Approved Answer

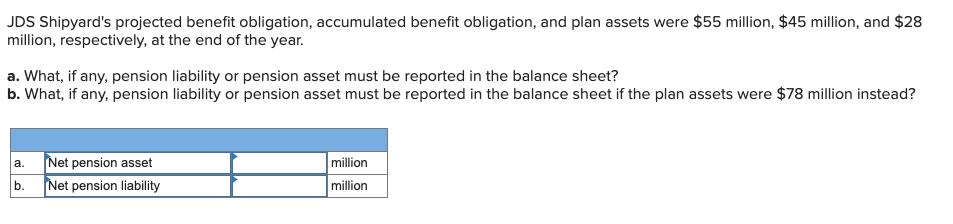

JDS Shipyard's projected benefit obligation, accumulated benefit obligation, and plan assets were $55 million, $45 million, and $28 million, respectively, at the end of

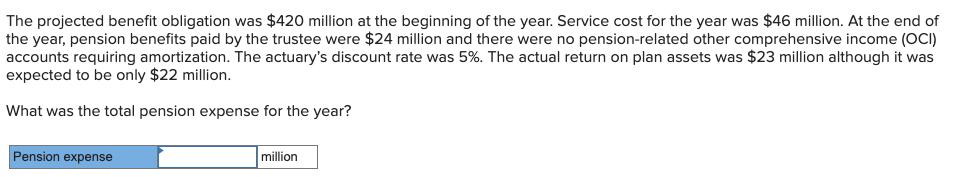

JDS Shipyard's projected benefit obligation, accumulated benefit obligation, and plan assets were $55 million, $45 million, and $28 million, respectively, at the end of the year. a. What, if any, pension liability or pension asset must be reported in the balance sheet? b. What, if any, pension liability or pension asset must be reported in the balance sheet if the plan assets were $78 million instead? Net pension asset million a. b. Net pension liability million The projected benefit obligation was $420 million at the beginning of the year. Service cost for the year was $46 million. At the end of the year, pension benefits paid by the trustee were $24 million and there were no pension-related other comprehensive income (OCI) accounts requiring amortization. The actuary's discount rate was 5%. The actual return on plan assets was $23 million although it was expected to be only $22 million. What was the total pension expense for the year? Pension expense million

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

What is a Pension Pension is referred as the retirement plan from which monthly payments are receive...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started